DEF 14A: Definitive proxy statements

Published on August 10, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required |

|

Fee paid previously with preliminary materials |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

What We Stand For: Our Values

Inclusion

We embrace people with different points of view, from all backgrounds. And we think and work as one team.

Honesty

We say what we mean and we do what we say. We hold ourselves to the highest standards. And we make it safe for people to speak out when they see something wrong.

Knowledge

We are insatiably curious, always learning new things. And we actively help our colleagues grow and develop, too, with mentoring and support.

Performance

We never settle for the status quo. We always strive to be better today than we were yesterday and do our best for our clients, colleagues, and stockholders.

Table of Contents

This page intentionally left blank

Dear Fellow Stockholders,

On behalf of the Board of Directors (the “Board”), senior management and more than 10,000 colleagues of Korn Ferry (the “Company,” “firm,” “we,” “its,” and “our”), it is my pleasure to invite you to our 2023 Annual Meeting of Stockholders on September 21, 2023, at 8:00 a.m. Pacific Time (the “Annual Meeting”).

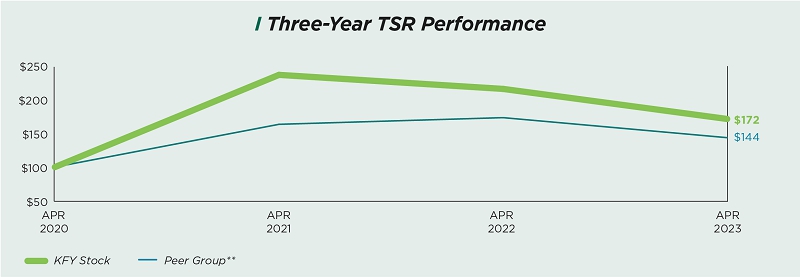

The Board is proud of the results Korn Ferry continues to deliver on behalf of our stockholders. These accomplishments include:

| • | an all-time high of fee revenue totaling $2.835 billion, | ||

| • | annual fee growth of 8% (12% on a constant currency* basis), | ||

| • | the acquisition and integration of Infinity Consulting Solutions and Salo LLC, enhancing our Interim business to $400 million of annual revenue on a run rate basis, | ||

| • | $127 million returned to stockholders in the form of share repurchases and dividends paid, | ||

| • | third-party recognition as a leading provider of executive search, professional search, management consulting, sales training and enablement services, and recruitment process outsourcing services, and | ||

| • | third-party recognition of our environmental, social, and governance (“ESG”) reporting and ESG practices related to human capital, climate, and sustainability. |

These accomplishments were achieved against a challenging environment of economic slowdowns, recession fears, sharp inflation increases followed by global central bank tightening, and continued geopolitical tensions and conflict. While each year carries its own set of challenges, opportunities, and uncertainties, Korn Ferry has remained steadfast and resilient in progressing forward. We believe our firm and Board will continue to exhibit agile leadership—focusing on strategic priorities to best position Korn Ferry for the future, creating lasting impact for our clients, achieving strong financial results for our stockholders, and contributing to the betterment of our communities and colleagues.

We want to thank you for your support and investment in our firm. We encourage you to attend the Annual Meeting. Our Annual Meeting will be conducted online this year through a live audiocast, which is often referred to as a “virtual meeting” of stockholders. Our digital format is meant to allow stockholders to participate safely, conveniently, and effectively. We intend to hold our virtual meeting in a manner that affords stockholders the same general rights and opportunities to participate, to the extent possible, as they would have at an in-person meeting. Whether or not you plan to attend, we encourage you to vote promptly.

Sincerely,

Jerry P. Leamon,

Chair of the Board

August 10, 2023

Korn Ferry

1900 Avenue of the Stars, Suite 1500

Los Angeles, CA 90067

(310) 552-1834

| * | Constant currency is a non-GAAP financial measure. See Appendix A to this Proxy Statement for how it is calculated and why management considers it useful. |

i

| 2023 Proxy Statement

| 2023 Proxy Statement

This page intentionally left blank

|

Notice

of 2023 Annual Meeting |

Meeting Information

|

Time

and Date 8:00 a.m. Pacific Time September 21, 2023 |

|

Location

Live Audiocast at www.virtualshareholdermeeting.com/KFY2023 |

|

Record

Date July 31, 2023 |

||

| Meeting Agenda | ||||

| 1. | Elect the nine directors nominated by our Board of Directors (the “Board”) and named in the Proxy Statement to serve on the Board until the 2024 Annual Meeting of Stockholders. | |||

|

FOR each Director Nominee |

||||

| 2. | Vote on a non-binding advisory resolution to approve the Company’s executive compensation. | |||

|

FOR | |||

| 3. | Vote on a non-binding advisory resolution on the frequency of future advisory votes to approve the Company’s executive compensation. | |||

|

FOR | |||

| 4. | Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the Company’s 2024 fiscal year. | |||

|

FOR | |||

| 5. | Transact any other business that may be properly presented at the Annual Meeting. | |||

Virtual Meeting: Korn Ferry (the “Company,” “we,” “its,” and “our”) will hold its 2023 Annual Meeting of Stockholders (the “Annual Meeting”) online.

Who Can Vote: Stockholders who owned our common stock as of the close of business on July 31, 2023 (the “Record Date”) can vote online at the Annual Meeting or any adjournments or postponements thereof.

How to Attend: To attend the Annual Meeting online, vote or submit questions during the Annual Meeting, or view the stockholder list, stockholders of record will need to go to www.virtualshareholdermeeting.com/KFY2023 and log in using their 16-digit control number included on their proxy card or Notice of Internet Availability of Proxy Materials (the “Notice”). Beneficial owners should review these proxy materials and their voting instruction form or the Notice for how to vote in advance of, and how to participate in, the Annual Meeting.

| How You Can Vote | |||

|

Via telephone |

1-800-690-6903 | ||

|

Via Internet |

Before the Annual Meeting by visiting www.proxyvote.com

During the Annual Meeting by visiting www.virtualshareholdermeeting.com/KFY2023 |

||

|

Via mail |

Sign, date, and mail the enclosed proxy card (if you received one) | ||

|

Please read the proxy materials carefully before voting.

Your vote is important, and we appreciate your cooperation in considering and acting on the matters presented. For more information, see pages 79 – 82.

|

|||

Meeting Disruption: In the event of a technical malfunction or situation that the chair of the Annual Meeting determines may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of stockholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Annual Meeting, the chair of the Annual Meeting will convene the meeting at 9:00 a.m. Pacific Time on the date specified above and at the Company’s address at 1900 Avenue of the Stars, Suite 1500, Los Angeles, CA 90067, solely for the purpose of adjourning the Annual Meeting to reconvene at a date, time, and physical or virtual location announced by the chair of the Annual Meeting. Under either of the foregoing circumstances, we will post information regarding the announcement on the Investors page of the Company’s website at https://ir.kornferry.com.

August 10, 2023

Los Angeles, California

By Order of the Board of Directors,

Jonathan Kuai

General Counsel, Managing Director of Business Affairs &

ESG, and Corporate Secretary

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on September 21, 2023:

The Proxy Statement and accompanying Annual Report to Stockholders are available at www.proxyvote.com.

