DEF 14A: Definitive proxy statements

Published on August 11, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

Korn Ferry

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

|

No fee required. | |

|

Fee paid previously with preliminary materials. | |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

What We Stand For: Our Values

Inclusion

We embrace people with different points of view, from all backgrounds. And we think and work as one team.

Honesty

We say what we mean and we do what we say. We hold ourselves to the highest standards. And we make it safe for people to speak out when they see something wrong.

Knowledge

We are insatiably curious, always learning new things. And we actively help our colleagues grow and develop, too, with mentoring and support.

Performance

We never settle for the status quo. We always strive to be better today than we were yesterday and do our best for our clients, colleagues, and stockholders.

This page intentionally left blank

Dear Fellow Stockholders,

On behalf of the Board of Directors (the “Board”) of Korn Ferry (the “Company,” “we,” “its,” and “our”) and all of our Korn Ferry colleagues, I am delighted to invite you to attend our 2022 Annual Meeting of Stockholders on September 22, 2022 at 8:00 a.m. Pacific Time.

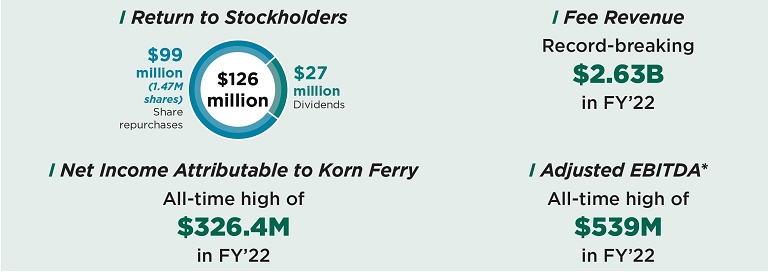

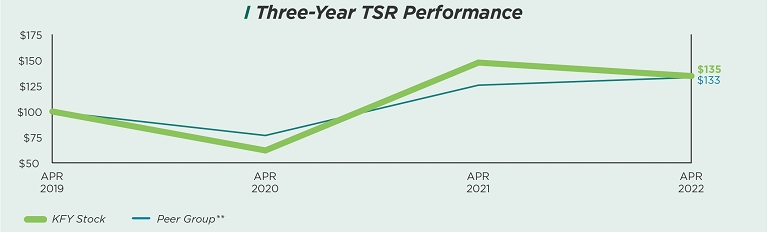

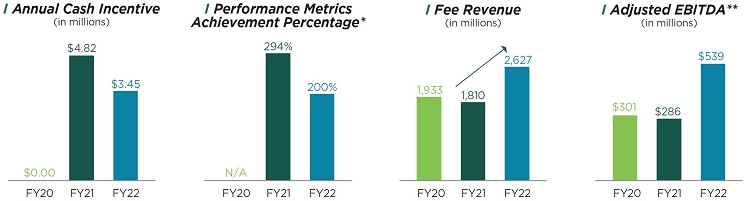

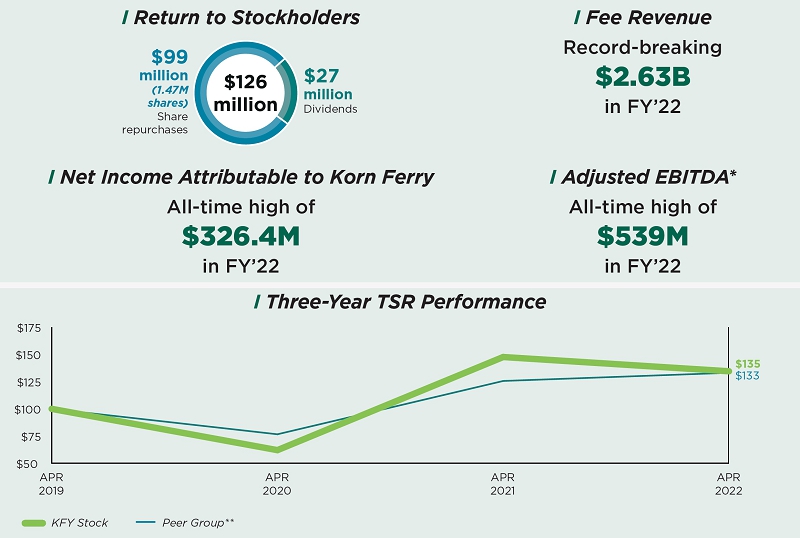

Korn Ferry’s fiscal year 2022 results were outstanding, a testament of the strength and dedication of our management team, the talent and resilience of our workforce, and the continued trust of our clients. Korn Ferry achieved record fee revenue of $2.63 billion (up 45% year over year), record net income attributable to Korn Ferry of $326.4 million (up 185% year over year), and record adjusted EBITDA* of $539 million (up 88% year over year) against the challenging backdrop of the ongoing coronavirus pandemic (“COVID-19”), war in Ukraine, and significant inflationary headwinds.

In fiscal year 2022, Korn Ferry continued to pursue a balanced capital allocation framework. The Company repurchased almost $100 million in shares, paid cash dividends of approximately $27 million, and acquired Lucas Group and Patina Solutions Group, Inc. to enhance our professional search and interim solutions business offerings.

Looking beyond our financial performance, Korn Ferry delivered for its colleagues and broader communities. As part of our environmental, social, and governance (“ESG”) initiatives:

| • | We supported our Ukrainian operations (including by providing lodging, relocation, and wellbeing resources to our colleagues), and the Korn Ferry Charitable Foundation (the “Foundation”) donated to humanitarian organizations focused on the people of Ukraine. |

| • | We increased our investment in internal talent development through programs such as the Mosaic Emerging Talent Program focused on diverse, high potential early-to-mid career professionals from across our lines of business and corporate functions. |

| • | We continued to provide financial and resource support for the Foundation’s Leadership U for Humanity program, which is available at no cost to participants, and offers an interactive six-month leadership development program to help mid-level professionals of color and other professionals from underrepresented backgrounds strengthen their leadership skills and empower them to accomplish their career goals. |

| • | We are on track to meet or exceed our target to reduce total Scope 1 and Scope 2 (market-based) greenhouse gas emissions for our global offices by 30% by 2025, compared to our 2019 emissions. |

| • | We invested in carbon removal projects in fiscal year 2022. |

We invite you to learn more about our ESG activities in our recently published 2021 ESG Report.

We are committed to pursuing Korn Ferry’s objective to expand its position as the preeminent organizational consulting firm by finding better ways to do our work, developing new capabilities, and creating strategies for success as we build an even stronger and more innovative company that delivers value to its employees, clients, stockholders, and communities. Despite the persistent external difficulties of COVID-19, uncertain economic headwinds, and heightened geopolitical tensions, we believe Korn Ferry is well-positioned for both a successful fiscal year 2023 and for substantial long-term success.

I also want to take a moment to mention that I will be retiring from the Board as of the 2022 Annual Meeting. It has been an honor to serve you and the broader Korn Ferry community alongside such a talented group of fellow Board members. After careful consideration, the Board has elected my colleague Jerry Leamon to serve as your new Board Chair following the 2022 Annual Meeting. Jerry has ably served Korn Ferry since joining the Board in 2012, and I know the Board, Korn Ferry, and our stakeholders will benefit from his experienced and thoughtful leadership.

In light of the continued public health impact of COVID-19, our 2022 Annual Meeting of Stockholders will be conducted online this year through a live audiocast, which is often referred to as a “virtual meeting” of stockholders. Our digital format allows stockholders to participate safely, conveniently, and effectively. We intend to hold our virtual meeting in a manner that affords stockholders the same general rights and opportunities to participate, to the extent possible, as they would have at an in-person meeting.

We look forward to your participation at the 2022 Annual Meeting of Stockholders. Thank you for your interest and investment in Korn Ferry.

|

Christina Gold, our current Board Chair, and George Shaheen will be retiring from our Board as of the Annual Meeting. Over the past years, Christina and George have served Korn Ferry with an abiding focus on safeguarding the best interests of the Company and our stakeholders. On behalf of myself, the rest of the Board, and Korn Ferry’s stockholders, I thank and congratulate Christina and George for their years of outstanding service.

