PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on July 31, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the Securities

Exchange Act of

1934

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to §240.14a-12 |

Korn/Ferry International

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

|

No fee required. |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: | |

| (2) Aggregate number of securities to which transaction applies: | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) Proposed maximum aggregate value of transaction: | |

| (5) Total fee paid: | |

|

Fee paid previously with preliminary materials. |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) Amount Previously Paid: | |

| (2) Form, Schedule or Registration Statement No.: | |

| (3) Filing Party: | |

| (4) Date Filed: | |

NOTICE OF 2017 ANNUAL STOCKHOLDERS’ MEETING

AND PROXY STATEMENT

September 27, 2017

8:00 a.m. Pacific Time

InterContinental

2151 Avenue of the Stars

Los Angeles, CA 90067

DEAR FELLOW SHAREHOLDERS

Thank you for your investment in Korn Ferry and for the trust you have placed in our Board to help oversee and facilitate Korn Ferry’s long-term success.

Fiscal 2017 Accomplishments

Against a backdrop of uncertain macroeconomic and geopolitical factors, Korn Ferry achieved yet another year of strong financial performance and continued to make progress on our strategic objectives. We are proud of these results, which include:

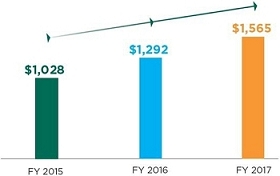

| • | Generated record fee revenue of $1.57 billion, representing a 21% increase year over year including organic growth and the Hay Group acquisition; |

| • | Returned $52.1 million to shareholders ($28.8 million through share repurchases and $23.3 million in quarterly dividends in FY 17); |

| • | Named #1 Best Executive Recruitment Firm in North America by Forbes Magazine (2017); and |

| • | Named #1 Recruitment Process Outsourcing Firm by HRO Magazine (2016). |

Leading Corporate Governance Practices

Complementing our financial performance is our Company’s commitment to corporate governance, including:

| • | Majority voting for directors in uncontested elections; |

| • | Declassified Board with annual election of directors; |

| • | Independent Chair and independent Board members (except for CEO); |

| • | Regular engagement with shareholders; |

| • | Board diversity; and |

| • | This year’s proxy proposals to eliminate the supermajority voting standards in our Restated Certificate of Incorporation. |

Commitment to Shareholder Engagement

In the past few years, the Company has stressed the importance of shareholder communication, with the Company increasing its outreach to its shareholders as a result. As part of those efforts, we sought feedback from our shareholders about the issues that mattered most to them. In 2015, we redesigned our proxy statement to address the issues we heard in that outreach, and to provide more meaningful and transparent disclosure regarding our compensation and corporate governance practices, including our Governance Insights section of the proxy statement discussing Board Committee priorities. We have received positive feedback from our shareholders to such enhancements and were even awarded 2016 Proxy of the Year (small to mid-cap) by Corporate Secretary Magazine.

Board Composition: Ongoing Commitment to Board Diversity

Our Board is composed of individuals whose skills and experiences permit them to make significant contributions to the Company and represent the long-term interest of our shareholders. It is critical that our Board include diverse perspectives, and a mix of skills, backgrounds, and industry experiences. To achieve and maintain such diversity, we periodically refresh the composition of our Board by appointing new members. Since 2012, we have elected five new directors to our Board, each with diverse skills, backgrounds and experiences. We are proud of the diversity of our directors and will continue our efforts to assemble an exceptional Board.

The commentary above is only a snap shot of the Company’s Fiscal 2017 achievements, but we believe these achievements are representative of our commitment and progress. We strongly encourage each of our shareholders to review this proxy statement, vote promptly and convey their views.

On behalf of our Board, Senior Management and the Company, thank you for being a Korn Ferry shareholder.

Sincerely,

George Shaheen,

Chair of the Board

August [____], 2017

Korn/Ferry International

1900 Avenue of the Stars,

Suite 2600

Los Angles, CA 90067

(310) 552-1834

NOTICE OF 2017 ANNUAL MEETING

MEETING INFORMATION

Date: September 27, 2017

Time: 8:00 a.m. Pacific Time

Location: InterContinental, 2151 Avenue of the Stars, Los Angeles, CA 90067

Record Date: August 4, 2017

MEETING AGENDA

To the Stockholders:

On September 27, 2017, Korn/Ferry International (the “Company”, “Korn Ferry”, “we”, “its” and “our”) will hold its 2017 Annual Meeting of Stockholders (the “Annual Meeting”) at the InterContinental located at 2151 Avenue of the Stars, Los Angeles, California 90067. The Annual Meeting will begin at 8:00 a.m. Pacific Time.

Only stockholders who owned our common stock as of the close of business on August 4, 2017 (the “Record Date”) can vote at the Annual Meeting or any adjournments or postponements thereof. The purposes of the Annual Meeting are to:

| 1. | Elect the eight directors nominated by our Board of Directors and named in the Proxy Statement accompanying this notice to serve on the Board of Directors until the 2018 Annual Meeting of Stockholders and until their successors have been duly elected and qualified, subject to their earlier death, resignation or removal; | |

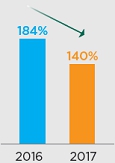

| 2. | Vote on a non-binding advisory resolution to approve the Company’s executive compensation; | |

| 3. | Vote on a non-binding advisory resolution on the frequency of future advisory votes to approve the Company’s executive compensation; | |

| 4. | Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the Company’s 2018 fiscal year; | |

| 5. | Approve amendments to our Restated Certificate of Incorporation to (a) remove the supermajority voting standard for future amendments to our Bylaws approved by our stockholders and (b) remove the supermajority voting standard to amend action by written consent right; and | |

| 6. | Transact any other business that may be properly presented at the Annual Meeting. |

RECOMMENDATION OF THE BOARD

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE YOUR SHARES “FOR” THE ELECTION OF EACH OF THE NOMINEES NAMED IN THE PROXY STATEMENT, FOR A “ONE YEAR” FREQUENCY TO CONDUCT FUTURE ADVISORY VOTES TO APPROVE EXECUTIVE COMPENSATION, AND “FOR” EACH OF THE OTHER ABOVE PROPOSALS.

Please read the proxy materials carefully.

Your vote is important and we appreciate your cooperation in considering and acting on the matters presented. See pages 67 - 69 for a description of the ways by which you may cast your vote on the matters being considered at the Annual Meeting.

August [ ], 2017

Los Angeles, California

By Order of the Board of Directors,

Jonathan Kuai

General Counsel and Corporate Secretary

The Proxy Statement and accompanying Annual Report to Stockholders are available at www.proxyvote.com.

PROXY SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

Annual Meeting of Stockholders (page 67)

Date and Time: September 27, 2017 at 8:00 a.m. Pacific Time.

Place: InterContinental, 2151 Avenue of the Stars, Los Angeles, California 90067.

Admission: To be admitted to the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) you must present valid photo identification and, if your shares are held by a bank, broker or other nominee, proof of beneficial ownership of the shares.