This page intentionally left blank

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

Annual Meeting of Stockholders (page 79)

| Date and Time: | September 21, 2023 at 8:00 a.m. Pacific Time |

| Location: | www.virtualshareholdermeeting.com/KFY2023 |

| Admission: | To participate in the Annual Meeting online, including to vote during the Annual Meeting, stockholders will need the 16-digit control number included on their proxy card, the Notice or voting instruction form, or, if they hold their shares in street name, contact their bank, broker, or other nominee (preferably at least 5 days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in, or vote at the Annual Meeting. |

| Who Can Vote and How: |

On or about August 10, 2023, we will mail the Notice to stockholders of our common stock as of the close of business on July 31, 2023, other than those stockholders who previously requested electronic or paper delivery of communications from us. Stockholders can vote by any of the following methods described on pages 79 – 81. |

Voting Roadmap (page 79)

| Proposal | Board Recommendation |

Page Reference |

|

| 1 |

Election of Directors • 8 of 9 nominees (89%) are independent • Diverse slate, including 56% of nominees and 2 committee chairs from underrepresented groups (by gender or race/ethnicity) • Active Board refreshment, with four new directors in last five years and one new director nominated for election at the Annual Meeting • Robust Board oversight of Company strategy and risks • Responsive and evolving corporate governance practices |

FOR each Director Nominee |

12 |

| 2 |

Advisory Resolution to Approve Executive Compensation • Program intended to offer competitive total direct compensation opportunities aligned with stockholder interests • Executives incentivized to focus on short-and long-term Company performance • Program continues to emphasize pay-for-performance via the Company’s standard mix of 60% performance-based awards and 40% time-based awards |

FOR |

33 |

| 3 |

Advisory Resolution on the Frequency of Future Advisory Votes to Approve Executive Compensation • Annual say-on-pay vote provides stockholders timely and frequent input on executive compensation for Compensation and Personnel Committee’s consideration • Company has held annual say-on-pay votes since 2011 |

ONE YEAR |

34 |

| 4 |

Ratification of Independent Registered Public Accounting Firm • Independent firm with reasonable fees and strong geographic and subject matter coverage • Performance annually assessed by the Audit Committee • Served as independent registered public accounting firm since 2002 • Lead audit partner rotated regularly, with most recent lead audit partner rotated in June 2023 |

FOR |

72 |

|

1 | 2023 Proxy Statement |

Who We Are*

|

Korn Ferry is a leading global organizational consulting firm. |

10.5K+ colleagues |

|

100+ global offices |

|

50+ countries |

With our core and integrated solutions, data, intellectual property, and content enabled by our technological platforms, including artificial intelligence (“AI”), we believe we are an industry of one, uniquely positioned to be the partner that helps people and organizations exceed their potential.

| FIVE LINES OF BUSINESS | ||||

|

I Executive Search |

I Consulting |

I Professional Search & Interim |

I Recruitment Process Outsourcing |

I Digital |

| $876M | $677M | $503M | $424M | $355M |

| FIVE CORE CAPABILITIES | ||||

|

|

|

|

|

|

I Organization Strategy |

I Assessment & Succession |

I Talent Acquisition |

I Leadership & Professional Development |

I Total Rewards |

|

OUR STRATEGIC PRIORITIES |

1 | Drive a One Korn Ferry Go-To-Market Strategy |

| 2 | Create the Top-of-Mind Brand in Organizational Consulting | |

| 3 | Deliver Client Excellence and Innovation | |

| 4 | Advance Korn Ferry as a Premier Career Destination | |

| 5 | Pursue Transformational M&A Opportunities |

| PRESTIGIOUS AND LOYAL CLIENT BASE | |||||

| 96% | 94% | 91% | 85% | 85% | 80% |

| S&P 100 |

Euronext 100 |

S&P Europe 350 |

FTSE 100 |

S&P 500 |

S&P Latin America 40 |

|

ALMOST 15K organizations served |

NEARLY 80% engagements with clients for whom we had conducted engagements in past 3 fiscal years |

| * | Highlights presented are for fiscal year 2023, unless otherwise indicated. For the five lines of business, figures represent fee revenue for fiscal year 2023. |

|

2 | 2023 Proxy Statement |

Highlights for Fiscal Year 2023

Against a tough macroeconomic and geopolitical environment, we delivered strong financial results and executed on our strategy.

| FINANCIAL HIGHLIGHTS | |||

|

I

Fee Revenue |

I

Operating Margin |

I

Diluted Earnings Per Share |

I

Net Income Attributable to Korn Ferry |

| $2.835B | 11.2% | $3.95 | $209.5M |

|

I

Adjusted EBITDA* |

I

Adjusted EBITDA Margin* |

I

Adjusted Diluted Earnings Per Share* |

I

Returned to Shareholders |

| $457.3M | 16.1% | $4.94 | $127M |

| * | Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted Diluted Earnings Per Share are non-GAAP financial measures. For a discussion of these measures and for their reconciliation to the most directly comparable GAAP measures, see Appendix A to this Proxy Statement. |

| BALANCED APPROACH TO CAPITAL ALLOCATION | ||||

| $254.8M | $61M | $18.5M | $93.9M | $33M |

|

I Invested in Acquisitions |

I Invested in Capital Expenditures |

I Spent on Debt Service Costs |

I Repurchased Shares |

I Paid in Dividends |

| ** | Excludes Nielsen Holdings Plc due to its acquisition in October 2022. |

| OTHER HIGHLIGHTS*** | |

| 20% | SUCCESSFULLY ACQUIRED |

| Dividend Increase (to $0.18 per Share) |

Two Interim Businesses (Infinity Consulting Solutions and Salo LLC) |

| *** | The dividend increase was announced in the first quarter of fiscal 2024. |

|

3 | 2023 Proxy Statement |

| RECENT BUSINESS AWARDS AND RECOGNITIONS | ||||

|

America’s I Forbes Magazine |

#1 Executive I Hunt Scanlon |

|

A Leader in I Everest Group |

#1 Global I HRO Today |

|

One of America’s Best I

Forbes Magazine |

One of America’s Best I

Forbes Magazine |

A 2023 Top Sales Training & I Training Industries |

| RECENT ESG AWARDS AND RECOGNITIONS | ||

|

100 BEST COMPANIES FOR

|

BEST COMPANIES

|

TOP COMPANIES FOR

|

|

BEST PLACES TO WORK

|

LEADERSHIP CDP RATING

|

TOP ECOVADIS

|

|

AMERICA’S CLIMATE USA TODAY

|

PLATINUM MARCOM AWARDS

|

PLATINUM HERMES CREATIVE AWARDS

|

| RECENT ESG ACCOMPLISHMENTS | ||||

|

PUBLISHED 2022 ESG Report |

$3M+ Donated Financially |

ISO Certified Global Privacy |

||

|

4 | 2023 Proxy Statement |

Corporate Governance (page 22)

| Strong Governance Practices |

| Annual Director Elections for All Directors. |

| Majority Voting in Uncontested Elections. |

| Committee Oversight of ESG Program. |

| No Supermajority Voting Standards. |

| Stockholder Right (at 25% Threshold) to Call Special Stockholder Meetings. |

|

|

|

||

| Board Structure | Committees, Attendance, and Commitments |

Stockholder Engagement | ||

|

Independent Board Chair.

7 of the 8 Directors (88%) on the Board and 8 of the 9 Nominees (89%) are Independent.

100% Independent Committees.

Independent Directors Meet in Regular Executive Sessions.

Annual Board and Committee Self-Evaluations.

10-Term Service Limit for Non-Executive Directors Joining the Board after October 1, 2020. |

Independent Audit, Compensation, and Nominating Committees.

All Directors Attended at Least 75% of Board and Their Respective Committee Meetings.

No Director Serves on More Than 4 Public Company Boards.

2 Committees Led by Directors from Underrepresented Groups (by Gender or Race/Ethnicity). |

Stockholder Communication Process for Communicating with the Board.

Regular Stockholder Engagement Throughout the Year.

Regular Attendance at Industry Conferences.

Quarterly Earnings Calls to Discuss Results and Investor Questions.

Met with >70% of Top 25 Active (Non-Index) Stockholders in Fiscal 2023. |

Governance Insights (pages 13, 39, and 74)

Each of the Company’s three standing Board committees is committed to staying abreast of the latest issues impacting good corporate governance. The Company has included three sets of Questions & Answers (“Q&As”), one with the chair of each of the Company’s standing committees.