Gary

Burnison |

| * | Adjusted EBITDA is a non-GAAP financial measure. For a discussion of this measure and for reconciliation to the most directly comparable GAAP measure, see Appendix A to this Proxy Statement. |

Sincerely,

Christina A. Gold,

Chair of the Board

August 11, 2022

Korn Ferry

1900 Avenue of the Stars, Suite 1500

Los Angeles, CA 90067

(310) 552-1834

i

| 2022 Proxy Statement

| 2022 Proxy Statement

This page intentionally left blank

|

Notice

of 2022 Annual Meeting |

Meeting Information

|

Time and Date 8:00 a.m. Pacific Time September 22, 2022 |

|

Location Live Audiocast at www.virtualshareholdermeeting.com/KFY2022 |

|

Record Date July 29, 2022 |

||

| Meeting Agenda | ||||

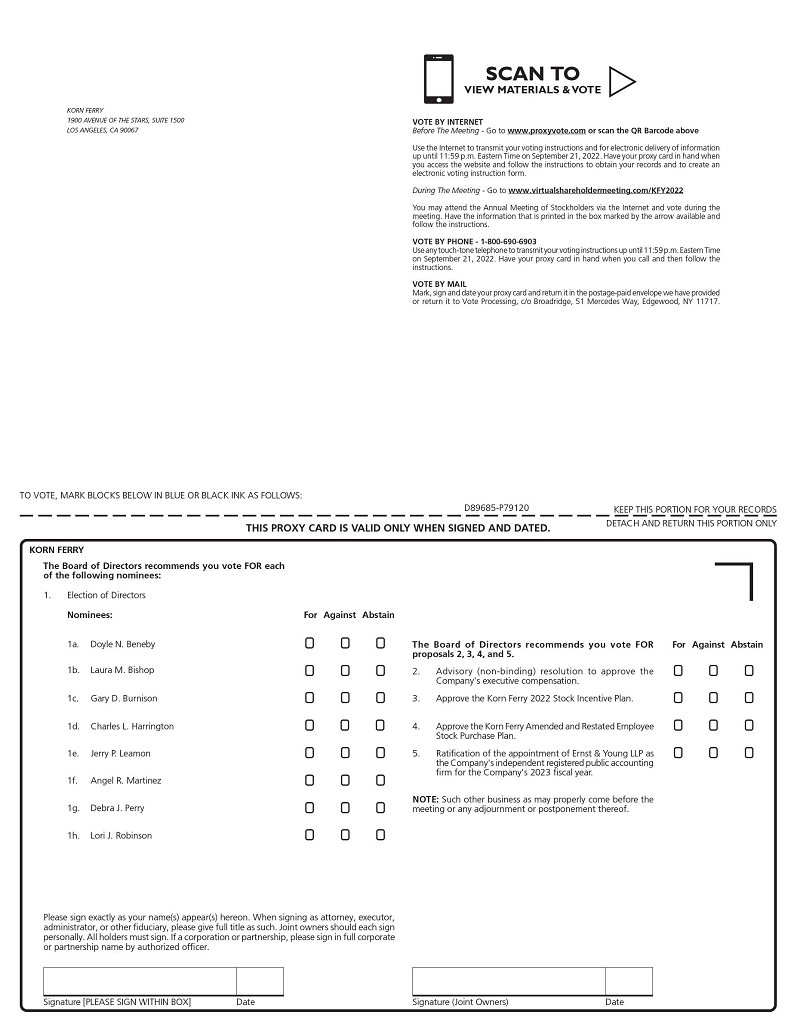

| 1. | Elect the eight directors nominated by our Board of Directors (the “Board”) and named in the Proxy Statement to serve on the Board until the 2023 Annual Meeting of Stockholders. | |||

|

FOR each Director Nominee |

||||

| 2. | Vote on a non-binding advisory resolution to approve the Company’s executive compensation. | |||

|

FOR | |||

| 3. | Approve the Korn Ferry 2022 Stock Incentive Plan. | |||

|

FOR | |||

| 4. | Approve the Korn Ferry Amended and Restated Employee Stock Purchase Plan. | |||

|

FOR | |||

| 5. | Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the Company’s 2023 fiscal year. | |||

|

FOR | |||

| 6. | Transact any other business that may be properly presented at the Annual Meeting. | |||

Virtual Meeting: In light of the ongoing public health and travel safety concerns relating to the coronavirus pandemic (“COVID-19”), Korn Ferry (the “Company,” “we,” “its,” and “our”) will hold its 2022 Annual Meeting of Stockholders (the “Annual Meeting”) online.

Who Can Vote: Stockholders who owned our common stock as of the close of business on July 29, 2022 (the “Record Date”) can vote online at the Annual Meeting or any adjournments or postponements thereof.

How to Attend: To attend the Annual Meeting online, vote or submit questions during the Annual Meeting, or view the stockholder list, stockholders of record will need to go to www.virtualshareholdermeeting.com/KFY2022 and log in using their 16-digit control number included on their proxy card or Notice of Internet Availability of Proxy Materials (the “Notice”). Beneficial owners should review these proxy materials and their voting instruction form or the Notice for how to vote in advance of, and how to participate in, the Annual Meeting.

| How You Can Vote | |||

|

Via telephone |

1-800-690-6903 | ||

|

Via Internet |

Before the Annual Meeting by visiting www.proxyvote.com

During the Annual Meeting by visiting www.virtualshareholdermeeting.com/KFY2022 |

||

|

Via mail |

Sign, date, and mail the enclosed proxy card (if you received one) | ||

|

Please read the proxy materials carefully before voting.

Your vote is important, and we appreciate your cooperation in considering and acting on the matters presented. For more information, see pages 91 - 94.

|

|||

Meeting Disruption: In the event of a technical malfunction or situation that the chair of the Annual Meeting determines may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of stockholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Annual Meeting, the chair of the Annual Meeting will convene the meeting at 9:00 a.m. Pacific Time on the date specified above and at the Company’s address at 1900 Avenue of the Stars, Suite 1500, Los Angeles, CA 90067, solely for the purpose of adjourning the Annual Meeting to reconvene at a date, time, and physical or virtual location announced by the chair of the Annual Meeting. Under either of the foregoing circumstances, we will post information regarding the announcement on the Investors page of the Company’s website at https://ir.kornferry.com.

August 11, 2022

Los Angeles, California

By Order of the Board of Directors,

Jonathan Kuai

General Counsel, Managing Director of Business

Affairs &

ESG, and Corporate Secretary

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on September 22, 2022:

The Proxy Statement and accompanying Annual Report to Stockholders are available at www.proxyvote.com.

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

Annual Meeting of Stockholders (page 91)

| Date and Time: | September 22, 2022 at 8:00 a.m. Pacific Time |

| Location: | www.virtualshareholdermeeting.com/KFY2022 |

| Admission: | To participate in the Annual Meeting online, including to vote during the Annual Meeting, stockholders will need the 16-digit control number included on their proxy card, the Notice or voting instruction form, or contact their bank, broker, or other nominee (preferably at least 5 days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in, or vote at the Annual Meeting. |

| Who Can Vote: | Holders of Korn Ferry’s common stock at the close of business on July 29, 2022. |

| How to Vote: | On or about August 11, 2022, we will mail the Notice to stockholders of our common stock as of July 29, 2022, other than those stockholders who previously requested electronic or paper delivery of communications from us. Stockholders can vote by any of the following methods described on pages 91 – 93. |

Voting Roadmap (page 91)

| Proposal |

Board Recommendation |

Page Reference |

|

| 1 |

Election of Directors • 7 of 8 nominees are independent • Diverse slate, including 2 committees led by directors from underrepresented groups (by gender or race/ethnicity) • Active Board refreshment, with five new directors or nominees in last five years • Robust Board oversight of Company strategy and risks • Responsive and evolving corporate governance practices |

FOR each Director Nominee |

12 |

| 2 |

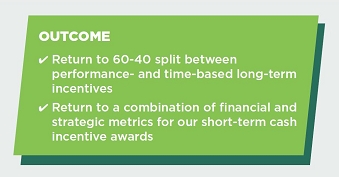

Advisory Resolution to Approve Executive Compensation • Program intended to offer competitive total direct compensation opportunities aligned with stockholder interests • Executives incentivized to focus on short-and long-term Company performance • Returned to the Company’s standard mix of 60% performance-based awards and 40% time-based awards at the beginning of fiscal year 2022 • Management outreach to 72% of outstanding shares post-2021 Annual Meeting |

FOR |

33 |

| 3 |

Approval of the Korn Ferry 2022 Stock Incentive Plan • Allows the Company to continue to maintain a compensation policy that includes a balanced mix of cash and equity • Helps the Company compete more effectively for key employee talent • Aligns the long-term interests of employees and stockholders |

FOR |

66 |

| 4 |

Approval of the Korn Ferry Amended and Restated Employee Stock Purchase Plan • Aids the Company in attracting and retaining employees • Aligns the interests of participating employees with those of stockholders by promoting stock ownership |

FOR |

78 |

| 5 |

Ratification of Independent Registered Public Accounting Firm • Independent firm with reasonable fees and strong geographic and subject matter coverage • Performance annually assessed by the Audit Committee • Served as independent registered public accounting firm since 2002 • Lead audit partner rotated in June 2020 |

FOR |

84 |

|

2 | 2022 Proxy Statement |

Highlights for Fiscal Year 2022

|

|

| ** | Excludes CoreLogic, Inc. and Nielsen Holdings Plc due to their recent and pending acquisitions, respectively. |