Eligibility to Vote: You can vote if you were a holder of Korn Ferry’s common stock at the close of business on August 4, 2017.

| Voting Matters (page 67) | ||

| 1 |

Election

of Directors Page Reference (for more detail) page 8 |

Board

Vote Recommendation FOR each Director Nominee |

| 2 |

Advisory

Resolution to Approve Executive Compensation Page Reference (for more detail) page 24 |

Board

Vote Recommendation FOR |

| 3 |

Advisory

Resolution on the Frequency of Future Advisory Votes to Approve Executive Compensation Page Reference (for more detail) page 25 |

Board

Vote Recommendation ONE YEAR |

| 4 |

Ratification

of Independent Registered Public Accounting Firm Page Reference (for more detail) page 56 |

Board

Vote Recommendation FOR |

| 5A |

Amendment

to Restated Certificate of Incorporation to Remove Supermajority Voting Standard for Future Amendments to our Bylaws Approved

by our Stockholders Page Reference (for more detail) pages 62 - 63 |

Board

Vote Recommendation FOR |

| 5B |

Amendment

to Restated Certificate of Incorporation to Remove Supermajority Voting Standard to Amend Action by Written Consent Right Page Reference (for more detail) page 63 |

Board

Vote Recommendation FOR |

How to Cast Your Vote (pages 67 - 69)

On or about August [ ], 2017, we will mail a Notice of Internet Availability of Proxy Materials to stockholders of our common stock as of August 4, 2017, other than those stockholders who previously requested electronic or paper delivery of communications from us.

Stockholders of record can vote by any of the following methods:

|

Via telephone by calling 1-800-690-6903; |

|

Via Internet by visiting www.proxyvote.com; |

|

Via mail (if you received your proxy materials by mail) by signing, dating and mailing the enclosed proxy card; or |

|

In person, at the Annual Meeting. You must present valid photo identification to be admitted to the Annual Meeting. |

| • | If you vote via telephone or the Internet, you must vote no later than 11:59 p.m. Eastern time on September 26, 2017. If you return a proxy card by mail, it must be received before the polls close at the Annual Meeting. |

| • | If your shares are held in the name of a bank, broker or other nominee, you must follow the voting instructions provided to you by your bank, broker or nominee in order for your shares to be voted. |

|

|

2017 Proxy Statement 2017 Proxy Statement |

1 |

BUSINESS HIGHLIGHTS FOR FISCAL YEAR 2017

|

|||

| Generated record fee revenue of $1.57 billion, representing a 21% increase year over year including organic growth and the Hay Group acquisition |

|

||

|

|

||

| 19% Share Price Appreciation in FY 17* | |||

| * Comparison of closing price on last trading day of FY 17 v FY 16 | |||

|

|

||||

|

#1 Best Executive Recruitment Firm in North America by Forbes Magazine (2017) |

#1 Recruitment Process Outsourcing Firm by HRO Magazine (2016) |

||||

Governance of the Company (page 15)

| ▼ | ▼ | ▼ | ▼ | |||

| Board Structure | Committees and Attendance | Stockholder Engagement | Recent Corporate | |||

|

• Independent Chair of the Board. • 7 of the 8 Directors on the Board are Independent. • Independent Directors Meet in Regular Executive Sessions. |

• Independent Audit, Compensation and Nominating Committees. • All Directors Attended at Least 75% of Board and Their Respective Committee Meetings. |

• Stockholder Communication Process for Communicating with the Board. • This year’s proxy statement includes proposals to amend the Company’s Restated Certificate of Incorporation to remove the supermajority voting standards. |

Governance Enhancements | |||

|

• Replaced Classified Board Structure with Annual Director Elections. • Implemented Majority Voting in Uncontested Elections. |

|

Governance Insights (pages 15, 33, and 58)

Each of the Company’s standing Board committees is committed to staying abreast of the latest issues impacting good corporate governance. The Company has included three sets of Questions & Answers (“Q&As”), one with the chair of each of the Company’s standing committees. These Q&As are meant to provide stockholders with insight into committee-level priorities and perspectives on Board diversity, pay alignment and retention, and oversight of the adoption of the new revenue recognition standard. |

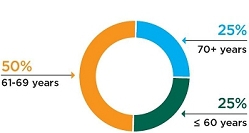

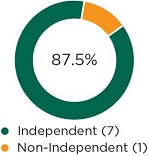

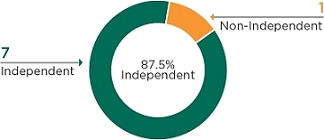

| AGE | DIRECTOR TENURE | DIRECTOR INDEPENDENCE |

|

|

|

|

|

2017 Proxy Statement 2017 Proxy Statement |

2 |

BOARD NOMINEES (PAGES 11 - 14)

|

|

|

|

|||

|

Doyle

N. BENEBY Director |

Gary

D. BURNISON Director and President/CEO, of Korn Ferry |

William

R. FLOYD Director |

Christina

A. GOLD Director |

|||

|

Age: 57 Director Since: 2015 Independent: Yes Committee Memberships: • Nominating and Corporate Governance • Compensation and Personnel Experience/Qualification: • Former CEO of New Generation Power International. • Former President and CEO of CPS Energy. • Brings extensive executive management experience in the energy industry. |

Age: 56 Director Since: 2007 Independent: No Committee Memberships: – Experience/Qualification: • President and CEO of the Company. • Brings in-depth knowledge of the Company’s business, operations, employees and strategic opportunities. |

Age: 72 Director Since: 2012 Independent: Yes Committee Memberships: • Audit • Compensation and Personnel Experience/Qualification: • Former Chairman of the Board of Buffet Holdings, Inc. • Brings extensive executive management experience in the service industry. |

Age: 69 Director Since: 2014 Independent: Yes Committee Memberships: • Nominating and Corporate Governance (Chair) • Compensation and Personnel Experience/Qualification: • Former President, CEO and Director of The Western Union Company. • Brings executive management and board experience. |

|||

|

|

|

|

|||

|

Jerry

P. LEAMON Director |

Angel

R. MARTINEZ Director |

Debra

J. PERRY Director |

George

T. SHAHEEN Director and Non-Executive Chair of the Board of Korn Ferry |

|||

|

Age: 66 Director Since: 2012 Independent: Yes Committee Memberships: • Compensation and Personnel (Chair) • Audit Experience/Qualification: • Former Global Managing Director of Deloitte & Touche. • Brings financial accounting expertise and extensive global professional services experience. |

Age: 62 Director Since: 2017 Independent: Yes Committee Memberships: – Experience/Qualification: • Current Non-Executive Chairman of the Board of Directors of, and Former President and CEO of, Deckers Outdoor Corporation. • Brings executive management, product, and marketing experience. |

Age: 66 Director Since: 2008 Independent: Yes Committee Memberships: • Audit (Chair) • Nominating and Corporate Governance Experience/Qualification: • Former senior managing director in the Global Ratings and Research Unit of Moody’s Investors Service, Inc. • Brings executive management, corporate governance, finance and analytical expertise and board and committee experience. |

Age: 73 Director Since: 2009 Independent: Yes Committee Memberships: – Experience/Qualification: • Chair of the Board of the Company. • Brings executive management, consulting, board and advisory experience. |

|

|

2017 Proxy Statement 2017 Proxy Statement |

3 |

2017 Executive Compensation Summary (page 41)*

|

Name

and Principal Position |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Change

in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

All

Other Compensation ($) |

Total ($) |

|||||||

|

Gary

D. Burnison, President and Chief Executive Officer |

910,000 | — | 1,787,537 | 1,267,630 | 7,979 | 53,462 | 4,026,608 | |||||||

|

Robert

P. Rozek, Executive Vice-President, Chief Financial Officer and Chief Corporate Officer |

575,000 | — | 856,534 | 800,975 | — | 27,711 | 2,260,220 | |||||||

|

Byrne

Mulrooney, Chief Executive Officer of Korn/Ferry International Futurestep, Inc. |

450,000 | — | 1,489,630 | 750,000 | — | 22,862 | 2,712,492 | |||||||

|

Mark

Arian, Chief Executive Officer of Korn/Ferry Hay Group |

37,500 | — | 399,960 | — | — | 541 | 438,001 | |||||||

|

Stephen

Kaye, Former Chief Executive Officer of Korn/Ferry Hay Group |

450,000 | 437,500 | 117,512 | — | — | 10,348 | 1,015,360 |

* See footnote disclosure to table on pages 41 - 42.