These Q&As are meant to provide stockholders with insight into director succession planning and ESG matters, annual cash incentive plan design, and how the Audit Committee adapts to its evolving oversight role.

|

5 | 2023 Proxy Statement |

|

Board Tenure* and Diversity I As of Filing |

|

|

5 years and less: 43% 6

to 10 years: 29% More than 10 years: 29% |

|

including 1 Military Veteran***

I If All Nominees Are Elected |

|

|

5 years and less: 50% 6 to 10 years: 25% More than 10 years: 25% |

|

including 1 Military Veteran*** |

|

|

Director Refreshment (Additions) |

||

| 2023 |  |

Matthew J. Espe (Nominee) |

| 2022 |  |

Charles L. Harrington |

| 2021 |  |

Laura M. Bishop |

| 2019 |

|

Lori J. Robinson Len J. Lauer |

| * | Tenure is provided for non-executive directors only. Figures may not total 100% due to rounding. |

| ** | This graphic represents directors who are members of underrepresented groups (by gender or race/ethnicity). |

| *** | Not included in percentages of directors from underrepresented groups. |

Board Nominees (pages 17 – 21)

|

Doyle

N. |

Independent Age: 63 Director Since: 2015 Committees Memberships: Compensation & Personnel Nominating & Corporate Governance (Chair) Experience: • Former President and CEO, Midland Cogeneration Venture • Former CEO, New Generation Power International • Former President and CEO, CPS Energy |

|

Laura

M. |

Independent Age: 61 Director Since: 2021 Committee Memberships: Audit Compensation & Personnel Experience: • Former EVP and CFO, USAA • Former SVP and CFO, Luby’s Inc. • Former Senior Manager, Ernst & Young LLP • Certified Public Accountant |

|

Gary

D. |

President/CEO Age: 62 Director Since: 2007 Committee Memberships: None Experience: • 20+ years of service with Korn Ferry • Former Principal and CFO, Guidance Solutions |

|

Matthew

J. |

Independent Age: 64 Director Nominee Experience: • Operating Partner, Advent International • 21+ years of public and private company board experience |

|

Charles

L.

|

Independent Age: 64 Director Since: 2022 Committee Memberships: Audit Compensation & Personnel Experience: • Former Chairman, CEO and President, Parsons Corporation • 14+ years of public board experience |

|

6 | 2023 Proxy Statement |

|

Jerry P. |

Independent Age: 72 Director Since: 2012 Committees Memberships: Compensation & Personnel (Chair) Experience: • Former Global Managing Director, Deloitte • Almost 40 years at Deloitte with responsibility for services to many of its largest clients • Certified Public Accountant |

|

Angel R.

|

Independent Age: 68 Director Since: 2017 Committee Memberships: Audit Experience: • Former Chairman of the Board of Directors and Former President and CEO of Deckers Brands (formerly known as Deckers Outdoor Corporation) • 24+ years of public board experience |

|

Debra J.

|

Independent Age: 72 Director Since: 2008 Committee Memberships: Audit (Chair) Nominating & Corporate Governance Experience: • Former senior managing director in the Global Ratings and Research Unit of Moody’s Investors Service, Inc. • 40+ years of experience in financial services and serving on financial institution boards and audit committees |

|

Lori J.

|

Independent Age: 64 Director Since: 2019 Committee Memberships: Compensation & Personnel Nominating & Corporate Governance Experience: • Former Commander, U.S. Northern Command and North American Aerospace Defense Command, Department of the Air Force (Ret.) • 3+ decades of U.S. Air Force experience • Four Star General and first female U.S. Combatant Commander |

| Board Skills & Competencies | |

|

Extensive Senior Leadership/Executive Officer Experience (including as a public company Chief Executive Officer) |

|

Risk Management/Oversight Experience |

|

Broad International Experience |

|

Accounting

Expertise (including two Certified Public Accountants) |

|

Significant Strategic Oversight and Execution Experience |

|

Broad Product and Marketing Experience |

|

Climate and Energy Experience |

|

Significant Public Company Board, Committee, and Corporate Governance Experience |

|

Innovative Thinking |

|

High Ethical Standards |

|

Appreciation of Diverse Cultures and Backgrounds |

|

Experience Overseeing Large and Diverse Workforces |

|

Information Security Expertise |

|

7 | 2023 Proxy Statement |

2023 Executive Compensation Summary (page 53)

| Gary D. Burnison(1) | Robert P. Rozek(2) | Byrne Mulrooney(3) | Mark Arian(4) | Michael Distefano(5) | |||||

|

|

|

|

|

|||||

| Base Salary | $1,000,000 | $625,000 | $550,000 | $550,000 | $550,000 | ||||

| Stock Awards | $9,335,918 | $3,295,355 | $2,526,648 | $2,526,648 | $649,619 | ||||

| Non-Equity Incentive Plan Compensation | $1,087,478 | $543,739 | $275,856 | $385,000 | $332,292 | ||||

| Change in Pension Value and Nonqualified Deferred Compensation Earnings | – | – | – | – | – | ||||

| All Other Compensation | $94,049 | $71,434 | $93,063 | $92,187 | $66,568 | ||||

| Total | $11,517,445 | $4,535,528 | $3,445,567 | $3,553,835 | $1,598,479 |

| (1) | President and Chief Executive Officer |

| (2) | Executive Vice President, Chief Financial Officer and Chief Corporate Officer |

| (3) | Former Chief Executive Officer, RPO and Digital |

| (4) | Chief Executive Officer, Consulting |

| (5) | Chief Executive Officer, Professional Search and Interim |

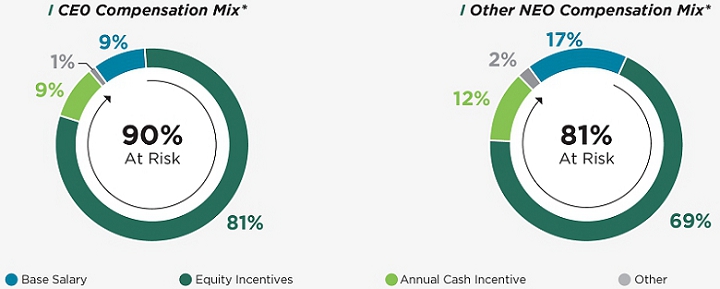

2023 Executive Total Compensation Mix (page 41)

| * | Equity awards based upon grant date value. |

|

8 | 2023 Proxy Statement |

Compensation Process Highlights (pages 27 and 40 – 43)

| • | Our Compensation and Personnel Committee receives advice from its independent compensation consultant. |

| • | We review total direct compensation and the mix of the compensation components for our named executive officers relative to our peer group as one of the factors in determining if compensation is adequate to attract and retain executive officers with the unique set of skills necessary to manage and motivate our global people and organizational consulting firm. |

Elements of Compensation (pages 44 – 50)

| Element | Purpose | Determination | ||

| Base Salary | Compensate for services rendered during the fiscal year and provide sufficient fixed cash income for retention and recruiting purposes. | Reviewed on an annual basis by the Compensation and Personnel Committee taking into account competitive data from our peer group, input from our compensation consultant, and the executive’s individual performance. | ||

| Annual Cash Incentives | Motivate and reward named executive officers for achieving performance goals over a one-year period. | Determined by the Compensation and Personnel Committee based upon performance goals, strategic objectives, and competitive data. | ||

| Long-Term Incentives | Align the named executive officers’ interests with those of stockholders and motivate and retain top talent. | Determined by the Compensation and Personnel Committee based upon a number of factors including competitive data, total overall compensation provided to each named executive officer, and historical grants. |