Business Performance

Achieved:

| I | Record Fee Revenue of $2.63 billion, up 45% over fiscal year 2021, and operating margin of 17.9%. |

| I | All-time high Diluted Earnings Per Share of $5.98, up 186% over fiscal year 2021. |

| I | All-time high net income attributable to Korn Ferry of $326.4 million, up 185% over fiscal 2021. |

| I | All-time high Adjusted EBITDA* of $539 million, up 88% over fiscal year 2021, and Adjusted EBITDA margin* of 20.5%. |

| I | All-time high Adjusted Diluted Earnings Per Share* of $6.23, up 148% over fiscal year 2021. |

| * | Adjusted Diluted Earnings Per Share, Adjusted EBITDA, and Adjusted EBITDA margin are non-GAAP financial measures. For a discussion of these measures and for reconciliation to the most directly comparable GAAP measures, see Appendix A to this Proxy Statement. |

|

3 | 2022 Proxy Statement |

Environmental, Social, and Governance (“ESG”) Accomplishments

| I | Published 2021 ESG Report and 2021 SASB Report. Received Platinum and Gold honors from MarCom Awards for our 2020 Corporate Responsibility Report and Platinum honors from Hermes Awards for our 2021 ESG Report. |

| I | Awarded the 2021 Silver Status Medal from EcoVadis for sustainability practices for the third consecutive year, and placed in the top 16% of companies assessed by EcoVadis based on our score. |

| I | Again achieved Management Level rating, this time for 2021 submission to the CDP Climate Change survey, which detailed our calendar year 2020 greenhouse gas emissions and climate-related practices. |

| I | Recognized by Seramount (formerly Working Mother Media) as one of the 2021 100 Best Companies for parents to work for the third consecutive year, as one of the 2021 Best Companies for Dads for the second consecutive year, and as one of the 2022 Top Companies for Executive Women for the third consecutive year. |

| I | For the fourth consecutive year, earned a perfect score of 100 on the 2022 Human Rights Campaign Foundation’s Corporate Equality Index and named a “best place to work” for LGBTQ+ equality. |

| I | Awarded $700,000 of scholarships to date through our independent, not-for-profit—the Korn Ferry Charitable Foundation—with the mission of making real, lasting changes by helping people exceed their potential through opportunity. |

| I | Continued to achieve certification to internationally recognized standards for mature global privacy and security programs (ISO/IEC 27001 and ISO/IEC 27018). |

| I | In 2021, named one of the Top Employers for Latino Leaders by the Council for Latino Workplace Equity, an initiative under the National Diversity Council. |

|

4 | 2022 Proxy Statement |

Corporate Governance (page 22)

| Strong Governance Practices |

| Annual Director Elections for All Directors. |

| Majority Voting in Uncontested Elections. |

| Committee Oversight of ESG Program. |

| No Supermajority Voting Standards. |

| Stockholder Right (at 25% Threshold) to Call Special Stockholder Meetings. |

|

|

|

||

| Board Structure |

Committees, Attendance,

and Commitments |

Stockholder Engagement | ||

|

Independent Chair of the Board.

8 of the 9 Directors on the Board are Independent.

Independent Directors Meet in Regular Executive Sessions.

10-Term Service Limit for Non-Executive Directors Joining the Board after October 1, 2020. |

Independent Audit, Compensation, and Nominating Committees.

All Directors Attended at Least 75% of Board and Their Respective Committee Meetings.

No Director Serves on More Than 4 Public Company Boards.

2 Committees Led by Directors from Underrepresented Groups (by Gender or Race/Ethnicity). |

Stockholder Communication Process for Communicating with the Board.

Regular Stockholder Engagement Throughout the Year.

Outreach to Stockholders Representing Approx. 75% of Outstanding Shares Prior to 2021 Annual Meeting (and Met with Stockholders Representing 55%).

Outreach to Stockholders Representing Approx. 72% of Outstanding Shares After 2021 Annual Meeting (and Met with Stockholders Representing 21%). |

Governance Insights (pages 13, 37, and 86)

Each of the Company’s three standing Board committees is committed to staying abreast of the latest issues impacting good corporate governance. The Company has included three sets of Questions & Answers (“Q&As”), one with the chair of each of the Company’s standing committees.

These Q&As are meant to provide stockholders with insight into committee-level priorities and perspectives on Board refreshment and ESG matters, the return to our traditional approach to compensating our executives and key employees once the Compensation and Personnel Committee of the Board was able to understand better the impact of the COVID-19 pandemic on the Company’s business, and the oversight of our independent registered public accounting firm.

|

5 | 2022 Proxy Statement |

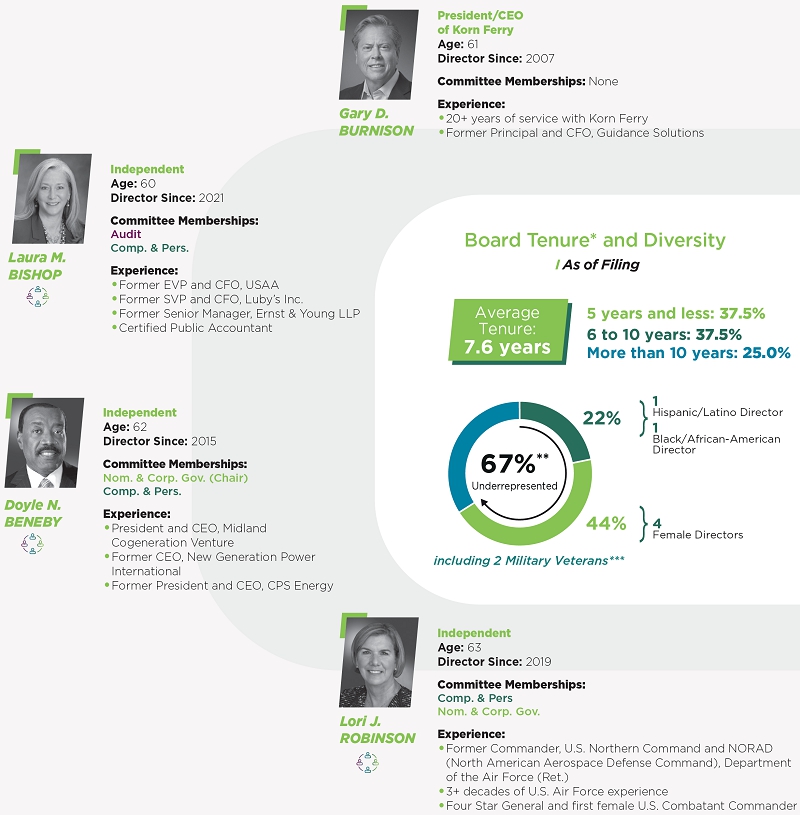

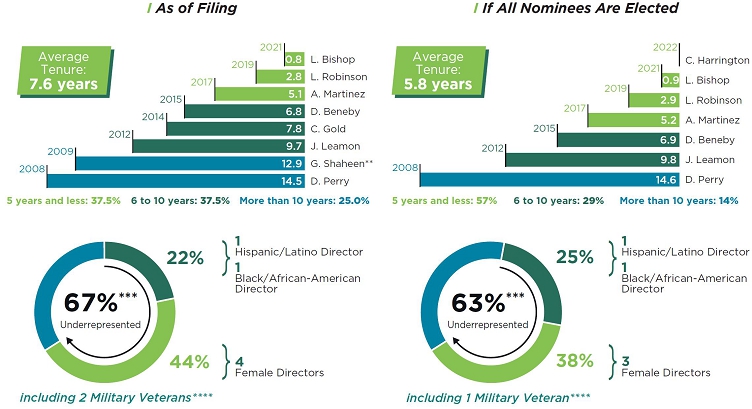

Board Nominees (pages 17 – 21)

| * | Tenure is provided for non-executive directors only. The “As of Filing” tenure calculations include Ms. Gold’s service with the Board since 2014 and Mr. Shaheen’s cumulative service with the Board from 2009 to 2019, and from April 2020 to present. |

| ** | This graphic represents directors who are members of underrepresented groups (by gender or race/ethnicity). |

| *** | Not included in percentages of directors from underrepresented groups. |

| Audit | Audit | Comp. & Pers. |

Compensation and Personnel | Nom. & Corp. Gov. |

Nominating and Corporate Governance |  |

Member of Underrepresented Group (by gender or race/ethnicity) |

|

6 | 2022 Proxy Statement |

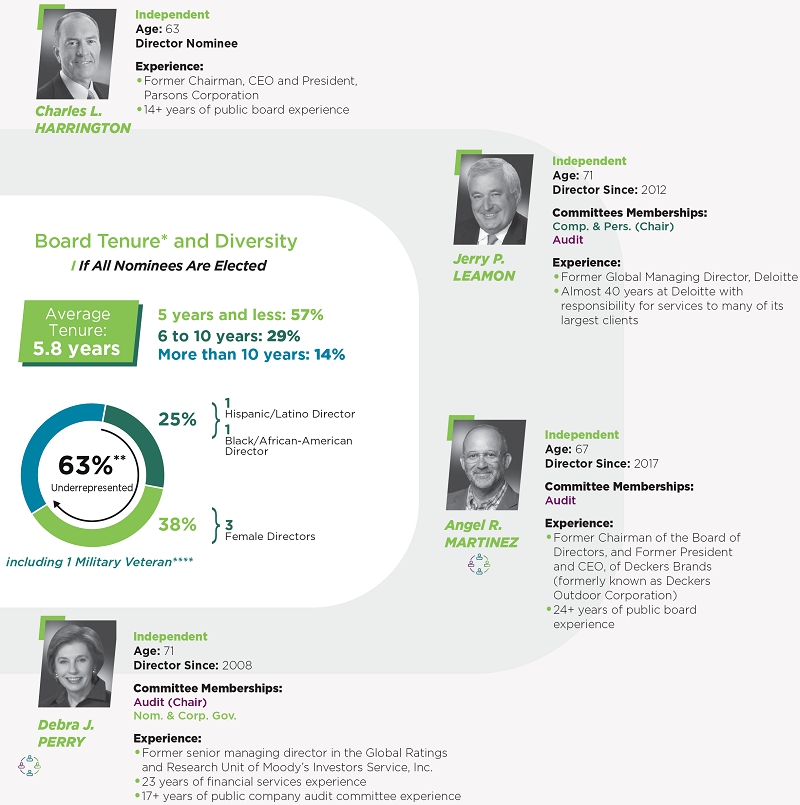

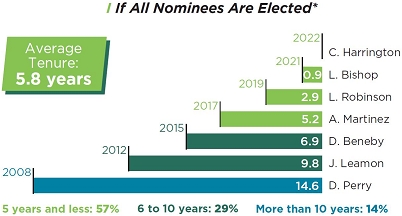

| * | Tenure is provided for non-executive directors only. |

| ** | This graphic represents directors who are members of underrepresented groups (by gender or race/ethnicity). |