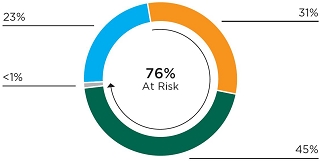

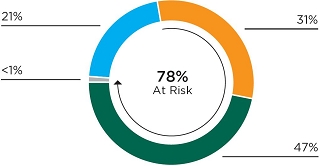

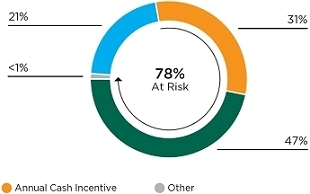

2017 Executive Total Compensation Mix (page 30)

| CEO COMPENSATION MIX* | OTHER NEO COMPENSATION MIX* | |

|

|

| * | Equity awards based upon grant date value. Excludes Mr. Kaye, whose employment terminated during the fiscal year and Mr. Arian, who joined the Company in the fourth quarter of fiscal 2017. |

|

|

2017 Proxy Statement 2017 Proxy Statement |

4 |

Compensation Process Highlights (pages 19 and 29 - 31)

| • | Our Compensation and Personnel Committee receives advice from its independent compensation consultant. |

| • | We review total direct compensation and the mix of the compensation components for the named executive officers relative to our peer group as one of the factors in determining if compensation is adequate to attract and retain executive officers with the unique set of skills necessary to manage and motivate our global people and organizational advisory firm. |

Elements of Compensation (pages 32 - 40)

| Element | Purpose | Determination | ||

| Base Salary | Compensate for services rendered during the fiscal year and provide sufficient fixed cash income for retention and recruiting purposes. | Reviewed on an annual basis by the Compensation and Personnel Committee taking into account competitive data from our peer group, input from our compensation consultant and the executive’s individual performance. | ||

| Annual Cash Incentives | Motivate and reward named executive officers for achieving financial and strategy execution goals over a one-year period. | Determined by the Compensation and Personnel Committee based upon performance goals, strategic objectives, competitive data and individual performance. | ||

| Long-Term Incentives | Align the named executive officers’ interests with those of stockholders, encourage the achievement of the long-term goals of the Company and motivate and retain top talent. | Determined by the Compensation and Personnel Committee based upon a number of factors including competitive data, total overall compensation provided to each named executive officer and historic grants. |

Best Practices (page 29)

|

Our Board has adopted a clawback policy applicable to all cash incentive payments and performance-based equity awards granted to executive officers. |

|

Our named executive officers are not entitled to any “single trigger” equity acceleration in connection with a change in control. |

|

We have adopted policies prohibiting hedging, speculative trading or pledging of Company stock. |

|

All named executive officers are required to own three times their annual base salary in Company common stock. |

|

We do not provide excise tax gross-ups to any of our executive officers. |

|

Corporate Secretary Magazine recognized Korn Ferry for “Best Proxy Statement (small to mid-cap)” for 2016. |

|

|

2017 Proxy Statement 2017 Proxy Statement |

5 |

This page intentionally left blank

01

|

|

2017 Proxy Statement 2017 Proxy Statement |

7 |

Our stockholders will be asked to consider eight nominees for election to our Board of Directors to serve for a one-year term until the 2018 Annual Meeting of Stockholders and until their successors have been duly elected and qualified, subject to their earlier death, resignation or removal.

The names of the eight nominees for director and their current position with the Company are set forth below. Detailed biographical information regarding each of these nominees is provided in this Proxy Statement under the heading “The Board of Directors.” All of the nominees, with the exception of Mr. Burnison, have been determined by the Board to be independent under the rules of The New York Stock Exchange (the “NYSE”). Our Nominating and Corporate Governance Committee has reviewed the qualifications of each of the nominees and has recommended to the Board that each nominee be submitted to a vote at the Annual Meeting.

All of the nominees have indicated their willingness to serve, if elected, but if any should be unable or unwilling to serve, proxies may be voted for a substitute nominee designated by the Board. The Company did not receive any stockholder nominations for director. Proxies cannot be voted for more than the number of nominees named in this Proxy Statement.

| Name | Position with Korn Ferry |

| Doyle N. Beneby | Director |

| Gary D. Burnison | Director and Chief Executive Officer |

| William R. Floyd | Director |

| Christina A. Gold | Director |

| Jerry P. Leamon | Director |

| Angel R. Martinez | Director |

| Debra J. Perry | Director |

| George T. Shaheen | Director and Non-Executive Chair of the Board |

In uncontested elections, directors are elected by a majority of the votes cast, meaning that each director nominee must receive a greater number of shares voted “for” such nominee than the shares voted “against” such nominee. If an incumbent director does not receive a greater number of shares voted “for” such director than shares voted “against” such director, then such director must tender his or her resignation to the Board. In that situation, the Company’s Nominating and Corporate Governance Committee would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. Within 90 days from the date the election results were certified, the Board would act on the Nominating and Corporate Governance Committee’s recommendation and publicly disclose its decision and rationale behind it.

In a contested election—a circumstance we do not anticipate at the Annual Meeting—director are elected by a plurality vote.

| RECOMMENDATION OF THE BOARD |

| The Board unanimously recommends that you vote “FOR” each of the nominees named above for election as a director. |

|

|

2017 Proxy Statement 2017 Proxy Statement |

8 |

The Company’s Restated Certificate of Incorporation provides that the number of directors shall not be fewer than eight nor more than fifteen, with the exact number of directors within such limits to be determined by the Board. Currently, the Board is comprised of eight directors. Upon the recommendation of the Company’s Nominating and Corporate Governance Committee, the Board has nominated the following persons to serve as directors until the 2018 Annual Meeting of Stockholders or their earlier resignation or removal:

| Doyle N. Beneby | Jerry P. Leamon |

| Gary D. Burnison | Angel R. Martinez |

| William R. Floyd | Debra J. Perry |

| Christina A. Gold | George T. Shaheen |

Each of the named nominees are independent under the NYSE rules, except for Mr. Burnison. If reelected, Mr. Shaheen will continue to serve as the Company’s independent Non-Executive Chair of the Board.

The Board held five meetings during fiscal year 2017. Each of the directors who were on the Board at the time attended at least 75% of the Board meetings and the meetings of committees of which they were members in fiscal 2017. Directors are expected to attend each annual meeting of stockholders. All directors then serving attended the 2016 Annual Meeting of Stockholders in person.

The Board believes that the Board, as a whole, should possess a combination of skills, professional experience and diversity of backgrounds necessary to oversee the Company’s business. In addition, the Board believes there are certain attributes every director should possess, as reflected in the Board’s membership criteria discussed below. Accordingly, the Board and the Nominating and Corporate Governance Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and the Company’s current and future needs.