Compensation Practices (page 49)

|

Clawback policy applicable to all cash incentive payments and performance-based equity awards granted to executive officers. |

|

No “single trigger” equity acceleration for named executive officers in connection with a change in control. |

|

Policies prohibiting hedging, speculative trading, or pledging of Company stock. |

|

Stock ownership requirements for named executive officers and directors. |

|

No excise tax gross-ups to any executive officers. |

Forward-Looking Statements & Website References

This Proxy Statement contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements include, but are not limited to, statements regarding the Company’s plans, objectives, expectations, and intentions, including regarding the Company’s goals or expectations with respect to future financial results, corporate responsibility, including the Company’s ESG Program, sustainability, employees, environmental matters, policy, procurement, philanthropy, data privacy and cybersecurity, and business risks and opportunities, as well as statements from third parties about our ESG performance and risk profile. These statements are based on current expectations and are subject to numerous risks and uncertainties, many of which are outside of the control of Korn Ferry. Forward-looking statements are not guarantees or promises that goals or targets will be met. The Company undertakes no obligation to update any forward-looking or other statements, whether as a result of new information, future events, or otherwise, and notwithstanding any historical practice of doing so. In addition, historical, current, and forward-looking sustainability-related statements may be based on current or historical goals, targets, aspirations, commitments, or estimates; standards for measuring progress that are still developing; diligence, internal controls, and processes that continue to evolve; data, certifications, or representations provided or reviewed by third parties, including information from acquired entities that is incomplete or subject to ongoing review or has not yet been integrated into the Company’s reporting processes; and assumptions that are subject to change in the future. Actual results may differ materially from those indicated by such forward-looking statements as a result of risks and uncertainties, including legislative and regulatory developments, technological innovations and advances, and those factors discussed or referenced in our most recent annual report on Form 10-K filed with the SEC for the fiscal year ended April 30, 2023 (the “Form 10-K”), under the heading “Risk Factors,” a copy of which is being made available with this Proxy Statement, and subsequent quarterly reports on Form 10-Q.

Website references and hyperlinks throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this Proxy Statement, nor does it constitute a part of this Proxy Statement.

|

9 | 2023 Proxy Statement |

This page intentionally left blank

|

11 | 2023 Proxy Statement |

Proposal No. 1

Election of Directors

Our stockholders will be asked to consider the following nine nominees for election to our Board to serve for a one-year term until the 2024 Annual Meeting of Stockholders and until their successors have been duly elected and qualified, subject to their earlier death, resignation, or removal:

| Name | Position with Korn Ferry |

| Doyle N. Beneby | Director |

| Laura M. Bishop | Director |

| Gary D. Burnison | Director and Chief Executive Officer |

| Matthew J. Espe | Nominee |

| Charles L. Harrington | Director |

| Jerry P. Leamon | Director |

| Angel R. Martinez | Director |

| Debra J. Perry | Director |

| Lori J. Robinson | Director |

Each of the nominees was previously elected by stockholders at the 2022 Annual Meeting of Stockholders, except for Matthew J. Espe. Mr. Espe was identified as part of a thorough search process conducted by Korn Ferry’s internal board search consultants. Detailed biographical information regarding each of these nominees is provided in this Proxy Statement under the heading “Background Information Regarding Director Nominees.” Our Nominating and Corporate Governance Committee (the “Nominating Committee”) has reviewed the qualifications of each of the nominees and has recommended to the Board that each nominee be submitted to a vote at the Annual Meeting.

All nominees have indicated their willingness to serve, if elected, but if any should be unable or unwilling to serve, proxies may be voted for a substitute nominee designated by the Board. The Company did not receive any stockholder nominations for director. Proxies cannot be voted for more than the number of nominees named in this Proxy Statement.

Required Vote

In uncontested elections, directors are elected by a majority of the votes cast, meaning that each director nominee must receive a greater number of shares voted “for” such nominee than the shares voted “against” such nominee. If an incumbent director does not receive a greater number of shares voted “for” such director than shares voted “against” such director, then such director must tender his or her resignation to the Board. In that situation, the Company’s Nominating Committee would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. Within 90 days from the date the election results were certified, the Board would act on the Nominating Committee’s recommendation and publicly disclose its decision and rationale behind it.

In a contested election, directors are elected by a plurality of the votes cast.

RECOMMENDATION

OF THE BOARD

The Board unanimously recommends that you vote “FOR” each of the nominees named above for election as a director.

|

12 | 2023 Proxy Statement |

The Board of Directors

The Company’s Restated Certificate of Incorporation provides that the number of directors shall not be fewer than eight nor more than fifteen, with the exact number of directors within such limits to be determined by the Board. Currently, the Board is comprised of eight directors; effective immediately upon the election of directors at the Annual Meeting, the size of the Board will be increased to nine directors. Upon the recommendation of the Company’s Nominating Committee, the Board has nominated the following persons to serve as directors until the 2024 Annual Meeting of Stockholders or their earlier death, resignation, or removal:

| Doyle N. Beneby | Jerry P. Leamon | |

| Laura M. Bishop | Angel R. Martinez | |

| Gary D. Burnison | Debra J. Perry | |

| Matthew J. Espe | Lori J. Robinson | |

| Charles L. Harrington |

Each of the named nominees is independent under the NYSE rules, except for Mr. Burnison. If re-elected, Mr. Leamon will continue to serve as the Company’s independent non-executive Chair of the Board.

The Board held four meetings during fiscal year 2023. Each of the incumbent directors attended at least 75% of the Board meetings and the meetings of committees of which they were members in fiscal year 2023. Directors are expected to attend each annual meeting of stockholders. The nine directors then-serving attended the 2022 Annual Meeting of Stockholders online.

Governance Insights

Director Succession Planning & ESG Matters

Q&A with Doyle Beneby, Chair of the Nominating and Corporate Governance Committee

Question: The Board has added a number of new directors over the past several years. How does the Committee approach succession planning for the Board?

The Nominating Committee is responsible for recommending changes to the size, structure, composition, and functioning of the Board and its committees, and we discuss the need for such changes on an annual basis (or periodically, if an unexpected change to the Board occurs). We seek candidates who can bring new perspectives and particular skills to support the Company’s strategy on a going-forward basis. In 2021, this effort resulted in the addition of Laura M. Bishop to increase the Board’s financial expertise and experience in executive management and corporate governance. In 2022, Charles L. Harrington’s addition expanded the breadth of the Board’s experience in business and technology transformation for complex organizations, as well as leadership and financial/audit expertise. And in 2023, the Board nominated Matthew J. Espe to expand the Board’s management experience and knowledge in the areas of finance, accounting, international business operations, risk oversight, and corporate governance.

Our efforts in this area are driven by the Board’s desire for a composition that represents a range of tenures, areas of expertise, industry experience, and backgrounds. We believe the newer members of our Board are balanced by our more tenured members, who contribute meaningful context and experience to our oversight of management and execution of the Company’s strategy.

Question: What recent progress and other milestones has the Company’s ESG Program achieved under the Committee’s oversight?

The Nominating and Corporate Governance Committee is responsible for overseeing the Company’s ESG Program, which includes initiatives that seek to improve the way we work and live, empower diversity, equity, and inclusion, and give back to the communities in which we operate.