| *** | Not included in percentages of directors from underrepresented groups. |

| Audit | Audit | Comp. & Pers. |

Compensation and Personnel | Nom. & Corp. Gov. |

Nominating and Corporate Governance |  |

Member of Underrepresented Group (by gender or race/ethnicity) |

|

7 | 2022 Proxy Statement |

2022 Executive Compensation Summary (page 51)

| Gary D. Burnison(1) | Robert P. Rozek(2) | Byrne Mulrooney(3) | Mark Arian(4) | |||||

|

|

|

|

|||||

| Salary | $985,000 | $616,667 | $533,333 | $533,333 | ||||

| Stock Awards | $5,052,479 | $2,105,429 | $1,515,800 | $1,515,800 | ||||

| Non-Equity Incentive Plan Compensation | $3,450,000 | $1,725,000 | $1,170,125 | $1,158,108 | ||||

| Change in Pension Value and Nonqualified Deferred Compensation Earnings | – | – | – | – | ||||

| All Other Compensation | $42,219 | $34,346 | $39,822 | $38,971 | ||||

| Total | $9,529,698 | $4,481,442 | $3,259,080 | $3,246,212 |

| (1) | President and Chief Executive Officer |

| (2) | Executive Vice President, Chief Financial Officer and Chief Corporate Officer |

| (3) | Chief Executive Officer of RPO and Digital |

| (4) | Chief Executive Officer of Consulting |

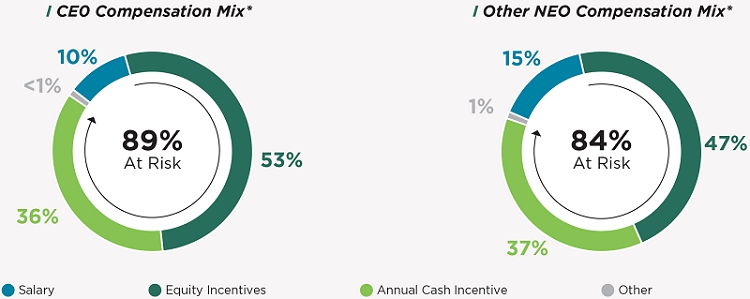

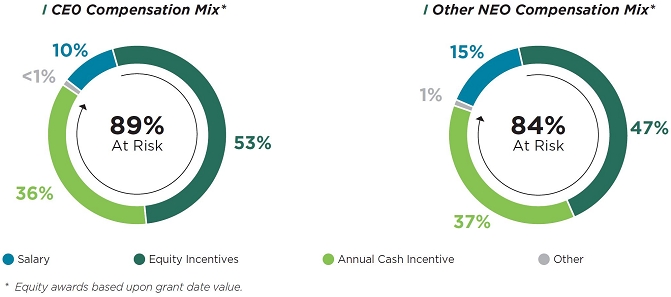

2022 Executive Total Compensation Mix (page 39)

|

|

| * | Equity awards based upon grant date value. |

|

8 | 2022 Proxy Statement |

Compensation Process Highlights (pages 26 and 38 – 41)

| • | Our Compensation and Personnel Committee receives advice from its independent compensation consultant. |

| • | We review total direct compensation and the mix of the compensation components for our named executive officers relative to our peer group as one of the factors in determining if compensation is adequate to attract and retain executive officers with the unique set of skills necessary to manage and motivate our global people and organizational consulting firm. |

Elements of Compensation (pages 42 – 48)

| Element | Purpose | Determination | ||

| Base Salary | Compensate for services rendered during the fiscal year and provide sufficient fixed cash income for retention and recruiting purposes. | Reviewed on an annual basis by the Compensation and Personnel Committee taking into account competitive data from our peer group, input from our compensation consultant, and the executive’s individual performance. | ||

| Annual Cash Incentives | Motivate and reward named executive officers for achieving performance goals over a one-year period. | Determined by the Compensation and Personnel Committee based upon performance goals, strategic objectives, and competitive data. | ||

| Long-Term Incentives | Align the named executive officers’ interests with those of stockholders and motivate and retain top talent. | Determined by the Compensation and Personnel Committee based upon a number of factors including competitive data, total overall compensation provided to each named executive officer, and historical grants. |

Compensation Practices (page 38)

|

Our Board has adopted a clawback policy applicable to all cash incentive payments and performance-based equity awards granted to executive officers. |

|

Our named executive officers are not entitled to any “single trigger” equity acceleration in connection with a change in control. |

|

We have adopted policies prohibiting hedging, speculative trading, or pledging of Company stock. |

|

All named executive officers are subject to stock ownership requirements. |

|

We do not provide excise tax gross-ups to any of our executive officers. |

Forward-Looking Statements & Website References

This Proxy Statement contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements include, but are not limited to, statements regarding the Company’s plans, objectives, expectations, and intentions, including regarding the Company’s goals or expectations with respect to corporate responsibility, sustainability, employees, environmental matters, policy, procurement, philanthropy, data privacy and cybersecurity, and business risks and opportunities. These statements are based on current expectations and are subject to numerous risks and uncertainties, many of which are outside of the control of Korn Ferry. Forward-looking statements are not guarantees or promises that goals or targets will be met. The Company undertakes no obligation to update any forward-looking or other statements, whether as a result of new information, future events, or otherwise, and notwithstanding any historical practice of doing so. In addition, historical, current, and forward-looking sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future—any such information included in, and any ESG issues identified as material for purposes of, this document may not be considered material for Securities and Exchange Commission (“SEC”) reporting purposes. In the context of this Report, the term “material” is distinct from, and should not be confused with, such term as defined for SEC reporting purposes. Actual results may differ materially from those indicated by such forward-looking statements as a result of risks and uncertainties, including those factors discussed or referenced in our most recent annual report on Form 10-K filed with the SEC, under the heading “Risk Factors,” a copy of which is being made available with this Proxy Statement, and subsequent quarterly reports on Form 10-Q.

Website references and hyperlinks throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this Proxy Statement, nor does it constitute a part of this Proxy Statement.

|

9 | 2022 Proxy Statement |

This page intentionally left blank

|

11 | 2022 Proxy Statement |

Proposal No. 1

Election of Directors

Our stockholders will be asked to consider the following eight nominees for election to our Board to serve for a one-year term until the 2023 Annual Meeting of Stockholders and until their successors have been duly elected and qualified, subject to their earlier death, resignation, or removal:

| Name | Position with Korn Ferry |

| Doyle N. Beneby | Director |

| Laura M. Bishop | Director |

| Gary D. Burnison | Director and Chief Executive Officer |

| Charles L. Harrington | Nominee |

| Jerry P. Leamon | Director |

| Angel R. Martinez | Director |

| Debra J. Perry | Director |

| Lori J. Robinson | Director |

Ms. Gold and Mr. Shaheen will not be standing for re-election at the Annual Meeting. The Company is most grateful to Ms. Gold and Mr. Shaheen for their valuable service to the Company.

Each of the nominees was previously elected by stockholders at the 2021 Annual Meeting of Stockholders, except for Charles L. Harrington. Charles L. Harrington was identified as part of a thorough search process conducted by Korn Ferry’s internal board search consultants. Detailed biographical information regarding each of these nominees is provided in this Proxy Statement under the heading “Background Information Regarding Director Nominees.” Our Nominating and Corporate Governance Committee has reviewed the qualifications of each of the nominees and has recommended to the Board that each nominee be submitted to a vote at the Annual Meeting.

All of the nominees have indicated their willingness to serve, if elected, but if any should be unable or unwilling to serve, proxies may be voted for a substitute nominee designated by the Board. The Company did not receive any stockholder nominations for director. Proxies cannot be voted for more than the number of nominees named in this Proxy Statement.

Required Vote

In uncontested elections, directors are elected by a majority of the votes cast, meaning that each director nominee must receive a greater number of shares voted “for” such nominee than the shares voted “against” such nominee. If an incumbent director does not receive a greater number of shares voted “for” such director than shares voted “against” such director, then such director must tender his or her resignation to the Board. In that situation, the Company’s Nominating and Corporate Governance Committee would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. Within 90 days from the date the election results were certified, the Board would act on the Nominating and Corporate Governance Committee’s recommendation and publicly disclose its decision and rationale behind it.