The Nominating and Corporate Governance Committee is responsible for developing and recommending Board membership criteria to the full Board for approval. The criteria, which are set forth in the Company’s Corporate Governance Guidelines, include:

| • | a reputation for integrity, |

| • | honesty and adherence to high ethical standards, |

| • | strong management experience, |

| • | current knowledge and contact in the Company’s industry or other industries relevant to the Company’s business, |

| • | the ability to commit sufficient time and attention to Board and Committee activities, and |

| • | the fit of the individual’s skills and personality with those of other directors in building a Board that is effective, collegial, diverse and responsive to the needs of the Company. |

The Nominating and Corporate Governance Committee seeks a variety of occupational, educational and personal backgrounds on the Board in order to obtain a range of viewpoints and perspectives and to enhance the diversity of the Board in such areas as professional experience, geography, race, gender, ethnicity and age. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, the Nominating and Corporate Governance Committee does believe it is essential that Board members represent diverse viewpoints and backgrounds. The Nominating and Corporate Governance Committee periodically evaluates the composition of the Board to assess the skills and experience that are currently represented on the Board, as well as the skills and experience that the Board will find valuable in the future, given the Company’s current situation and strategic plans. This periodic assessment enables the Board to update the skills and experience it seeks in the Board as a whole, and in individual directors, as the Company’s needs evolve and change over time and to assess the effectiveness of efforts at pursuing diversity. In identifying director candidates from time to time, the Nominating and Corporate Governance Committee may establish specific skills and experience that it believes the Company should seek in order to constitute a balanced and effective board.

In evaluating director candidates, and considering incumbent directors for renomination to the Board, the Nominating and Corporate Governance Committee takes into account a variety of factors. These include each nominee’s independence, financial literacy, personal and professional accomplishments, and experience, each in light of the composition of the Board as a whole and the needs of the Company in general, and for incumbent directors, past performance on the Board.

|

|

2017 Proxy Statement 2017 Proxy Statement |

9 |

| SNAPSHOT OF DIRECTOR NOMINEES | |||||||||||||||

|

|

|

|

|

|

|

|

||||||||

| Doyle N. BENEBY | Gary D. BURNISON | William R. FLOYD | Christina A. GOLD | Jerry P. LEAMON | Angel R. MARTINEZ | Debra J. PERRY | George T. SHAHEEN | ||||||||

| All director nominees possess: | |||||||||||||||

|

• Relevant Senior Executive / CEO Experience

• Innovative Thinking

• Knowledge of Corporate Governance Practices |

• High Ethical Standards

• Appreciation of Diverse Cultures and Backgrounds |

||||||||||||||

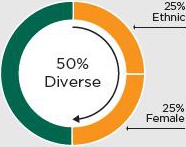

The Board and Company are focused on ensuring the Board reflects a wide range of backgrounds, experiences and cultures. Fifty percent of our director nominees are women or racially diverse individuals.

BOARD DIVERSITY

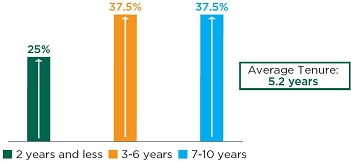

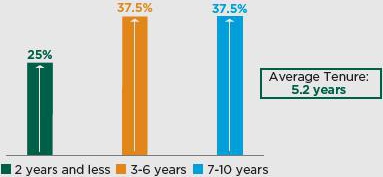

The Company believes that a variety of tenures on our Board helps to provide an effective mix of deep knowledge and new perspectives. The current tenure of our Board is as follows:

DIRECTOR TENURE

|

|

2017 Proxy Statement 2017 Proxy Statement |

10 |

The biographies below set forth information about each of the nominees for director, including each such person’s specific experience, qualifications, attributes and skills that led our Board to conclude that such nominee/director should serve on our Board. The process undertaken by the Nominating and Corporate Governance Committee in recommending qualified director candidates is described below under “Corporate Governance—Board Committees—Nominating and Corporate Governance Committee”.

BACKGROUND INFORMATION REGARDING DIRECTOR

NOMINEES

|

Doyle N. BENEBY

Director Since: 2015

Former Chief Executive Officer – CPS Energy

Age: 57 |

Board Qualifications and Skills:

Extensive Senior Leadership/Executive Officer Experience: Previously served in a multitude of senior leadership positions, including as former Chief Executive Officer of New Generation Power International, as President and Chief Executive Officer of CPS Energy, and various leadership roles at PECO Energy and Exelon Power, where he served as President.

Broad Energy Industry Experience: Over 30 years of experience in the energy industry, with expertise in many facets of the electric & gas utility industry. |

|

|

Other Directorships:

Capital Power Corporation, Quanta Services, University of Texas Energy Institute, Argonne National Laboratory and University of Miami (Trustee).

|

Mr. Beneby is currently an independent consultant. Mr. Beneby served as Chief Executive Officer of New Generation Power International, a start-up international renewable energy company, based in Chicago, Illinois, from November 2015 until May 2016. Prior to that, Mr. Beneby served as President and Chief Executive Officer of CPS Energy, the largest municipal electric and gas utility in the nation, from July 2010 to November 2015. Prior to joining CPS Energy, Mr. Beneby served at Exelon Corporation from 2003 to 2010 in various roles, most recently, as President of Exelon Power and Senior Vice President of Exelon Generation from 2009 to 2010. From 2008 to 2009, Mr. Beneby served as Vice President, Generation Operations for Exelon Power. From 2005 to 2008, Mr. Beneby served as Vice President, Electric Operations for PECO Energy, a subsidiary of Exelon Corporation. Mr. Beneby serves on the boards of numerous energy industry organizations such as Capital Power Corporation, Argonne National Laboratory, Keystone Center & Energy Board (Trustee) and University of Texas Energy Institute. Mr. Beneby also serves as a Trustee for his alma mater, the University of Miami.

|

Gary D. BURNISON

Director Since: 2007

President and Chief Executive Officer

Age: 56 |

Board Qualifications and Skills:

High Level of Financial Experience: Substantial financial experience gained in roles as President, Chief Executive Officer and as former Chief Financial Officer and Chief Operating Officer of the Company, as Chief Financial Officer of Guidance Solutions, as an executive officer of Jefferies and Company, Inc. and as a partner at KPMG Peat Warwick.

Senior Leadership/Executive Officer Experience: In addition to serving as the Company’s President and Chief Executive Officer, served as Chief Financial Officer of Guidance Solutions.

Extensive Knowledge of the Company’s Business and Industry: Over 14 years of service with the Company, including as President and Chief Executive Officer of the Company since July 2007 and Chief Operating Officer of the Company from October 2003 until June 2007. |

|

|

Other Directorships:

N/A

|

Mr. Burnison has served as President and Chief Executive Officer of the Company since July 2007. He was the Executive Vice President and Chief Financial Officer of the Company from March 2002 until June 30, 2007. He also served as Chief Operating Officer of the Company from October 2003 until June 30, 2007. From 1999 to 2001, Mr. Burnison was Principal and Chief Financial Officer of Guidance Solutions and from 1995 to 1999 he served as an executive officer and member of the board of directors of Jefferies and Company, Inc., the principal operating subsidiary of Jefferies Group, Inc. Prior to that, Mr. Burnison was a partner at KPMG Peat Marwick.

|

|

2017 Proxy Statement 2017 Proxy Statement |

11 |

|

William R. FLOYD

Director Since: 2012

Former Chairman of the Board Buffet Holdings, Inc.

Age: 72 |

Board Qualifications and Skills:

High Level of Financial Experience: Significant financial experience gained through senior leadership roles over the past 30-plus years.

Extensive Senior Leadership/Executive Officer Experience: Previously served in a multitude of senior leadership positions, including as Chairman of the Board of Buffet Holdings, Inc., Chairman and Chief Executive Officer of Physiotherapy Associates, Chairman and Chief Executive Officer of Beverly Enterprises, Inc., and various executive positions with PepsiCo Inc.’s restaurant group.

