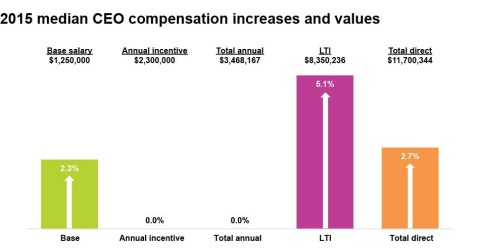

CEO Pay Hits New Low With Smallest Pay Increase in Five Years According to Korn Ferry Hay Group Study

— In light of overall company financial performance and investor caution CEOs see only 2.3 percent in salary increase and flat bonuses

— Move to long-term compensation continues with an increase of 5.1 percent

— A continued focus on linking CEO pay to performance, with performance awards making up 33 percent of the CEO pay mix

LOS ANGELES--(BUSINESS WIRE)-- In determining CEO compensation at top public companies in 2015, economic uncertainty, slowing revenue growth and negative shareholder returns are driving nearly flat compensation for CEOs, according to the Korn Ferry Hay Group 2015 CEO Compensation Study. CEOs received the lowest pay increase in 5 years and for the first time also in 5 years, shareholders experienced a negative return. The ninth annual study, which is conducted by the Hay Group division of Korn Ferry (NYSE: KFY), examined all forms of pay for CEOs at 300 companies with revenue in excess of $9.2 billion in fiscal year 2015.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20160525006450/en/

2015 median CEO compensation increases and values (Graphic: Business Wire)

Overall, total direct compensation for the 300 CEOs at the largest firms last year to file their proxy between May 1, 2015 and April 30, 2016 increased 2.7 percent to $11.7 million. That’s a slower growth rate than the previous year, which saw a median growth rate of 5.0 percent. Median annual compensation for CEOs was flat at $3.5 million, including base salary growth of 2.3 percent to $1.3 million and annual incentive payments remaining at $2.3 million*. For the fifth year running, long-tern incentives (LTIs) increased, growing 5.1 percent to a median value of $8.4 million.

The smallest increase in the past 5 years in CEO total direct compensation (2.7 percent) corresponds to the first decrease in total shareholder returns (TSR) in five years with a negative TSR of -0.3 percent compared to a 17.5 percent return in 2014. Total revenue was also down -0.4 percent and net income growth among the companies was only 1.8 percent, compared to last year’s growth of 7.1 percent.

“When companies were seeing double digit returns, boards and shareholders were much more likely to approve higher CEO compensation packages,” said Irv Becker, North America Leader for Korn Ferry Hay Group’s Executive Pay and Governance practice. “But with today’s uncertain market and slower growth rates, compensation committees and shareholders will put CEO pay under a much more intense spotlight.”

Performance-based LTIs reached their highest level ever in this year’s study, accounting for 33 percent of CEO pay packages in 2015, which overall is up from 25 percent in 2011. Bonuses were the second-heaviest weighted component of pay, making up 21 percent of the median CEO’s total direct compensation.

“Based on the current environment, we continue to see a shift to performance-based and long-term compensation packages for U.S. CEOs,” said Becker. “With this being the lowest total shareholder return since the beginning of the ‘say on pay’ era and active shareholders pushing for more performance-linked pay, it’s no surprise that we continue to see the use of more performance-based equity awards in our study this year, a trend that we expect to continue.”

About the Korn Ferry Hay Group 2015 CEO compensation study

The 2015 study focused on the primary elements of compensation for CEOs of the 300 largest public companies by revenue to file their final definitive proxy statements between May 1, 2015 and April 30, 2016.

*Note: All dollar figures are medians and are calculated independently. Medians should not be added to create another data point.

About Korn Ferry

Korn Ferry is the preeminent global people and organizational advisory firm. We help leaders, organizations, and societies succeed by releasing the full power and potential of people. Our nearly 7,000 colleagues deliver services through our Executive Search, Hay Group and Futurestep divisions. Visit kornferry.com for more information.

View source version on businesswire.com: http://www.businesswire.com/news/home/20160525006450/en/

Korn Ferry

Tracy Kurschner, 612-309-3957

Tracy.Kurschner@kornferry.com

Source: Korn Ferry

Released May 25, 2016