In a contested election, directors are elected by a plurality of the votes cast.

|

12 | 2022 Proxy Statement |

The Board of Directors

The Company’s Restated Certificate of Incorporation provides that the number of directors shall not be fewer than eight nor more than fifteen, with the exact number of directors within such limits to be determined by the Board. Currently, the Board is comprised of nine directors; effective immediately following the election of directors at the Annual Meeting, the size of the Board will be reduced to eight directors. Upon the recommendation of the Company’s Nominating and Corporate Governance Committee, the Board has nominated the following persons to serve as directors until the 2023 Annual Meeting of Stockholders or their earlier death, resignation or removal:

| Doyle N. Beneby | Jerry P. Leamon | |

| Laura M. Bishop | Angel R. Martinez | |

| Gary D. Burnison | Debra J. Perry | |

| Charles L. Harrington | Lori J. Robinson |

Each of the named nominees is independent under the NYSE rules, except for Mr. Burnison. If re-elected, Mr. Leamon will serve as the Company’s independent Non-Executive Chair of the Board.

The Board held 9 meetings during fiscal year 2022. Each of the incumbent directors attended at least 75% of the Board meetings and the meetings of committees of which they were members in fiscal year 2022. Directors are expected to attend each annual meeting of stockholders. Seven of the directors then-serving attended the 2022 Annual Meeting of Stockholders online.

Governance

Insights

Board Refreshment & ESG Matters

Q & A with Doyle Beneby, Chair of the Nominating and Corporate Governance Committee

Question: How has the Board’s membership evolved to garner new ideas and perspectives, and to respond to the ever-changing needs of the Company’s clients and other stakeholders?

The Board actively seeks candidates representing a range of tenures, areas of expertise, industry experience, and backgrounds. A central responsibility of the Nominating and Corporate Governance Committee is to identify and recommend individuals to the Board for nomination as members. Our active attention to the evolving landscape in which the Company and its stakeholders operate is reflected in our robust refreshment over the last five years:

| • | In 2017, the Board added Angel R. Martinez to, among other benefits, increase its knowledge of products and marketing. |

| • | In 2019, the Board added Len J. Lauer (who unexpectedly passed away in April 2020) and Lori J. Robinson, each of whom brought a number of valuable perspectives and experiences to the Board, including, in the case of Gen. (ret.) Robinson, extensive leadership, strategic oversight, and international experience. |

| • | In 2021, the Board added Laura M. Bishop to increase the Board’s financial expertise and experience in executive management and corporate governance. |

| • | And in 2022, the Board nominated Charles L. Harrington to expand the breadth of the Board’s experience in business and technology transformation for complex organizations, as well as leadership and financial/audit expertise. |

Question: How is the Company’s ESG Program, and the Board’s oversight of it, continuing to evolve?

The Nominating and Corporate Governance Committee is responsible for overseeing the Company’s ESG Program, which includes initiatives that seek to improve the way we work and live, empower diversity, equity, and inclusion, and give back to the communities in which we operate.

The Proxy Statement Summary on page 4 highlights a number of recent ESG recognitions of which we are proud, and below are some of our ESG Program’s recent initiatives and accomplishments:

|

13 | 2022 Proxy Statement |

Reporting

| • | The Company published its fourth ESG Report, covering 2021 activities and achievements, and its second report in general alignment with the reporting recommendations for its industry by the Sustainability Accounting Standards Board. |

| • | Korn Ferry was awarded the 2021 Silver Status Medal from EcoVadis for its sustainability practices for the third consecutive year, and our score placed us in the top 16% of companies that EcoVadis assessed. |

| • | For the fifth consecutive year, Korn Ferry responded to the CDP Climate Change survey, reporting on our greenhouse gas emissions and broader practices related to climate change. Korn Ferry again achieved a Management Level rating, this time for our 2021 submission for having a strong awareness of our climate change impacts and opportunities, as well as managing them effectively. |

| • | The Company is in the process of preparing its inaugural report in alignment with the standards of the Task Force for Climate-Related Disclosures, with disclosure anticipated in 2023. |

|

14 | 2022 Proxy Statement |

Director Qualifications

| Our Approach | The Board believes that the Board, as a whole, should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee the Company’s business. In addition, the Board believes there are certain attributes every director should possess, as reflected in the Board’s membership criteria discussed below. Accordingly, the Board and the Nominating and Corporate Governance Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and the Company’s current and future needs. |

| Minimum Criteria |

The Nominating and Corporate Governance Committee is responsible for developing and recommending Board membership criteria to the full Board for approval. The criteria, which are set forth in the Company’s Corporate Governance Guidelines include:

|

| Diverse Experience and Backgrounds | The Nominating and Corporate Governance Committee seeks a variety of occupational, educational, and personal backgrounds on the Board in order to obtain a range of viewpoints and perspectives and to enhance the diversity of the Board in such areas as professional experience, geography, race, gender, and ethnicity. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, the Nominating and Corporate Governance Committee believes it is essential that Board members represent diverse viewpoints and backgrounds. |

| Evaluating Board Composition | The Nominating and Corporate Governance Committee periodically evaluates the composition of the Board to assess the skills and experience that are currently represented on the Board, as well as the skills and experience that the Board will find valuable in the future, given the Company’s current business and strategic plans. This periodic assessment enables the Board to update the skills and experience it seeks in the Board as a whole and in individual directors as the Company’s needs evolve and change over time, and to assess the effectiveness of efforts to pursue diversity. |

| Identifying Director Candidates | In identifying director candidates from time to time, the Nominating and Corporate Governance Committee considers recommendations from Board members, management, and stockholders, and may from time to time engage a third- party search firm or utilize Company resources. The Nominating and Corporate Governance Committee may establish specific skills and experience that it believes the Company should seek in order to constitute a balanced and effective board. In evaluating director candidates, and considering incumbent directors for renomination to the Board, the Nominating and Corporate Governance Committee takes into account a variety of factors. These include each nominee’s independence, financial literacy, personal and professional accomplishments, and experience, each in light of the composition of the Board as a whole and the needs of the Company in general, and for incumbent directors, past performance on the Board. |

| Reviewing Director Commitments | The Nominating and Corporate Governance Committee also considers each nominee’s or incumbent director’s ability and willingness to commit adequate time to Board and committee matters. |

Annual Board and Committee Evaluations

Each year, the Board and its committees conduct a self-evaluation to determine that they are functioning effectively and consistently with their purpose and responsibilities. Topics addressed through these processes have included Board structure, director nominations and recruitment, Board and committee meetings and information, Board responsibilities, including management succession planning, and Board and management relations.

| Solicit Feedback |

Review

By Outside Counsel |

Internal Review |

Discussion

& Updates |

| Directors receive via a secure website a detailed questionnaire designed to elicit feedback regarding the functioning and leadership of the Board and each of the committees as a whole. | Outside counsel reviews the responses to the questionnaire and consolidates the feedback into a summary presentation. | A summary of results are provided by outside counsel, with the anonymized responses, to the Chair of the Board and the Chair of the Nominating and Corporate Governance Committee for review. | The results are discussed at both the Board and Nominating and Corporate Governance Committee levels, along with a determination of what, if any, changes should be made in light of the responses. |

|

15 | 2022 Proxy Statement |

Snapshot of Director Nominees

Board Composition: Skills, Tenure*, and Diversity

The Board and Company are focused on creating a Board that reflects a wide range of backgrounds, experiences, and cultures.

The following skills are possessed by one or more of our nominees:

|

Extensive Senior Leadership / Executive Officer Experience (including as a public company Chief Executive Officer) |

|

Significant Public Company Board, Committee, and Corporate Governance Experience | |

|

Risk Management / Oversight Experience |  |

Innovative Thinking | |

|

Broad International Experience |

|

High Ethical Standards | |

|

Accounting Expertise (including two Accountants) |  |

Appreciation of Diverse Cultures and Backgrounds | |

|

Significant Strategic Oversight and Execution Experience |

|

Experience Overseeing Large and Diverse Workforces | |

|

Broad Product and Marketing Experience |  |

Breadth of Experience Across Industries | |

|

Climate and Energy Experience |  |

Information Security Expertise | |

| * | Tenure is provided for non-executive directors only. |

| ** | This graphic includes Mr. Shaheen’s cumulative service with the Board of Directors from 2009 to 2019, and from April 2020 to present. |

| *** | These graphics represent directors who are members of underrepresented groups (by gender or race/ethnicity). |

| **** | Not included in percentages of directors from underrepresented groups. |

|

16 | 2022 Proxy Statement |

Background and Qualifications of Director Nominees

The biographies below set forth information about each of the director nominees, including each such person’s specific experience, qualifications, attributes, and skills that led our Board to conclude that such director nominee should serve on our Board in light of the Company’s current business, structure, and strategic plans. The process undertaken by the Nominating and Corporate Governance Committee in recommending qualified director candidates is described above under “Director Qualifications” and below under “Corporate Governance—Board Committees—Nominating and Corporate Governance Committee.”

|

Doyle N. BENEBY Director Since: 2015 President and Chief Executive Officer, Midland Cogeneration Venture

Age: 62

Other Directorships: Public Companies: • Quanta Services • Capital Power Corporation

Other Companies: • Midland Business Alliance

|

Professional Experience: President and Chief Executive Officer (Nov. 2018 – Present) Midland Cogeneration Venture, a natural gas fired combined electrical energy and steam energy generating plant

Chief Executive Officer (Nov. 2015 – May 2016) New Generation Power International, a start-up international renewable energy company

President and Chief Executive Officer (July 2010 – Nov. 2015) CPS Energy, the largest municipal electric and gas utility in the nation

President, Exelon Power, and Senior Vice President, Exelon Generation (2009 – 2010) Vice President, Generation Operations for Exelon Power (2008 – 2009) Vice President, Electric Operations for PECO Energy (2005 – 2008) Exelon Corporation, a nuclear electric power generation company

Board Qualifications and Skills:

Extensive Senior Leadership/Executive Officer Experience: In addition to his experience as a professional director, Mr. Beneby currently serves as President and Chief Executive Officer of Midland Cogeneration Venture, and previously served in a multitude of senior leadership positions, including as former Chief Executive Officer of New Generation Power International, as President and Chief Executive Officer of CPS Energy, and various leadership roles at PECO Energy and Exelon Power, where he served as President.