The Proxy Statement Summary on page 4 and the graphics on the next page highlight several recent ESG awards and recognitions of which we are proud, including for our efforts to recruit and retain veterans and support women, parents, and LGBTQ+ colleagues. We believe these awards reflect our ongoing efforts to create an inclusive culture and workplace. In addition, the following section describes some of our ESG Program’s recent initiatives and accomplishments. More information about our ESG Program, our reporting, and other achievements is available on the Korn Ferry website.

|

13 | 2023 Proxy Statement |

Reporting

| • | The Company published its fifth ESG Report in 2023, covering 2022 activities and achievements. The 2022 ESG Report received Platinum honors from the Hermes Creative Awards. The Company’s 2021 ESG Report (published in 2022) covering 2021 activities and achievements also received Platinum honors from the Hermes Creative Awards and Platinum honors from MarCom Awards. |

| • | In 2023, the Company also published its inaugural report in alignment with the standards of the Task Force for Climate-Related Disclosures and its third report in general alignment with the reporting recommendations for its industry by the Sustainability Accounting Standards Board. |

| • | Korn Ferry was awarded the 2022 Gold Status Medal from EcoVadis for its sustainability practices. This represents a score in the top 5% of the companies assessed by EcoVadis globally. We received the Silver Status Medal from EcoVadis for three consecutive years prior to 2022, and our score has improved each year. |

| • | For the sixth consecutive year, Korn Ferry responded to the CDP Climate Change survey, reporting on our greenhouse gas emissions and broader practices related to climate change. Korn Ferry achieved a Leadership Level rating for our 2022 submission, which detailed calendar year 2021 emissions and climate-related practices. The Leadership Level rating is the highest level in the CDP framework. |

|

14 | 2023 Proxy Statement |

Director Qualifications

| Our Approach | The Board believes that the Board, as a whole, should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee the Company’s business. In addition, the Board believes there are certain attributes every director should possess, as reflected in the Board’s membership criteria discussed below. Accordingly, the Board and the Nominating Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and the Company’s current and future needs. | |

| Minimum Criteria |

The Nominating Committee is responsible for developing and recommending Board membership criteria to the full Board for approval. The criteria, which are set forth in the Company’s Corporate Governance Guidelines, include:

a reputation for integrity,

honesty and adherence to high ethical standards,

strong management experience,

current knowledge of and contacts in the Company’s industry or other industries relevant to the Company’s business,

the ability and willingness to commit adequate time and attention to Board and Committee activities, and

the fit of the individual’s skills and personality with those of other directors in building a Board that is effective, collegial, diverse, and responsive to the needs of the Company. |

|

| Diverse Experience and Backgrounds | The Nominating Committee seeks a variety of occupational, educational, and personal backgrounds on the Board in order to obtain a range of viewpoints and perspectives and to enhance the diversity of the Board in such areas as professional experience, geography, race, gender, and ethnicity. While the Nominating Committee does not have a formal policy with respect to diversity, the Nominating Committee believes it is essential that Board members represent diverse viewpoints and backgrounds. | |

| Evaluating Board Composition | The Nominating Committee periodically evaluates the composition of the Board to assess the skills and experience that are currently represented on the Board, as well as the skills and experience that the Board will find valuable in the future, given the Company’s current business and strategic plans. This periodic assessment enables the Board to update the skills and experience it seeks in the Board as a whole and in individual directors as the Company’s needs evolve and change over time, and to assess the effectiveness of efforts to pursue diversity. | |

| Identifying Director Candidates | In identifying director candidates from time to time, the Nominating Committee considers recommendations from Board members, management, and stockholders, and may from time to time engage a third-party search firm or utilize Company resources. The Nominating Committee may establish specific skills and experience that it believes the Company should seek in order to constitute a balanced and effective board. In evaluating director candidates, and considering incumbent directors for renomination to the Board, the Nominating Committee takes into account a variety of factors. These include each nominee’s independence, financial literacy, personal and professional accomplishments, and experience, each in light of the composition of the Board as a whole and the needs of the Company in general, and for incumbent directors, past performance on the Board. | |

| Reviewing Director Commitments | The Nominating Committee also considers each nominee’s or incumbent director’s ability and willingness to commit adequate time to Board and committee matters. |

Annual Board and Committee Evaluations

Each year, the Board and its committees conduct a self-evaluation to determine that they are functioning effectively and consistently with their purpose and responsibilities. Topics addressed through these processes have included Board structure, director nominations and recruitment, Board and committee meetings and information, Board responsibilities, including management succession planning, and Board and management relations.

| Solicit Feedback | Review By Outside Counsel |

Internal Review | Discussion & Updates |

| Directors receive via a secure website a detailed questionnaire designed to elicit feedback regarding the functioning and leadership of the Board and each of the committees as a whole. | Outside counsel reviews the responses to the questionnaire and consolidates the feedback into a summary presentation. | A summary of results are provided by outside counsel, with the anonymized responses, to the Chair of the Board and the Chair of the Nominating Committee for review. | The results are discussed at both the Board and Nominating Committee levels, along with a determination of what, if any, changes should be made in light of the responses. |

|

15 | 2023 Proxy Statement |

Snapshot of Director Nominees

Board Composition: Skills, Tenure,* and Diversity

The Board and Company are focused on creating a Board that reflects a wide range of backgrounds, experiences, and cultures. The following skills are possessed by one or more of our nominees:

|

Extensive Senior Leadership/Executive Officer Experience (including as a public company Chief Executive Officer) |  |

Significant Public Company Board, Committee, and Corporate Governance Experience | |

|

Risk Management/Oversight Experience |  |

Innovative Thinking | |

|

Broad International Experience |  |

High Ethical Standards | |

|

Accounting Expertise (including two Certified Public Accountants) |  |

Appreciation of Diverse Cultures and Backgrounds | |

|

Significant Strategic Oversight and Execution Experience |  |

Experience Overseeing Large and Diverse Workforces | |

|

Broad Product and Marketing Experience |  |

Breadth of Experience Across Industries | |

|

Climate and Energy Expertise |  |

Information Security Expertise | |

| Beneby | Bishop | Burnison | Espe | Harrington | Leamon | Martinez | Perry | Robinson | |

| Gender | M | F | M | M | M | M | M | F | F |

| Racially/Ethnically Diverse | ● | ● |

| * | Tenure is provided for non-executive directors only. Figures may not total 100% due to rounding. |

| ** | These graphics represent directors who are members of underrepresented groups (by gender or race/ethnicity). |

| *** | Not included in percentages of directors from underrepresented groups. |

|

16 | 2023 Proxy Statement |

Background and Qualifications of Director Nominees

The biographies below set forth information about each of the director nominees, including each such person’s specific experience, qualifications, attributes, and skills that led our Board to conclude that such director nominee should serve on our Board in light of the Company’s current business, structure, and strategic plans. The process undertaken by the Nominating Committee in recommending qualified director candidates is described above under “Director Qualifications” and below under “Corporate Governance—Board Committees—Nominating and Corporate Governance Committee.”

|

Doyle N. BENEBY

Director Since: 2015

Former President and Chief Executive Officer, Midland Cogeneration Venture

Age: 63

Other Directorships: • Quanta Services • Capital Power Corporation • West Fraser Timber Co. Ltd.

Other Companies: • N/A |

Professional Experience: President and Chief Executive Officer (Nov. 2018 – Sept. 2022) Midland Cogeneration Venture, a natural gas fired combined electrical energy and steam energy generating plant

Chief Executive Officer (Nov. 2015 – May 2016) New Generation Power International, a start-up international renewable energy company

President and Chief Executive Officer (July 2010 – Nov. 2015) CPS Energy, the largest public power, natural gas, and electric company in the nation

President, Exelon Power, and Senior Vice President, Exelon Generation

(2009 – 2010) Exelon Corporation, a nuclear electric power generation company

Board Qualifications and Skills:

Extensive Senior Leadership/Executive Officer Experience: In addition to his experience as a professional director, Mr. Beneby previously served in a multitude of senior leadership positions, including as former President and Chief Executive Officer of Midland Cogeneration Venture, as Chief Executive Officer of New Generation Power International, as President and Chief Executive Officer of CPS Energy, and various leadership roles at PECO Energy and Exelon Power, where he served as President.