Broad Service Industry Experience: Over 30 years of experience in service industries, including restaurants, lodging and healthcare. |

|

|

Other Directorships:

El Pollo Loco Holdings, Inc., Muzinich Capital LLC, Pivot Physical Therapy, Chairman of the Board of Trustees of Valley Forge Military Academy and College, Board of Overseers at the University of Pennsylvania School of Nursing, and Member of Union League of Philadelphia.

|

Mr. Floyd served as Chairman of the Board of Buffet Holdings, Inc., which through its subsidiaries owns and operates a chain of restaurants in the United States, from June 2009 to July 2012. He has over 30 years of experience in service industries, including restaurants, lodging and healthcare. His prior positions include, among others, Chairman and Chief Executive Officer of Physiotherapy Associates (which was formed by the merger of Benchmark Medical, Inc. and Physiotherapy Corporation), a provider of outpatient physical rehabilitation services in the United States, from June 2007 to February 2009; Chairman and Chief Executive Officer of Benchmark Medical, Inc. from November 2006 to June 2007; Chairman and Chief Executive Officer of Beverly Enterprises, Inc. from December 2001 to March 2006 (he joined Beverly Enterprises in April 2000 as President and Chief Operating Officer); President and Chief Executive Officer of Choice Hotels International from October 1996 to May 1998; and various executive positions within PepsiCo Inc.’s restaurant group from December 1989 to September 1996, including as Chief Operating Officer of Kentucky Fried Chicken from August 1994 through July 1995 and as Chief Operating Officer of Taco Bell Corp. from July 1995 until September 1996. Mr. Floyd currently serves on the board of El Pollo Loco Holdings, Inc., Muzinich Capital LLC, and Pivot Physical Therapy, a private equity-owned physical therapy business, as a member and Chairman Emeritus of the Board of Trustees of Valley Forge Military Academy and College, is on the Board of Overseers at the University of Pennsylvania School of Nursing and is a member of the Union League of Philadelphia. Mr. Floyd received a BA degree from the University of Pennsylvania and a MBA from the Wharton School.

|

Christina A. GOLD

Director Since: 2014

Former Chief Executive Officer,

Age: 69 |

Board Qualifications and Skills:

High Level of Financial Experience: Substantial financial experience gained from a ten-year career with The Western Union Company and its former parent company.

Extensive Senior Leadership/Executive Officer Experience: Served in numerous senior leadership positions, including as Chief Executive Officer and President of The Western Union Company, President of Western Union Financial Services, Vice Chairman and Chief Executive Officer of Excel Communications and President and CEO of Beaconsfield Group, Inc.

Broad International Experience: Significant international experience from 28 year career at Avon Products, Inc., including as Senior Vice President & President of Avon North America.

Significant Public Company Board Experience: Over 16 years of public company board experience, including as a director of ITT Corporation since 1997, International Flavors & Fragrances, Inc. since 2013, Exelis Inc. from 2011 to 2013 and The Western Union Company from 2006 to 2010. |

|

|

Other Directorships:

ITT Corporation, International Flavors & Fragrances, Inc., New York Life Insurance and Safe Water Network.

|

From September 2006 until September 2010, Ms. Gold was Chief Executive Officer, President and a director of The Western Union Company, a leading company in global money transfer. Ms. Gold was President of Western Union Financial Services, Inc. and Senior Executive Vice President of First Data Corporation, former parent company of The Western Union Company and provider of electronic commerce and payment solutions, from May 2002 to September 2006. Prior to that, Ms. Gold served as Vice Chairman and Chief Executive Officer of Excel Communications, Inc., a former telecommunications and e-commerce services provider, from October 1999 to May 2002. From 1998 to 1999, Ms. Gold served as President and CEO of Beaconsfield Group, Inc., a direct selling advisory firm that she founded. Prior to founding Beaconsfield Group, Ms. Gold spent 28 years (from 1970 to 1998) with Avon Products, Inc., in a variety of positions, including as Executive Vice President, Global Direct Selling Development, Senior Vice President and President of Avon North America, and Senior Vice President & CEO of Avon Canada. Ms. Gold is currently a director of ITT Corporation, International Flavors & Fragrances, Inc. and New York Life Insurance. From October 2011 to May 2013, Ms. Gold was a director of Exelis, Inc. She also sits on the board of Safe Water Network, a non-profit organization working to develop locally owned, sustainable solutions to provide safe drinking water.

|

|

2017 Proxy Statement 2017 Proxy Statement |

12 |

|

Jerry P. LEAMON

Director Since: 2012

Former Global Managing Director, Deloitte

Age: 66 |

Board Qualifications and Skills:

High Level of Financial Experience: Substantial financial experience gained from almost 40-year career with Deloitte & Touche, including as leader of the tax practice and as leader of the M&A practice for more than ten years.

Accounting Expertise: In addition to an almost 40-year career with Deloitte & Touche LLP, Mr. Leamon is a certified public accountant.

Broad International Experience: Served as leader of Deloitte & Touche’s tax practice, both in the U.S. and globally and was Global Managing Director for all client programs.

Service Industry Experience: Deep understanding of operational and leadership responsibilities within the professional services industry having held senior leadership positions at Deloitte while serving some of their largest clients.

|

|

|

Other Directorships:

Credit Suisse USA, Geller & Company, Americares Foundation, and member of Business Advisory Council of the Carl H. Lindner School of Business.

|

Mr. Leamon served as Global Managing Director for Deloitte & Touche until 2012, having responsibility for all of Deloitte’s businesses at a global level. In a career of almost 40 years, 31 of which as a partner, he held numerous roles of increasing responsibility. Previously, he served as the leader of the tax practice, both in the U.S. and globally, and had responsibility as Global Managing Director for all client programs including industry programs, marketing communication and business development. In addition, he was leader of the M&A practice for more than ten years. Throughout his career he served some of Deloitte’s largest clients. Mr. Leamon serves on a number of boards of public, privately held and non-profit organizations, including Credit Suisse USA where he chairs the Audit Committee, and Geller & Company, and serves as the Chairman of the Americares Foundation. Mr. Leamon is also a Senior Advisor to Lead Edge Investments. He is also a former member of the University of Cincinnati Foundation and Board and serves as a member of the Business Advisory Council of the Carl H. Lindner School of Business. Mr. Leamon is also a certified public accountant.

|

Angel R. MARTINEZ

Director Since: 2017

Non-Executive Chairman of the Board of Directors of, and former President and CEO of, Deckers Outdoor Corp.

Age: 62 |

Board Qualifications and Skills:

Extensive Senior Leadership/Executive Officer Experience: Served in numerous senior leadership positions, including as Chief Executive Officer and President of Deckers Outdoor Corp., Executive Vice President and Chief Marketing Officer of Reebok International Ltd., President of The Rockport Company, and President and Chief Executive Officer of Keen, LLC.

Broad Product and Marketing Experience: Almost 40 years of experience in product and marketing from senior positions with, among other companies, Deckers Outdoor Corp., Reebok International and The Rockport Company.

Significant Public Company Board and Corporate Governance Experience: Over 19 years of public company board service, including as a director of Tupperware Brands Corporation since 1998 and Chairman of the Board of Deckers Outdoor Corp. since 2008.

|

|

|

Other Directorships:

Deckers Outdoor Corp. and Tupperware Brands Corporation.

|

Mr. Martinez is currently the non-executive Chairman of Board of Directors of Deckers Outdoor Corp. (“Deckers”), a global leader in designing, marketing and distributing innovative footwear, apparel and accessories developed for both everyday casual lifestyle use and high performance activities. He served as CEO and President of Deckers from April 2005 until his retirement in May 2016, Prior to joining Deckers, he was Chief Executive Officer and Vice Chairman of Keen LLC, an outdoor footwear manufacturer, from January 2005 to March 2005, after serving as President and Chief Executive Officer from April 2003 to December 2004, and as an independent consultant since June 2001. Prior thereto he served as Executive Vice President and Chief Marketing Officer of Reebok International Ltd. (Reebok) and as Chief Executive Officer and President of The Rockport Company, a subsidiary of Reebok. Mr. Martinez graduated from the University of California, Davis, in 1977.

|

|

2017 Proxy Statement 2017 Proxy Statement |

13 |

|

Debra J. PERRY

Director Since: 2008

Former senior managing director in the Global Ratings and Research Unit of Moody’s Investors Service, Inc.