Broad Energy Industry Experience: Over 30 years of experience in the energy industry, with expertise in many facets of the electric and gas utility industry.

|

|

17 | 2022 Proxy Statement |

|

Laura M. BISHOP Director Since: 2021 Former Executive Vice President and Chief Financial Officer, USAA Age: 60 Other Directorships: Public Companies: • N/A Other Companies: • Pie Group Holdings, Inc.

|

Professional Experience: Executive Vice President and Chief Financial Officer (June 2014 – Dec. 2020) Various Roles, including member of Executive Council (2001 – 2014) USAA, a Fortune 100 integrated financial services company that provides financial products and services for the military and their families

Various Roles, including Senior Vice President and Chief Financial

Officer (1992 – 2000)

Various Roles, including Senior Manager (1983 - 1992) Ernst & Young LLP, a multinational professional services network

Board Qualifications and Skills:

Senior Leadership/Executive Officer Experience: Held senior leadership positions over a nearly 20-year career with USAA, including as Executive Vice President and Chief Financial Officer, and in her near decade of work with Luby’s Inc., including as Senior Vice President and Chief Financial Officer. As a member of USAA’s Executive Council, Ms. Bishop was also responsible for developing and executing strategy while directing activities across enterprise-wide financial management and reporting, including treasury, capital management, controller, tax, planning and forecasting, and strategic cost management. She was also responsible for governance and oversight for investment strategy and management of all institutional and benefit plan portfolios, as well as all capital markets activities, including commercial paper and long-term debt programs, credit facilities, asset-backed securitizations, and reinsurance programs. Financial Experience and Investment Expertise: At USAA, served as the enterprise Chief Financial Officer for all of USAA’s operating companies spanning the Property and Casualty companies, USAA Federal Savings Bank, and USAA Life Insurance Company. As a Senior Manager at Ernst & Young LLP, she directed audits of publicly traded and privately held companies in a variety of industries. Ms. Bishop also holds a Bachelor of Business Administration in Accounting and is on the Audit Committee of private company Pie Group Holdings, Inc. Ms. Bishop is a certified public accountant.

|

|

Gary D. BURNISON Director Since: 2007 President and Chief Executive Officer Age: 61 Other Directorships: Public Companies: • N/A Other Companies: • N/A

|

Professional Experience: President and Chief Executive Officer (July 2007 – Present) Executive Vice President and Chief Financial Officer (March 2002 – June 2007) Chief Operating Officer (Oct. 2003 – June 2007)

Principal and Chief Financial Officer (1999 – 2001)

Executive Officer and Director (1995 – 1999) Jefferies & Company, Inc., the principal operating subsidiary of Jefferies Group, Inc., a diversified financial services company

Partner KPMG Peat Marwick, a multinational professional services network

Board Qualifications and Skills:

High Level of Financial Experience: Substantial financial experience gained in roles as President, Chief Executive Officer, and as former Chief Financial Officer and Chief Operating Officer of the Company, as Chief Financial Officer of Guidance Solutions, as an executive officer of Jefferies & Company, Inc., and as a partner at KPMG Peat Marwick. Senior Leadership/Executive Officer Experience: In addition to serving as the Company’s President and Chief Executive Officer, served as Chief Financial Officer of Guidance Solutions. Extensive Knowledge of the Company’s Business and Industry: Over 20 years of service with the Company, in increasingly senior roles. Thought Leader: Author of eight leadership and career development books, and regular content focused on the intersection of strategy, talent, and leadership, as well as a frequent contributor to media outlets.

|

|

18 | 2022 Proxy Statement |

|

Charles L. Harrington Nominee Age: 63 Other Directorships: Public Companies: • J.G. Boswell Company • John Bean Technologies • Constellation Energy Other Companies: • Cal Poly Foundation • Institute of Digital Engineering USA

|

Professional Experience: President (2009 – 2021) Chief Executive Officer (2008 – 2021) Executive Vice President, Chief Financial Officer, and Treasurer (2006 – 2008) Various Roles, including Group President, PARCOM, Biotechnology, Semiconductors and Telecommunications (1982 – 2006) Parsons Corporation, a technology-focused defense, intelligence, security, and infrastructure engineering firm

Board Qualifications and Skills:

Senior Leadership/Executive Officer Experience: Over his nearly 40-year career at Parsons Corporation, held increasing roles of responsibility, including 13 years as Chief Executive Officer, 12 years as President, and two years as Chief Financial Officer, Executive Vice President, and Treasurer. He has deep experience in strategy development and execution, business transformation, operational management, business development, and technology development. Significant Advisory and Board Experience: More than 14 years of public company board experience, including at Parsons Corporation (as Chairman from 2008 to 2021 and Executive Chairman from 2021 to 2022) and AES Corporation (from 2013 to 2020) where he chaired the Audit Committee. Serves as director of the Cal Poly Foundation since 2010 and as Vice Chair since 2019. Also serves as the director and chairman of the non-profit Institute for Digital Engineering USA, and as an advisor to Glasswing Ventures, and The Holdsworth Group, LLC.

|

|

Jerry P. LEAMON Director Since: 2012 Former Global Managing Director, Deloitte Age: 71 Other Directorships: Public Companies: • N/A Other Companies: • Credit Suisse USA, a subsidiary of Credit Suisse Group AG • Geller & Company • Jackson Hewitt Tax Services • Business Advisory Council of the Carl H. Lindner School of Business

|

Professional Experience: Various Roles, including Global Managing Director and Partner (1972 – 2012) Deloitte, a multinational professional services company

Board Qualifications and Skills:

High Level of Financial Experience: Substantial financial experience gained from an almost 40-year career with Deloitte (ending in 2012), including as leader of the tax practice in the U.S. and globally, and as leader of the M&A practice for more than 10 years. Accounting Expertise: In addition to an almost 40-year career with Deloitte, Mr. Leamon is a certified public accountant. Broad International Experience: Served as leader of Deloitte’s tax practice, both in the U.S. and globally, and was Global Managing Director for all client programs, including industry programs, marketing communication and business development. Service Industry Experience: Deep understanding of operational and leadership responsibilities within the professional services industry, having held senior leadership positions at Deloitte while serving some of their largest clients. Significant Board Experience: Mr. Leamon serves on a number of boards and non-profit organizations, including Credit Suisse USA, where he chairs the Audit Committee, Geller & Company, and Jackson Hewitt Tax Services. He served as chairman of Americares Foundation for 7 years and a Board member for 17. He is also Trustee Emeritus of the University of Cincinnati Foundation and Board and serves as a member of the Business Advisory Council of the Carl H. Lindner School of Business. |

|

19 | 2022 Proxy Statement |

|

Angel R. MARTINEZ Director Since: 2017 Former Chairman of the Board of Directors, and former Chief Executive Officer and President, of Deckers Brands Age: 67 Other Directorships: Public Companies: • Genesco Inc. Other Companies: • N/A

|

Professional Experience: Chief Executive Officer and President (April 2005 – June 2016) Deckers Brands (formerly known as Deckers Outdoor Corporation), a global leader in designing, marketing and distributing innovative footwear, apparel, and accessories developed for both everyday casual lifestyle use and high performance activities

President, Chief Executive Officer and Vice Chairman (April 2003 – March 2005) Keen LLC, an outdoor footwear manufacturer

Executive Vice President and Chief Marketing Officer (1999 – 2001) Chief Executive Officer and President, The Rockport Company (1995 – 1999) Reebok International Ltd., an American fitness footwear and clothing manufacturer

Board Qualifications and Skills:

Extensive Senior Leadership/Executive Officer Experience: Served in numerous senior leadership positions, including as Chief Executive Officer and President of Deckers Brands, Executive Vice President and Chief Marketing Officer of Reebok International Ltd., President of The Rockport Company, and President and Chief Executive Officer of Keen, LLC. Broad Product and Marketing Experience: Almost 40 years of experience in management, product, and marketing from senior positions with, among other companies, Deckers Brands, Reebok International, and The Rockport Company. Significant Public Company Board and Corporate Governance Experience: Over 24 years of public company board service, including as a director of Tupperware Brands Corporation from 1998 to 2020, and Executive Chairman (2008 to 2016) and non-Executive Chairman (2016 to 2017) of the Board of Deckers Brands.

|

|

Debra J. PERRY Director Since: 2008 Former senior managing director in the Global Ratings and Research Unit of Moody’s Investors Service, Inc. Age: 71 Other Directorships: Public Companies: • Assurant, Inc. Other Companies: • The Bernstein Funds, Inc., a mutual fund complex

|

Professional Experience: Senior Managing Director, Global Ratings and Research Unit, Moody’s Investors Service, Inc. (2001 – 2004) Chief Administrative Officer and Chief Credit Officer (1999 – 2001) Group Managing Director, Finance, Securities and Insurance Rating Groups (1996 – 1999) Various Roles (1992 – 1996) Moody’s Corporation, a business and financial services company