Broad Energy Industry Experience: Over 35 years of experience in the energy industry, with expertise in many facets of the electric and gas utility industry.

|

|

17 | 2023 Proxy Statement |

|

Laura M. BISHOP

Director Since: 2021

Former Executive Vice President and Chief Financial Officer, USAA

Age: 61

Other Directorships: • N/A

Other Companies: • Pie Group Holdings, Inc. • Fidelity Mutual Funds |

Professional Experience: Executive Vice President and Chief Financial Officer (June 2014

– Dec. 2020) USAA, a Fortune 100 integrated financial services company that provides financial products and services for the military and their families

Various Roles, including Senior Vice President and Chief Financial Officer (1992 – 2000) Luby’s Inc., a publicly traded restaurant company

Various Roles, including Senior Manager (1983 – 1992) Ernst & Young LLP, a multinational professional services network

Board Qualifications and Skills:

Senior Leadership/Executive Officer Experience: Held senior leadership positions over a nearly 20-year career with USAA, including as Executive Vice President and Chief Financial Officer, and in her near decade of work with Luby’s Inc., including as Senior Vice President and Chief Financial Officer. As a member of USAA’s Executive Council, Ms. Bishop was also responsible for developing and executing strategy while directing activities across enterprise-wide financial management and reporting, including treasury, capital management, controller, tax, planning and forecasting, and strategic cost management. She was also responsible for governance and oversight for investment strategy and management of all institutional and benefit plan portfolios, as well as all capital markets activities, including commercial paper and long-term debt programs, credit facilities, asset-backed securitizations, and reinsurance programs.

Financial Experience and Investment Expertise: In September 2022, Ms. Bishop joined the Board of Trustees of the Fixed Income & Asset Allocation Funds of Fidelity Mutual Funds as an Advisory Trustee. At USAA, she served as the enterprise Chief Financial Officer for all of USAA’s operating companies spanning the Property and Casualty companies, USAA Federal Savings Bank, and USAA Life Insurance Company. As a Senior Manager at Ernst & Young LLP, she directed audits of publicly traded and privately held companies in a variety of industries. Ms. Bishop also holds a Bachelor of Business Administration in Accounting and is on the Audit Committee of private company Pie Group Holdings, Inc. Ms. Bishop is a certified public accountant.

|

|

Gary D. BURNISON

Director Since: 2007

President and Chief Executive Officer

Age: 62

Other Directorships: • N/A

Other Companies: • N/A |

Professional Experience: President and Chief Executive Officer (July 2007 – Present) Executive Vice President and Chief Financial Officer (March 2002 – June 2007) Chief Operating Officer (Oct. 2003 – June 2007) Korn Ferry

Principal and Chief Financial Officer (1999 – 2001) Guidance Solutions, a website development company

Executive Officer and Director (1995 – 1999) Jefferies & Company, Inc., the principal operating subsidiary of Jefferies Group, Inc., a diversified financial services company

Partner KPMG Peat Marwick, a multinational professional services network

Board Qualifications and Skills:

High Level of Financial Experience: Substantial financial experience gained in roles as President, Chief Executive Officer, and as former Chief Financial Officer and Chief Operating Officer of the Company, as Chief Financial Officer of Guidance Solutions, as an executive officer of Jefferies & Company, Inc., and as a partner at KPMG Peat Marwick.

Senior Leadership/Executive Officer Experience: In addition to serving as the Company’s President and Chief Executive Officer, served as Chief Financial Officer of Guidance Solutions.

Extensive Knowledge of the Company’s Business and Industry: Over 20 years of service with the Company, in increasingly senior roles.

Thought Leader: Author of nine leadership and career development books, and regular content focused on the intersection of strategy, talent, and leadership, as well as a frequent contributor to media outlets.

|

|

18 | 2023 Proxy Statement |

|

Matthew J. ESPE

Nominee

Age: 64

Other Directorships: • Anywhere Real Estate Inc. • WESCO International, Inc.

Other Companies: • N/A |

Professional Experience: Operating Partner (November 2017 – Present) Advent International, a Boston-based private equity investment firm

Chief Executive Officer (February 2017 – November 2017) Radial Inc., an ecommerce services business

Operating Advisor (2016 – 2017) Berkshire Partners, LLC, a private equity firm

President and Chief Executive Officer (2010 – March 2016) Armstrong World Industries, Inc., a global producer of flooring products and ceiling systems

Chairman and Chief Executive Officer (2008 – 2010) Ricoh Americas Corporation, an information management and digital services company

Chairman, President and Chief Executive Officer (2003 – 2008) President and Chief Executive Officer (2002 – 2003) IKON Office Solutions, Inc., a document management services company

Various Roles, including President and Chief Executive Officer, GE Lighting (1980 - 2002) General Electric Company, a multinational conglomerate

Board Qualifications and Skills:

Senior Leadership/Executive Officer Experience: Over 22-year career at General Electric Company, held increasing roles of responsibility, followed by leadership positions as Chief Executive Officer of multiple private companies across industries. He has deep experience in strategy development and execution, operational management, business development, and technology development.

Significant Business Transformation Experience: In his work for private equity firms, served as chairman for two privately held portfolio companies and led the transformation of Radial Inc. as Chief Executive Officer, resulting in the successful sale of the business. As Chief Executive Officer of IKON Office Solutions, transformed the company’s business model and increased shareholder value following its merger with Ricoh Japan.

Extensive Advisory and Board Experience: More than 21 years of public and private company board experience, including as Chairman at Klöckner Pentaplast Europe GmbH & Co. (from 2018 to 2023) and as a director at Foundation Building Materials Inc. (from 2018 to 2021), Veritiv Corporation (from 2016 to 2017), Armstrong World Industries, Inc. (from 2010 to 2016), and KG Unisys Corporation (from 2004 to 2014).

|

|

Charles L. HARRINGTON

Director Since: 2022

Age: 64

Other Directorships: • J.G. Boswell Company • John Bean Technologies • Constellation Energy

Other Companies: • Cal Poly Foundation • Institute of Digital Engineering USA |

Professional Experience: Executive Chairman (2021 - 2022) Various Roles, including Group President, PARCOM, Biotechnology, Semiconductors and Telecommunications (1982 – 2006) Parsons Corporation, a technology-focused defense, intelligence, security, and infrastructure engineering firm

Board Qualifications and Skills:

Senior Leadership/Executive Officer Experience: Over his nearly 40-year career at Parsons Corporation, held increasing roles of responsibility, including 13 years as Chief Executive Officer, 12 years as President, and two years as Chief Financial Officer, Executive Vice President, and Treasurer. He has deep experience in strategy development and execution, business transformation, operational management, business development, and technology development.

Significant Advisory and Board Experience: More than 15 years of public company board experience, including at Parsons Corporation (as Chairman from 2008 to 2021 and Executive Chairman from 2021 to 2022) and AES Corporation (from 2013 to 2020) where he chaired the Audit Committee. Serves as director of the Cal Poly Foundation since 2010 and as Vice Chair since 2019. Also serves as the director and chairman of the non-profit Institute for Digital Engineering USA, and as an advisor to Glasswing Ventures, and The Holdsworth Group, LLC.

|

|

19 | 2023 Proxy Statement |

|

Jerry P. LEAMON

Director Since: 2012

Former Global Managing Director, Deloitte

Age: 72

Other Directorships: • N/A

Other Companies: • Credit Suisse USA, a subsidiary of Credit Suisse Group AG • Geller & Company • Jackson Hewitt Tax Services • Business Advisory Council of the Carl H. Lindner School of Business |

Professional Experience: Various Roles, including Global Managing Director and Partner (1972 – 2012) Deloitte, a multinational professional services company

Board Qualifications and Skills:

High Level of Financial Experience: Substantial financial experience gained from an almost 40-year career with Deloitte, including as leader of the tax practice in the U.S. and globally, and as leader of the M&A practice for more than 10 years.

Accounting Expertise: In addition to an almost 40-year career with Deloitte, Mr. Leamon is a certified public accountant.

Broad International Experience: Served as leader of Deloitte’s tax practice, both in the U.S. and globally, and was Global Managing Director for all client programs, including industry programs, marketing communication and business development.

Service Industry Experience: Deep understanding of operational and leadership responsibilities within the professional services industry, having held senior leadership positions at Deloitte while serving some of their largest clients.