Age: 66 |

Board Qualifications and Skills:

High Level of Financial Experience: Substantial financial experience gained from 23 years of professional experience in financial services, including a 12-year career at Moody’s Corporation, where among other things, Ms. Perry oversaw the Americas Corporate Finance, Leverage Finance and Public Finance departments.

Significant Audit Committee Experience: Over 12 years of public company audit committee service, including as a member of MBIA Inc.’s audit committee (2004 to 2008), PartnerRe’s audit committee (from June 2013 to March 2016, including as chair of the audit committee from January 2015 to March 2016) and Korn Ferry’s audit committee (since 2008; appointed chair of audit committee in 2010).

Significant Public Company Board and Corporate Governance Experience: Previously served as a director (June 2013 to March 2016) and chair of the audit committee (January 2015 to March 2016) of PartnerRe, and as a director of BofA Funds Series Trust (June 2011 to April 2016), of MBIA Inc. (2004 to 2008) and CNO Financial Group, Inc. (2004 to 2011). Actively involved in corporate governance organizations, including the National Association of Corporate Directors (“NACD”) and the Shareholder-Director Exchange working group. Named in 2014 to NACD’s Directorship 100, which recognizes the most influential people in the boardroom and corporate governance community.

|

|

|

Other Directorships:

The Sanford C. Bernstein Fund, Inc. and Genworth Financial Inc.

|

Ms. Perry currently serves on the boards of directors of the Sanford C. Bernstein Fund, Inc. (elected July 2011) and Genworth Financial Inc. (elected December 2016). She was a member of the board (from June 2013) and chair of the Audit Committee (from January 2015) of PartnerRe, a Bermuda-based reinsurance company, until the sale of the company to a European investment holding company in March 2016. She was also a trustee of the Bank of America Funds from June 2011 until April 2016. Ms. Perry served on the board of directors and chair of the human resources and compensation committee of CNO Financial Group, Inc., from 2004 to 2011. In 2014, Ms. Perry was named to NACD’s Directorship 100, which recognizes the most influential people in the boardroom and corporate governance community. From September 2012 to December 2014, Ms. Perry served as a member of the Executive Committee of the Committee for Economic Development (“CED”) in Washington, D.C. a non-partisan, business-led public policy organization, until its merger with the Conference Board, and she continues as a member of CED. She worked at Moody’s Corporation from 1992 to 2004. From 2001 to 2004, Ms. Perry was a senior managing director in the Global Ratings and Research Unit of Moody’s Investors Service, Inc. where she oversaw the Americas Corporate Finance, Leverage Finance, Public Finance and Financial Institutions departments. From 1999 to 2001, Ms. Perry served as Chief Administrative Officer and Chief Credit Officer, and from 1996 to 1999, she was a group managing director for the Finance, Securities and Insurance Rating Groups of Moody’s Corporation. Ms. Perry has also been a managing member of Perry Consulting LLC, an advisory firm specializing in credit risk management and governance within the financial industry since 2008.

|

George T. SHAHEEN

Director Since: 2009

Chair of the Board

Age: 73 |

Board Qualifications and Skills:

Extensive Senior Leadership/Executive Officer Experience: Previously served as Chief Executive Officer of Siebel Systems, Inc., Chief Executive Officer and Global Managing Partner of Andersen Consulting and CEO of Webvan Group, Inc.

Significant Public Company Board Experience: 13 years of public company board experience, including as a director of NetApp (since 2004), Marcus & Millichap (since 2013), and Green Dot Corporation (since 2013).

Service Industry Experience: Former Chief Executive Officer of Andersen Consulting.

|

|

|

Other Directorships:

NetApp, 24/7 Customer, Marcus & Millichap, and Green Dot Corporation.

|

Mr. Shaheen was Chief Executive Officer of Siebel Systems, Inc., a CRM software company, which was purchased by Oracle in January 2006, from April 2005 to January 2006. He was Chief Executive Officer and Global Managing Partner of Andersen Consulting, which later became Accenture, from 1989 to 1999. He then became CEO and Chairman of the Board of Webvan Group, Inc. from 1999 to 2001. Mr. Shaheen serves on the boards of NetApp, 24/7 Customer, Marcus & Millichap, and Green Dot Corporation. He also served on the Strategic Advisory Board of Genstar Capital. He has served as IT Governor of the World Economic Forum, and was a member of the Board of Advisors for the Northwestern University Kellogg Graduate School of Management. He has also served on the Board of Trustees of Bradley University. Mr. Shaheen received a BS degree and a MBA from Bradley University.

|

|

2017 Proxy Statement 2017 Proxy Statement |

14 |

The Board oversees the business and affairs of the Company and believes good corporate governance is a critical factor in our continued success and also aligns management and stockholder interests. Through our website, at www.kornferry.com, our stockholders have access to key governing documents such as our Code of Business Conduct and Ethics, Corporate Governance Guidelines and charters of each committee of the Board. The highlights of our corporate governance program are included below:

| ▼ | ▼ | ▼ |

| Board Structure | |

| • | 87.5% of the Board consists of Independent Directors |

| • | Independent Chair of the Board |

| • | Independent Audit, Compensation and Nominating Committees |

| • | Regular Executive Sessions of Independent Directors |

| • | Annual Board and Committee Self-Evaluations |

| • | 50% Diverse Board Members |

| • | Annual Strategic Off-Site Meeting |

| Stockholder Rights | |

| • | Annual Election of Directors |

| • | Majority Voting for Directors in Uncontested Elections |

| • | No Poison Pill in Effect |

| • | Stockholder Communication Process for Communicating with the Board |

| Other Highlights | |

| • | Clawback Policy |

| • | Stock Ownership Guidelines |

| • | Pay-for-Performance Philosophy |

| • | Policies Prohibiting Hedging, Pledging and Short-Sales |

| • | No Excise Tax Gross-Ups |

| • | Quarterly Education on Latest Corporate Governance Developments |

|

||

| GOVERNANCE INSIGHTS: BOARD DIVERSITY | ||

| Q & A WITH CHRISTINA GOLD, CHAIR OF THE NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | ||

| Question: How important is Board diversity to the Company? | ||

| Diversity remains a very high priority at Korn Ferry, both at the Board level and throughout the organization. We believe it is essential to our continued success. As our business grows and new and different challenges present themselves it is critical that our Board members possess diverse skills, experiences and backgrounds. Diversity of background includes racial and gender diversity. Having directors with a wide range of perspectives allows the Company to better understand and serve our clients and to continue to adapt our business to a constantly changing world. The diversity of our Board has been particularly instrumental in helping to facilitate the successful integration of Hay Group into our organization and develop and pursue our strategic initiatives. Our focus on diversity has led to a diverse boardroom with half of our Board comprised of women and racially diverse directors. Diversity of experience and background is also key to our Board composition. Our directors have a variety of industry and professional experiences that are fundamental to oversight of our organization, including experience in the service, financial and consumer products industries and roles in marketing, brand and product development. The value we place on diversity is best highlighted by the fact that our two newest Board members are racially diverse. | ||

| Question: How does the Company achieve diversity on the Board and its Committees? | ||

| One of the key ways the Company achieves diversity on the Board and its committees is through its periodic refreshment of the composition of the Board and its committees. As part of the Board and Committee annual self-evaluations, the Nominating and Corporate Governance Committee considers, among other things, the composition of the Board and each of its committees, including whether the Company’s directors possess the right diversity of skills, experiences and backgrounds for the current issues facing the Company. As a result of such evaluations, since 2012, we have elected five new directors to our Board, each with diverse skills, backgrounds and experiences, a new Chairperson, rotated the Chairs of the Compensation and Personnel Committee and Nominating and Corporate Governance Committee, made some changes to the composition of our Board Committees, and expanded the qualifications and diversity represented on the Board. | ||

|

|

2017 Proxy Statement 2017 Proxy Statement |

15 |

The Board has determined that as of the date hereof a majority of the Board is “independent” under the independence standards of the NYSE. The Board has determined that the following directors are “independent” under the independence standards of the NYSE: Doyle N. Beneby, William R. Floyd, Christina A. Gold, Jerry P. Leamon, Angel R. Martinez, Debra J. Perry, and George T. Shaheen. In addition, during his term of service, former director Harry L. You was determined to be “independent” under the NYSE standards.