Board Qualifications and Skills:

High Level of Financial Experience: Substantial financial experience gained from 23 years of professional experience in financial services, including a 12-year career at Moody’s Corporation, where among other things, Ms. Perry oversaw the Americas Corporate Finance, Leverage Finance, Public Finance and Financial Institutions departments. Significant Audit Committee Experience: Over 17 years of public company audit committee service, including as a member of MBIA Inc.’s Audit Committee (2004 to 2008), CNO Financial’s Audit Committee (2004 to 2011), PartnerRe’s Audit Committee (from June 2013 to March 2016, including as Chair of the Audit Committee from January 2015 to March 2016), Genworth Financial’s Audit Committee (from Dec. 2016 to May 2022), Korn Ferry’s Audit Committee (since 2008; appointed Chair of Audit Committee in 2010), and The Bernstein Funds, Inc.’s Audit Committee (since 2011). Significant Public Company Board and Corporate Governance Experience: Previously served as a director of Genworth Financial (Dec. 2016 to May 2022), as a director (June 2013 to March 2016) and Chair of the Audit Committee (January 2015 to March 2016) of PartnerRe, and as a trustee of BofA Funds Series Trust (June 2011 to April 2016), MBIA Inc. (2004 to 2008), and CNO Financial Group, Inc. (2004 to 2011). Actively involved in corporate governance organizations, including the National Association of Corporate Directors (“NACD”). Named in 2014 to NACD’s Directorship 100, which recognizes the most influential people in the boardroom and corporate governance community. Served on the board of the Committee for Economic Development, a non-partisan, business-led public policy organization. |

|

20 | 2022 Proxy Statement |

|

Lori J. ROBINSON General (ret.) Director Since: 2019 Commander, U.S. Northern Command and North American Aerospace Defense Command, Department of the Air Force (Ret.) Age: 63 Other Directorships: Public Companies: • Nacco Industries • Centene Corp. Other Companies: • The Robinson Group, LLC

|

Professional Experience: Non-Resident Fellow (2018 – Present) Harvard Kennedy School, Belfer Center for Science and International Affairs

Founder, Director (2018 – Present) The Robinson Group, LLC

Commander (2016 – 2018) U.S. Northern Command and North American Aerospace Defense Command, Department of Defense

Commander (2014 – 2016) Pacific Air Forces and Air Component Commander for U.S. Pacific Command

Vice Commander (2013 – 2014) Air Combat Command

Air Force Fellow (2002) The Brookings Institution

Board Qualifications and Skills:

High Level of Leadership Experience: Four Star General and first female U.S. Combatant Commander, with numerous government leadership roles with the U.S. Department of Defense, including serving as Commander of the U.S. Northern Command and North American Aerospace Defense Command, and Commander, Pacific Air Forces and Air Component Commander for U.S. Pacific Command, leading more than 45,000 Airmen. Named by Time Magazine as one of the “Women Who Are Changing The World” in 2017, in recognition of her service as the first woman to lead a top-tier U.S. Combat Command, and as one of “Time’s Most Influential People in 2016.” Significant Strategic Oversight and Execution Experience: Over three decades of experience with the U.S. Air Force overseeing, among other things, homeland defense, civil support, and security cooperation. Extensive International Experience: Interacted with counterparts in the Indo-Pacific (including China) and the Middle East, reported directly to the U.S. Secretary of Defense and Chief of the Canadian Defence Staff, served four combat tours, and oversaw U.S. Air Force operations in the Middle East.

|

|

21 | 2022 Proxy Statement |

Corporate Governance

The Board oversees the business and affairs of the Company and believes good corporate governance is a critical factor in our continued success and also aligns management and stockholder interests. Through our website, at www.kornferry.com, our stockholders have access to key governing documents such as our Code of Business Conduct and Ethics, Corporate Governance Guidelines, and charters of each committee of the Board, as well as information regarding our Corporate Responsibility Program. The highlights of our corporate governance program are included below:

|

|

|

||

| Board Structure | Stockholder Rights | Other Highlights | ||

|

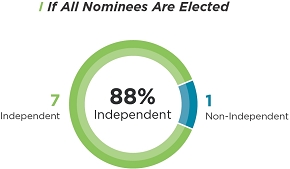

• 89% of the Board consists of Independent Directors • Independent Chair of the Board, Separate from CEO • Independent Audit, Compensation, and Nominating Committees • Regular Executive Sessions of Independent Directors • Annual Board and Committee Self-Evaluations • 63% Board Members and nominees from Underrepresented Groups (by Gender or Race/Ethnicity) (if all are elected) • 2 Committees Led by Directors from Underrepresented Groups (by Gender or Race/Ethnicity) • Annual Strategic Off-Site Meeting • No Director Serves on More than Four Public Company Boards (including the Company’s Board) • 10-Term Service Limit for Non-Executive Directors Joining the Board after October 1, 2020

|

• Annual Election of All Directors • Majority Voting for Directors in Uncontested Elections • No Poison Pill in Effect • Stockholder Communication Process for Communicating with the Board • Regular Stockholder Engagement • No Supermajority Voting Standards • Ability of Stockholders to Call Special Stockholder Meetings |

• Clawback Policy • Stock Ownership Policy • Pay-for-Performance Philosophy • Policies Prohibiting Hedging, Pledging, and Short Sales • No Excise Tax Gross-Ups • Quarterly Education on Latest Corporate Governance Developments • Committee Oversight of ESG Program • Board Oversight of Political Contributions and Risk |

Board Leadership Structure

Board Discretion. The Company’s Corporate Governance Guidelines provide that the Board is free to select its Chair and Chief Executive Officer in the manner it considers to be in the best interests of the Company and that the role of Chair and Chief Executive Officer may be filled by a single individual or two different persons. This provides the Board with flexibility to decide what leadership structure is in the best interests of the Company at any point in time.

Separate Chair and CEO. Currently, the Board is led by an independent, non-executive Chair, Ms. Gold. Ms. Gold is not standing for re-election at the Annual Meeting. Following the Annual Meeting, Mr. Leamon will serve as Chair of the Board, subject to his re-election as a director at the Annual Meeting. The Board has determined that having an independent director serve as Chair of the Board is in the best interests of the Company at this time as it allows the Chair to focus on the effectiveness and independence of the Board while the Chief Executive Officer focuses on executing the Company’s strategy and managing the Company’s business. In the future, the Board may determine that it is in the best interests of the Company to combine the role of Chair and Chief Executive Officer.

|

22 | 2022 Proxy Statement |

Director Independence

Board Determinations. The Board has determined that as of the date hereof a majority of the Board is “independent” under the independence standards of The New York Stock Exchange (the “NYSE”). The Board has determined that the following directors and nominees are “independent” under the independence standards of the NYSE: Doyle N. Beneby, Laura M. Bishop, Christina A. Gold, Charles L. Harrington, Jerry P. Leamon, Angel R. Martinez, Debra J. Perry, Lori J. Robinson, and George T. Shaheen.

Independence Standards. For a director to be “independent,” the Board must affirmatively determine that such director does not have any material relationship with the Company. To assist the Board in its determination, the Board reviews director independence in light of the categorical standards set forth in the NYSE’s Listed Company Manual. Under these standards, a director cannot be deemed “independent” if, among other things:

| • | the director is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company; |

| • | the director has received, or has an immediate family member who received, during any 12-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| • | (1) the director or an immediate family member is a current partner of a firm that is the Company’s internal or external auditor, (2) the director is a current employee of such a firm, (3) the director has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit, or (4) the director or an immediate family member was within the last three years a partner or employee of such firm and personally worked on the Company’s audit within that time; |

| • | the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serve or served on that company’s compensation committee; or |

| • | the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million or 2% of the other company’s consolidated gross revenues. |

Executive Sessions. The independent directors of the Board meet regularly in executive sessions outside the presence of management. Ms. Gold, as Chair of the Board, currently presides at all executive sessions of the independent directors.

|

23 | 2022 Proxy Statement |

Board’s Oversight of Enterprise Risk and Risk Management

The Board plays an active role, both as a whole and also at the committee level, in overseeing the Company’s management of risks. Management is responsible for the Company’s day-to-day risk management activities. The Company has established an enterprise risk framework for identifying, aggregating, and evaluating risk across the enterprise. The risk framework is integrated with the Company’s annual planning, audit scoping, and control evaluation management by its internal auditor. The review of risk management is a dedicated periodic agenda item for the Audit Committee, and the Company’s other Board committees also consider and address risk during the course of their performance of their committee responsibilities, as summarized in the following graphic.

| The Board |

| Oversees Company process for assessing and managing risk |

| Monitors risks through regular reports from each committee chair and the General Counsel |

| Apprised of particular risk management matters in connection with its general oversight and approval of corporate matters, including, but not limited to, cybersecurity |

|

|

|

|

|||

| Audit Committee |

Nominating and Corporate Governance Committee |

Compensation and Personnel Committee |

Management | |||

| Periodically reviews management’s financial and operational risk assessment and risk management policies, the Company’s major financial risk exposures (including risks related to cybersecurity vulnerabilities), and the steps management has taken to monitor and control such exposures |

Oversees risks associated with operations of the Board and its governance structure

Oversees risks associated with ESG matters |

Reviews risks related to Company’s compensation programs for senior management and employees

Assists Board in determining whether the Company’s compensation programs involve risks that are reasonably likely to have a material adverse effect on the Company |

General Counsel periodically reports to the Board on litigation and other legal risks that may affect the Company

Various members of senior management periodically report to the Board on risk mitigation measures related to business continuity, disaster recovery, COVID-19, data privacy, and cybersecurity |

We believe the division of risk management responsibilities described above provides an effective framework for evaluating and addressing the risks facing the Company, and that our Board leadership structure supports this approach because it allows our independent directors, through the independent committees and non-executive Chair, to exercise effective oversight of the actions of management.