Significant Board Experience: Mr. Leamon serves on a number of boards and non-profit organizations, including Credit Suisse USA, where he chairs the Audit Committee, Geller & Company, and Jackson Hewitt Tax Services. He served as chairman of Americares Foundation for seven years and a Board member for 17 years. He is also Trustee Emeritus of the University of Cincinnati Foundation and Board and serves as a member of the Business Advisory Council of the Carl H. Lindner School of Business. |

|

Angel R. MARTINEZ

Director Since: 2017

Former Chairman of the Board of Directors and former Chief Executive Officer and President, of Deckers Brands

Age: 68

Other Directorships: • Genesco Inc.

Other Companies: • N/A |

Professional Experience: Chief Executive Officer and President (April 2005 – June 2016) Deckers Brands (formerly known as Deckers Outdoor Corporation), a global leader in designing, marketing, and distributing innovative footwear, apparel, and accessories developed for both everyday casual lifestyle use and high performance activities

President, Chief Executive Officer and Vice Chairman (April 2003 – March 2005) Keen LLC, an outdoor footwear manufacturer

Executive Vice President and Chief Marketing Officer (1999 –

2001) Reebok International Ltd., an American fitness footwear and clothing manufacturer

Board Qualifications and Skills:

Extensive Senior Leadership/Executive Officer Experience: Served in numerous senior leadership positions, including as Chief Executive Officer and President of Deckers Brands, Executive Vice President and Chief Marketing Officer of Reebok International Ltd., President of The Rockport Company, and President and Chief Executive Officer of Keen, LLC.

Broad Product and Marketing Experience: Almost 40 years of experience in management, product, and marketing from senior positions with, among other companies, Deckers Brands, Reebok International, and The Rockport Company.

Significant Public Company Board and Corporate Governance Experience: Over 24 years of public company board service, including as a director of Tupperware Brands Corporation from 1998 to 2020, and Executive Chairman (2008 to 2016) and non-Executive Chairman (2016 to 2017) of the Board of Deckers Brands.

|

|

20 | 2023 Proxy Statement |

|

Debra J. PERRY

Director Since: 2008

Former senior managing director in the Global Ratings and Research Unit of Moody’s Investors Service, Inc.

Age: 72

Other Directorships: • Assurant, Inc.

Other Companies: • The Bernstein Funds, Inc., a mutual fund complex |

Professional Experience: Senior Managing Director, Global Ratings and Research Unit, Moody’s

Investors Service, Inc. (2001 – 2004) Moody’s Corporation, a business and financial services company

Board Qualifications and Skills:

High Level of Financial Experience: Substantial financial experience gained from more than 40 years of professional experience in financial services and serving on financial institution boards and audit committees, including a 12-year career at Moody’s Corporation, where among other things, Ms. Perry oversaw the Americas Corporate Finance, Leverage Finance, Public Finance and Financial Institutions departments.

Significant Audit Committee Experience: Over 19 years of public company audit committee service, including as a Chair of PartnerRe’s Audit Committee (from January 2015 to March 2016) and as a member of the audit committees of the BofA Funds Series Trust (from April 2011 to May 2016), Genworth Financial (from Dec. 2016 to May 2022), MBIA (from 2004 to 2008), CNO Financial Group, Inc. (from 2004 to 2011), Korn Ferry (since 2008; appointed Chair in 2010), and The Bernstein Funds, Inc. (since 2011).

Significant Public Company Board and Corporate Governance Experience: Currently serves as a director of Assurant, Inc. (since August 2017), including as Finance & Risk Committee Chair and Nominating and Governance member, and as a director of The Bernstein Funds, Inc. (since July 2011), including as a member of the Audit Committee and Nominating Committee, and former Chair (from July 2018 to June 2023). Previously served as a director of Genworth Financial (Dec. 2016 to May 2022), as a director of PartnerRe (June 2013 to March 2016), MBIA (2004 to 2008), and CNO Financial Group, Inc. (2004 to 2011), and as a trustee of BofA Funds Series Trust (April 2011 to May 2016). Named in 2014 to the National Association of Corporate Directors’ Directorship 100, which recognizes the most influential people in the boardroom and corporate governance community. Serves as a trustee of the Committee for Economic Development of the Conference Board, a non-partisan, business-led public policy organization.

|

|

Lori J. ROBINSON General (ret.)

Director Since: 2019

Commander, U.S. Northern Command and North American Aerospace Defense Command, Department of the Air Force (Ret.)

Age: 64

Other Directorships: • Nacco Industries • Centene Corp.

Other Companies: • The Robinson Group, LLC |

Professional Experience: Non-Resident Senior Fellow (2018 – Present) Harvard Kennedy School, Belfer Center for Science and International Affairs

Founder, Director (2018 – Present) The Robinson Group, LLC

Commander (2016 – 2018) U.S. Northern Command and North American Aerospace Defense Command, Department of Defense

Commander (2014 – 2016) Pacific Air Forces, U.S. Air Force

Vice Commander (2013 – 2014) Air Combat Command, U.S. Air Force

Board Qualifications and Skills:

High Level of Leadership Experience: Four Star General and first female U.S. Combatant Commander, holding numerous government leadership roles with the U.S. Department of Defense, including serving as Commander of the U.S. Northern Command and North American Aerospace Defense Command, and Commander, Pacific Air Forces and Air Component Commander for U.S. Pacific Command, leading more than 45,000 Airmen. Named by Time Magazine as one of the “Women Who Are Changing The World” in 2017, in recognition of her service as the first woman to lead a top-tier U.S. Combat Command, and as one of “Time’s Most Influential People in 2016.”

Significant Strategic Oversight and Execution Experience: Over three decades of experience with the U.S. Air Force overseeing, among other things, homeland defense, civil support, and security cooperation.

Extensive International Experience: Interacted with counterparts in the Indo-Pacific (including China) and the Middle East, reported directly to the U.S. Secretary of Defense and Chief of the Canadian Defence Staff, served four combat tours, and oversaw U.S. Air Force operations in the Middle East.

|

|

21 | 2023 Proxy Statement |

Corporate Governance

The Board oversees the business and affairs of the Company and believes good corporate governance is a critical factor in our continued success and also aligns management and stockholder interests. Through our website, at www.kornferry.com, our stockholders have access to key governing documents such as our Code of Business Conduct and Ethics, Corporate Governance Guidelines, and charters of each committee of the Board, as well as information regarding our internal ESG Program. The highlights of our corporate governance program are included below:

|

|

|

||

| Board Structure | Stockholder Rights | Other Highlights | ||

|

•

88% of the Board consists of Independent Directors •

Independent Chair of the Board, Separate from CEO •

Independent Audit, Compensation, and Nominating Committees •

Regular Executive Sessions of Independent Directors •

Annual Board and Committee Self-Evaluations •

56% Board Members and nominees from Underrepresented Groups (by Gender or Race/Ethnicity) (if all are elected) •

2 Committees Led by Directors from Underrepresented Groups (by Gender or Race/Ethnicity) •

Annual Strategic Off-Site Meeting •

No Director Serves on More than Four Public Company Boards (including the Company’s Board) •

10-Term Service Limit for Non-Executive Directors Joining the Board after October 1, 2020 |

•

Annual Election of All Directors •

Majority Voting for Directors in Uncontested Elections

•

No Poison Pill in Effect •

Stockholder Communication Process for Communicating with the Board

•

Regular Stockholder Engagement •

No Supermajority Voting Standards •

Ability of Stockholders to Call Special Stockholder Meetings |

•

Clawback Policy •

Stock Ownership Policy •

Pay-for-Performance Philosophy •

Policies Prohibiting Hedging, Pledging, and Short Sales •

No Excise Tax Gross-Ups •

Quarterly Education on Latest Corporate Governance Developments •

Committee Oversight of ESG Program •

Board Oversight of Political Contributions and Risk •

Annual Evaluation of Corporate Governance Guidelines and Committee Charters •

Annual Board and Compensation Committee Review of Succession Planning •

Board Access to Management |

Board Leadership Structure

Board Discretion. The Company’s Corporate Governance Guidelines provide that the Board is free to select its Chair and Chief Executive Officer in the manner it considers to be in the best interests of the Company and that the role of Chair and Chief Executive Officer may be filled by a single individual or two different persons. This provides the Board with flexibility to decide what leadership structure is in the best interests of the Company at any point in time.