For a director to be “independent”, the Board must affirmatively determine that such director does not have any material relationship with the Company. To assist the Board in its determination, the Board reviews director independence in light of the categorical standards set forth in the NYSE’s Listed Company Manual. Under these standards, a director cannot be deemed “independent” if, among other things:

| • | the director is, or has been within the last three years, an employee of the Company, or an immediate family member is, or has been within the last three years, an executive officer of the Company; |

| • | the director has received, or has an immediate family member who received, during any 12-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| • | (1) the director or an immediate family member is a current partner of a firm that is the Company’s internal or external auditor, (2) the director is a current employee of such a firm, (3) the director has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit, or (4) the director or an immediate family member was within the last three years a partner or employee of such firm and personally worked on the Company’s audit within that time; |

| • | the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serve or served on that company’s compensation committee; or |

| • | the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million or 2% of the other company’s consolidated gross revenues. |

The independent directors of the Board meet regularly in executive sessions outside the presence of management. Mr. George Shaheen, as Chair of the Board, currently presides at all executive sessions of the independent directors. Subject to his reelection at the Annual Meeting, Mr. Shaheen will continue in this role following the Annual Meeting.

All current members of the Board, with the exception of our CEO, Mr. Burnison, are independent. Further, all members of our Audit Committee, Compensation and Personnel Committee and Nominating and Corporate Governance Committee are independent.

DIRECTOR INDEPENDENCE

The Company’s Corporate Governance Guidelines provide that the Board is free to select its Chair and CEO in the manner it considers to be in the best interests of the Company and that the role of Chair and CEO may be filled by a single individual or two different persons. This provides the Board with flexibility to decide what leadership structure is in the best interests of the Company at any point in time. Currently, the Board is led by an independent, non-executive Chair, Mr. George Shaheen. Mr. Shaheen will continue to serve as Chair of the Board, subject to his reelection as a director at the Annual Meeting. The Board has determined that having an independent director serve as Chair of the Board is in the best interests of the Company at this time as it allows the Chair to focus on the effectiveness and independence of the Board while the CEO focuses on executing the Company’s strategy and managing the Company’s business. In the future, the Board may determine that it is in the bests interests of the Company to combine the role of Chair and CEO.

|

|

2017 Proxy Statement 2017 Proxy Statement |

16 |

BOARD’S OVERSIGHT OF ENTERPRISE RISK AND RISK MANAGEMENT

The Board plays an active role, both as a whole and also at the committee level, in overseeing management of the Company’s risks. Management is responsible for the Company’s day-to-day risk management activities. The Company has established an enterprise risk framework for identifying, aggregating and evaluating risk across the enterprise. The risk framework is integrated with the Company’s annual planning, audit scoping and control evaluation management by its internal auditor. The review of risk management is a dedicated periodic agenda item for the Audit Committee, whose responsibilities include periodically reviewing management’s financial and operational risk assessment and risk management policies, the Company’s major financial risk exposures, and the steps management has taken to monitor and control such exposures. The Company’s other Board committees also consider and address risk during the course of their performance of their committee responsibilities. Specifically, the Compensation and Personnel Committee reviews the risks related to the Company’s compensation programs for senior management, discussed in more detail below, and the Nominating and Corporate Governance Committee oversees risks associated with operations of the Board and its governance structure. Further, the General Counsel periodically reports to the Board on litigation and other legal risks that may affect the Company. The full Board monitors risks through regular reports from each of the Committee chairs and the General Counsel, and is apprised of particular risk management matters in connection with its general oversight and approval of corporate matters. We believe the division of risk management responsibilities described above provides an effective framework for evaluating and addressing the risks facing the Company, and that our Board leadership structure supports this approach because it allows our independent directors, through the independent committees and non-executive Chair, to exercise effective oversight of the actions of management.

Assessment of Risk Related to Compensation Programs

During fiscal 2017, the Company completed its annual review of executive and non-executive compensation programs globally, with particular emphasis on incentive compensation plans and programs. Based on this review, the Company evaluated the primary components of its compensation plans and practices to identify whether those components, either alone or in combination, properly balanced compensation opportunities and risk. As part of this inventory, several factors were noted that reduce the likelihood of excessive risk taking. These factors include: balancing performance focus between near-term objectives and strategic initiatives; issuing equity awards that vest over multi-year time horizons (and, in the case of named executive officers, a majority of which are also subject to the achievement of performance goals); and maintaining stock ownership guidelines and a clawback policy applicable to our executive officers. Furthermore, the Compensation and Personnel Committee retains its own independent compensation consultant to provide input on executive pay matters, meets regularly, and approves all performance goals, award vehicles, and pay opportunity levels for named executive officers. As a result of this evaluation, the Company concluded that risks arising from the Company’s compensation policies and practices are not reasonably likely to have a material adverse impact on the Company.

|

|

2017 Proxy Statement 2017 Proxy Statement |

17 |

Although the full Board considers all major decisions, the Company’s Bylaws permit the Board to have the following standing committees to more fully address certain areas of importance: (1) an Audit Committee, (2) a Compensation and Personnel Committee, and (3) a Nominating and Corporate Governance Committee. The members of the standing committees as of the date hereof are set forth in the tables below. Following the Annual Meeting, the Nominating and Corporate Governance Committee intends to evaluate the composition of the standing committees and make recommendations to the Board regarding any appropriate changes to the Committees. The Nominating and Corporate Governance Committee expects, at such time, to recommend to the Board the appointment of Mr. Martinez to a Board Committee or Committees.