Throughout the year, the Board receives regular training and updates on governance topics ranging from the increasing focus on ESG, diversity, and human capital matters by investors and regulators, legal developments related to corporate governing documents, and evolving SEC disclosure and stockholder proposal requirements, among others.

Assessment of Risk Related to Compensation Programs

During fiscal year 2022, the Company conducted its annual review of executive and non-executive compensation programs globally, with particular emphasis on incentive compensation plans and programs. Based on this review, the Company evaluated the primary components of its compensation plans and practices to identify whether those components, either alone or in combination, properly balanced compensation opportunities and risk. As part of this inventory, several factors were noted that reduce the likelihood of excessive risk taking. These factors include: balancing performance focus between near-term objectives and strategic initiatives; issuing annual equity awards that vest over multiyear time horizons; and maintaining a stock ownership policy and a clawback policy applicable to our executive officers. Furthermore, the Compensation and Personnel Committee retains its own independent compensation consultant to provide input on executive pay matters, meets regularly, and approves all performance goals, award vehicles, and pay opportunity levels for named executive officers. As a result of this evaluation, the Company concluded that risks arising from the Company’s compensation policies and practices are not reasonably likely to have a material adverse impact on the Company.

|

24 | 2022 Proxy Statement |

Board Committees

Although the full Board considers all major decisions, the Company’s Bylaws permit the Board to have the following standing committees to more fully address certain areas of importance: (1) an Audit Committee, (2) a Compensation and Personnel Committee, and (3) a Nominating and Corporate Governance Committee. The members of the standing committees as of the date hereof are set forth in the tables below. Following the Annual Meeting, the Nominating and Corporate Governance Committee intends to evaluate the composition of the standing committees and make recommendations to the Board regarding any appropriate changes to the Committees.

Audit Committee

Fiscal 2022 Meetings Held: 8

|

|

|

|

|||||

| Debra J. PERRY | Jerry P. LEAMON | Angel R. MARTINEZ | Laura M. BISHOP | |||||

| CHAIR | ||||||||

| Independence: | All Audit Committee members are “independent directors” under the applicable listing standards of the NYSE and the applicable rules of the SEC. |

| Financial Literacy: | The Board, in its business judgment, has determined that Mses. Bishop and Perry and Messrs. Leamon and Martinez are “financially literate” under the NYSE rules. |

| Audit Committee | |

| Financial Experts: | The Board determined that Ms. Perry qualifies as an “audit committee financial expert” from her many years of experience in the financial services industry and service on other public company Audit Committees, that Ms. Bishop qualifies based on her years of service as a chief financial officer and certified public accountant with Ernst & Young LLP, and that Mr. Leamon qualifies based on his almost 40 years of experience as a certified public accountant with Deloitte. |

| Key Responsibilities: | |

| • | Is directly responsible for the appointment, compensation, retention, evaluation, and oversight of the independent registered public accounting firm, including annual assessments that consider, among other topics, the level of open and professional communication with the Audit Committee; |

| • | Reviews the independent registered public accounting firm’s qualifications and independence and has processes in place for the timely communication of corporate changes or other events that could impact the firm’s independence; |

| • | Reviews the plans and results of the audit engagement with the independent registered public accounting firm; |

| • | Oversees financial reporting principles and policies; |

| • | Considers the range of audit and non-audit fees; |

| • | Reviews the adequacy of the Company’s internal accounting controls, including through regular discussions at committee meetings; |

| • | Oversees the Company’s internal audit function, including annually reviewing and discussing the performance and effectiveness of the Internal Audit Department; |

| • | Oversees the Company’s Ethics and Compliance Program, including annually reviewing and discussing the implementation and effectiveness of the program; and |

| • | Works to provide for the integrity of financial information supplied to stockholders. |

The Audit Committee also reviews new accounting standards applicable to the Company with the independent registered public accounting firm, Internal Audit Department, General Counsel and the Chief Financial Officer, and is available to receive reports, suggestions, questions, and recommendations from them. The Audit Committee also confers with these parties in order to help assure the sufficiency and effectiveness of the programs being followed by corporate officers in the areas of compliance with legal and regulatory requirements, business conduct, and conflicts of interest.

|

25 | 2022 Proxy Statement |

Compensation and Personnel Committee

Fiscal 2022 Meetings Held: 8

|

|

|

|

|

||||||

| Jerry P. LEAMON | Doyle N. BENEBY | Lori J. ROBINSON | George T. SHAHEEN | Laura M. BISHOP | ||||||

| CHAIR | ||||||||||

| Independence: | The Board has determined that all members of the Compensation and Personnel Committee are “independent directors” under the applicable listing standards of the NYSE. |

| Key Responsibilities: | |

| • | Approves and oversees the Company’s compensation programs, including cash, deferred compensation, and equity-based incentive programs provided to members of the Company’s senior management group, including the Company’s Chief Executive Officer, Chief Financial Officer, and other named executive officers, as well as equity-based compensation and deferred compensation programs provided to any Company employee; |

| • | Reviews the compensation of directors for service on the Board and its committees; and |

| • | Approves or recommends to the Board, as required, specific compensation actions, including salary adjustments, annual cash incentives, equity award grants, and employment and severance arrangements for the Chief Executive Officer and other executive officers. |

The Compensation Committee also reviews and develops, in conjunction with the CEO, a CEO succession plan, both for use in an emergency situation and in the ordinary course of business, which the committee reports at least annually to the full Board. The Compensation Committee also oversees succession planning for positions held by senior management (other than the CEO) and reviews such plans at least annually with the Board, including recommendations and evaluations of potential successors to fulfill such positions.

The Compensation and Personnel Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee consisting solely of members of the Compensation and Personnel Committee who are non-employee directors and outside directors.

|

26 | 2022 Proxy Statement |

Nominating and Corporate Governance Committee

Fiscal 2022 Meetings Held: 5

|

|

|

|

|||||

| Doyle N. BENEBY | Debra J. PERRY | Lori J. ROBINSON | George T. SHAHEEN | |||||

| CHAIR | ||||||||

| Independence: | The Board has determined that all members of the Nominating and Corporate Governance Committee are “independent directors” under the applicable listing standards of the NYSE. |

| Key Responsibilities: | |

| • | Recommends criteria to the Board for the selection of nominees to the Board; |

| • | Evaluates all proposed nominees; |

| • | Prior to each annual meeting of stockholders, recommends to the Board a slate of nominees for election to the Board by the stockholders at the annual meeting; |

| • | Makes recommendations to the Board from time to time as to changes the Committee believes to be desirable to the size, structure, composition, and functioning of the Board or any committee thereof; |

| • | Oversees and monitors the Company’s ESG Program; and |

| • | Oversees risks associated with operations of the Board and its governance structure. |

In evaluating potential nominees, the Nominating and Corporate Governance Committee considers a variety of criteria, including business experience and skills, independence, judgment, integrity, the ability and willingness to commit adequate time and attention to Board activities, and the absence of potential conflicts with the Company’s interests. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, it also takes into account the diversity of the Board when considering director nominees.

Stockholder Recommendations. Any stockholder recommendations for director are evaluated in the same manner as all other candidates considered by the Nominating and Corporate Governance Committee. Stockholders may recommend director nominees by mailing submissions to Korn Ferry, 1900 Avenue of the Stars, Suite 1500, Los Angeles, California 90067, Attention: Corporate Secretary.

|

27 | 2022 Proxy Statement |

Board Refreshment Mechanisms

The Board seeks to bring together a diverse mix of directors that the Board and senior management can leverage to make well considered strategic decisions in the best interests of the Company and its stockholders. In support of this effort, the Board has adopted or updated refreshment mechanisms in the Corporate Governance Guidelines to balance the desire for Board refreshment with the flexibility to prioritize a director’s contributions to the Board as the most important factor for determining continued service, and allow the Board to retain significantly contributing directors for additional time where warranted.

Ten-Term Service Limit. To encourage Board refreshment, new non-executive directors are not eligible to stand for re-election after serving as a director for ten full terms on the Board.

Retirement Age Policy. A director is generally not eligible to stand for election after his or her 74th birthday. The Corporate Governance Guidelines, however, reserve the Board’s right, after a formal review of a director’s contributions, to allow a director to stand for election for up to three additional terms of service after reaching his or her 74th birthday. Any such formal review will be conducted prior to nominating a director for any such additional term. The Board and the Nominating and Corporate Governance Committee believe that this policy appropriately enables the Board to retain the experienced insights of current directors while retaining a retirement age limit as a succession mechanism.

| * | Tenure is provided for non-executive directors only. |

Culture of Integrity and Code of Business Conduct and Ethics