Separate Chair and CEO. Currently, the Board is led by an independent, non-executive Chair, Mr. Leamon. Following the Annual Meeting, Mr. Leamon will serve as Chair of the Board, subject to his re-election as a director at the Annual Meeting. The Board has determined that having an independent director serve as Chair of the Board is in the best interests of the Company at this time because it allows the Chair to focus on the effectiveness and independence of the Board while the Chief Executive Officer focuses on executing the Company’s strategy and managing the Company’s business. In the future, the Board may determine that it is in the best interests of the Company to combine the role of Chair and Chief Executive Officer.

|

22 | 2023 Proxy Statement |

Director Independence

Board Determinations. The Board has determined that as of the date hereof, 88% of the Board is “independent” under the independence standards of The New York Stock Exchange (the “NYSE”). The Board has determined that the following directors and nominees are “independent” under the independence standards of the NYSE: Doyle N. Beneby, Laura M. Bishop, Matthew J. Espe, Charles L. Harrington, Jerry P. Leamon, Angel R. Martinez, Debra J. Perry, and Lori J. Robinson. The Board also determined that George Shaheen and Christina Gold qualified as independent during their service on the Board in fiscal 2022.

Independence Standards. For a director to be “independent,” the Board must affirmatively determine that such director does not have any material relationship with the Company. To assist the Board in its determination, the Board reviews director independence in light of the categorical standards set forth in the NYSE’s Listed Company Manual. Under these standards, a director cannot be deemed “independent” if, among other things:

| • | the director is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company; |

| • | the director has received, or has an immediate family member who received, during any 12-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| • | (1) the director or an immediate family member is a current partner of a firm that is the Company’s internal or external auditor, (2) the director is a current employee of such a firm, (3) the director has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit, or (4) the director or an immediate family member was within the last three years a partner or employee of such firm and personally worked on the Company’s audit within that time; |

| • | the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serve or served on that company’s compensation committee; or |

| • | the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million or 2% of the other company’s consolidated gross revenues. |

Executive Sessions. The independent directors of the Board meet regularly in executive sessions outside the presence of management. Mr. Leamon, as Chair of the Board, currently presides at all executive sessions of the independent directors.

|

23 | 2023 Proxy Statement |

Board’s Oversight of Enterprise Risk and Risk Management

The Board plays an active role, both as a whole and also at the committee level, in overseeing the Company’s management of risks. Management is responsible for the Company’s day-to-day risk management activities.

| The Board |

|

Oversees Company process for assessing and managing risk |

| Monitors risks through regular reports from each committee chair and the General Counsel |

| Apprised of particular risk management matters in connection with its general oversight and approval of corporate matters, including, but not limited to, cybersecurity |

|

|

|

||

| Audit Committee |

Nominating

and Corporate Governance Committee |

Compensation

and Personnel Committee |

||

| Periodically reviews management’s risk assessment and risk management policies, the Company’s major financial risk exposures (including risks related to cybersecurity vulnerabilities), and the steps management has taken to monitor and control such exposures |

Oversees risks associated with operations of the Board and its governance structure

Oversees risks associated with ESG matters

|

Reviews risks related to Company’s compensation programs for senior management and employees

Assists Board in determining whether the Company’s compensation programs involve risks that are reasonably likely to have a material adverse effect on the Company |

| Management |

|

General Counsel periodically reports to the Board on litigation and other legal risks that may affect the Company |

| Various members of senior management periodically report to the Board on risk mitigation measures related to business continuity, disaster recovery, data privacy, and cybersecurity |

The Company has established an enterprise risk assessment framework for identifying, aggregating, and evaluating risk across the enterprise. This framework is integrated with the Company’s annual planning, audit scoping, and control evaluation management by its internal auditor and the Company’s Enterprise Risk Council, composed of leaders of key functions. While the Board reviews risk management more broadly as a dedicated periodic agenda item, the review of the results of the enterprise risk assessment is a dedicated annual agenda item for the Audit Committee. The Company’s other Board committees also consider and address risk during the course of their performance of their committee responsibilities, as summarized in the above graphic.

We believe the division of risk management responsibilities described above provides an appropriate framework for evaluating and addressing the risks facing the Company, and that our Board leadership structure supports this approach because it allows our independent directors, through the independent committees and non-executive Chair, to exercise effective oversight of the actions of management. To address emerging risks, the Company will from time to time form working groups to monitor or focus on such risks, such as the AI & Emerging Technology Working Group, whose responsibilities, membership, and goals have evolved over time.

Throughout the year, the Board receives regular training and updates on governance topics ranging from the increasing focus on ESG, diversity, and human capital matters by investors and regulators, legal developments related to corporate governing documents, and evolving SEC disclosure and stockholder proposal requirements, among others.

|

24 | 2023 Proxy Statement |

Cybersecurity and Data Privacy Risk Oversight

Cybersecurity and data privacy are risk categories surveyed as part of the Company’s annual enterprise risk assessment. We also engage industry-leading third-party cybersecurity companies to conduct testing and assessments of our systems and processes and independently evaluate our policies and programs. This is complemented by a third-party risk management program designed to identify and mitigate third-party cyber risks. In addition, employees are required to complete annual training related to information security and privacy matters, augmented by dynamic training through an industry-leading security training platform that provides real-time feedback through tailored phishing simulations. Korn Ferry regularly evolves its information security and data privacy programs and practices to promote the compliant handling, security, and responsible use of the information and data entrusted to us.

| Board Oversight | In connection with the Board’s risk management oversight responsibility, Board members receive a full cybersecurity and data privacy program briefing annually as well as periodic briefings based on specific requests or current events. | |

| Management’s Role |

Our Senior Vice President, Chief Information Officer oversees the Vice President of Security and the global security organization, which are responsible for managing and enforcing Korn Ferry’s information security policies and programs. Korn Ferry’s global Security team is responsible for managing Korn Ferry’s Information Security Management System, which includes policies like our Information Technology (“IT”) Security Policy (“IT Security Policy”). The IT Security Policy is designed and administered to follow the guidelines outlined in ISO standards 27001 and 27018.

Our Senior Vice President, Chief Information Officer and Associate General Counsel (Privacy) are Co-Chief Privacy Officers. They lead our global Privacy team, which is responsible for overseeing the compliant processing of personal data. The global Privacy team is also charged with the maintenance and enhancement of the Company’s data privacy program.

Korn Ferry’s privacy and security functions are governed by the Privacy Executive Committee/Security Executive Committee, which meets on a regular basis to discuss matters pertaining to data privacy and cybersecurity. The committee includes senior representatives from Korn Ferry’s IT, Security, Privacy, Legal, Finance, Digital, and Human Resources teams. Our executive management, Security, and Privacy teams are responsible for reviewing our security and privacy programs and policies.

Korn Ferry’s Cloud Infrastructure Board sets governance guidelines for cloud infrastructure across the enterprise, including priorities for cloud security and operational excellence, targeted security and privacy training for developers, and direction of cloud investments, such as disaster recovery for digital applications. The Cloud Infrastructure Board meets regularly and includes representatives from Korn Ferry’s IT, Security, Privacy, Cloud Operations, and Digital teams. |

|

| Governance Highlights |

Korn Ferry has been certified by the British Standards Institute (“BSI”) to ISO/IEC 27001 and ISO/IEC 27018 under certificate numbers IS 700177 and PII 707431, respectively, for our key technology platforms and processes across global operations.

Korn Ferry maintains a formal Security Incident Response Plan designed to enable incidents to be promptly discovered, contained, remediated, and escalated as needed to clients or other parties.

Korn Ferry has maintained cyber insurance for more than a decade. |

Assessment of Risk Related to Compensation Programs