Audit Committee

|

|

|

||

| Debra J. PERRY | Jerry P. LEAMON | William R. FLOYD | ||

| Chair | ||||

| Among other things, the Audit Committee: | ||||

| • | Is directly responsible for appointment, compensation, retention and oversight of the independent registered public accounting firm; | |||

| • | Reviews the independent registered public accounting firm’s qualifications and independence; | |||

| • | Reviews the plans and results of the audit engagement with the independent registered public accounting firm; | |||

| • | Approves financial reporting principles and policies; | |||

| • | Considers the range of audit and non-audit fees; | |||

| • | Reviews the adequacy of the Company’s internal accounting controls; | |||

| • | Oversees the Company’s internal audit function, including annually reviewing and discussing the performance and effectiveness of the Internal Audit Department; and | |||

| • | Works to ensure the integrity of financial information supplied to stockholders. | |||

The Audit Committee is also available to receive reports, suggestions, questions and recommendations from the Company’s independent registered public accounting firm, Internal Audit Department, the Chief Financial Officer and the General Counsel. It also confers with these parties in order to help assure the sufficiency and effectiveness of the programs being followed by corporate officers in the area of compliance with legal and regulatory requirements, business conduct and conflicts of interest. The Audit Committee is composed entirely of non-employee directors whom the Board has determined are “independent directors” under the applicable listing standards of the NYSE and the applicable rules of the Securities and Exchange Commission (the “SEC”). The Board, in its business judgment, has determined that Ms. Perry and Messrs. Leamon and Floyd are “financially literate,” under the NYSE rules, and that Mr. Leamon and Ms. Perry qualify as “audit committee financial experts” as such term is defined in Item 407(d)(5) of Regulation S-K under the Exchange Act. The Board determined that Ms. Perry qualifies as an “audit committee financial expert” from her many years of experience in the financial services industry and service on other public company Audit Committees. The Audit Committee met nine times in fiscal 2017. The Audit Committee operates pursuant to a written charter adopted by the Board, which is available on the Company’s website and in print to any stockholder that requests it. To access the charter from the Company’s website, go to www.kornferry.com, select “Investor Relations” from the drop-down menu, then click on the “Corporate Governance” link located in a list on the right side of the page. Requests for a printed copy should be addressed to Korn/Ferry International, 1900 Avenue of the Stars, Suite 2600, Los Angeles, California 90067, Attention: Corporate Secretary.

|

|

2017 Proxy Statement 2017 Proxy Statement |

18 |

Compensation and Personnel Committee

|

|

|

|

||

| Jerry P. LEAMON | William R. FLOYD | Christina A. GOLD | Doyle N. BENEBY | ||

| Chair | |||||

| Among other things, the Compensation and Personnel Committee: | |||||

| • | Approves and oversees the Company’s compensation programs, including cash and equity-based incentive programs provided to members of the Company’s senior management group, including the Company’s Chief Executive Officer, Chief Financial Officer and other named executive officers; | ||||

| • | Reviews the compensation of directors for service on the Board and its committees; and | ||||

| • | Approves or recommends to the Board, as required, specific compensation actions, including salary adjustments, annual cash incentives, stock option grants and employment and severance arrangements for the Chief Executive Officer and other executive officers. | ||||

The Compensation and Personnel Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee consisting solely of members of the Compensation and Personnel Committee who are non-employee directors and outside directors. The Board has determined that all members of the Compensation and Personnel Committee are “independent directors” under the applicable listing standards of the NYSE. The Compensation and Personnel Committee met eight times during fiscal 2017. The Compensation and Personnel Committee operates pursuant to a written charter adopted by the Board, which is available on the Company’s website and in print to any stockholder that requests it. To access the charter from the Company’s website, go to www.kornferry.com, select “Investor Relations” from the drop-down menu, then click on the “Corporate Governance” link located in a list on the right side of the page. Requests for a printed copy should be addressed to Korn/Ferry International, 1900 Avenue of the Stars, Suite 2600, Los Angeles, California 90067, Attention: Corporate Secretary.

|

|

2017 Proxy Statement 2017 Proxy Statement |

19 |

Nominating and Corporate Governance Committee

|

|

|

||

| Christina A. GOLD | Doyle N. BENEBY | Debra J. PERRY | ||

| Chair | ||||

| Among other things, the Nominating and Corporate Governance Committee: | ||||

| • | Recommends criteria to the Board for the selection of nominees to the Board; | |||

| • | Evaluates all proposed nominees; | |||

| • | Prior to each annual meeting of stockholders, recommends to the Board a slate of nominees for election to the Board by the stockholders at the annual meeting; | |||

| • | Make recommendations to the Board from time to time as to changes the Committee believes to be desirable to the size, structure, composition and functioning of the Board or any committee thereof; and | |||

| • | Oversee risks associated with operations of the Board and its governance structure. | |||

In evaluating nominations, the Nominating and Corporate Governance Committee considers a variety of criteria, including business experience and skills, independence, judgment, integrity, the ability to commit sufficient time and attention to Board activities and the absence of potential conflicts with the Company’s interests. The Nominating and Corporate Governance Committee, with the assistance of the Company’s executive search business, identified and recommended to the Board that Angel R. Martinez be nominated as a director in this Proxy Statement to serve as a director until the 2018 Annual Meeting of Stockholders. Any stockholder recommendations for director are evaluated in the same manner as all other candidates considered by the Nominating and Corporate Governance Committee. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, it also takes into account the diversity of the Board when considering director nominees. The Board has determined that all members of the Nominating and Corporate Governance Committee are “independent directors” under the applicable listing standards of the NYSE. The Nominating and Corporate Governance Committee met five times in fiscal 2017. The Nominating and Corporate Governance Committee operates pursuant to a written charter adopted by the Board, which is available on the Company’s website and in print to any stockholder that requests it. To access the charter from the Company’s website, go to www.kornferry.com, select “Investor Relations” from the drop-down menu, then click on the “Corporate Governance” link located in a list on the right side of the page. Requests for a printed copy should be addressed to Korn/Ferry International, 1900 Avenue of the Stars, Suite 2600, Los Angeles, California 90067, Attention: Corporate Secretary. Stockholders may recommend director nominees by mailing submissions to Korn/Ferry International, 1900 Avenue of the Stars, Suite 2600, Los Angeles, California 90067, Attention: Corporate Secretary.

|

|

2017 Proxy Statement 2017 Proxy Statement |

20 |

CODE OF BUSINESS CONDUCT AND ETHICS

The Board has adopted a Code of Business Conduct and Ethics that is applicable to all directors, employees and officers (including the Company’s Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer). Among other things, the Code of Business Conduct and Ethics requires directors, employees and officers to maintain the confidentiality of all information entrusted to them (except when disclosure is authorized or legally mandated); to deal fairly with the Company’s clients, service providers, suppliers, competitors and employees; to protect Company assets; and for those who have a role in the preparation and/or review of information included in the Company’s public filings, to report such information accurately and honestly. It also prohibits directors, employees and officers from using or attempting to use their position at the Company to obtain an improper personal benefit. The Code of Business Conduct and Ethics is available on the Company’s website and in print to any stockholder that requests it. To access the Code of Business Conduct and Ethics from the Company’s website, go to www.kornferry.com, select “Investor Relations” from the drop-down menu, then click on the “Corporate Governance” link located in a list on the right side of the page. Requests for a printed copy should be addressed to Korn/Ferry International, 1900 Avenue of the Stars, Suite 2600, Los Angeles, California 90067, Attention: Corporate Secretary. We intend to post on the Company’s website amendments, if any, to the Code of Business Conduct and Ethics, as well as any waivers thereunder, with respect to our officers and directors as required to be disclosed by the SEC and NYSE rules.

CORPORATE GOVERNANCE GUIDELINES

The Board has adopted Corporate Governance Guidelines, which among other things, impose limits on the number of directorships each member of the Board may hold (the Chief Executive Officer of the Company may not sit on more than two boards of directors of public companies (including the Company), while all other directors may not sit on more than five boards of directors of public companies (including the Company)); specifies the criteria to be considered for director candidates; and requires non-management directors to meet periodically without management. Additionally, the guidelines require that, when a director’s principal occupation or business association changes substantially during his or her tenure as a director, that director is required to provide written notice of such change to the chair of the Nominating and Corporate Governance Committee, and agree to resign from the Board if the Board determines to accept such resignation. The Nominating and Corporate Governance Committee must then review and assess the circumstances surrounding such change, and recommend to the Board any appropriate action to be taken. The Corporate Governance Guidelines are available on the Company’s website and in print to any stockholder that requests it. To access the Corporate Governance Guidelines from the Company’s website, go to www.kornferry.com, select “Investor Relations” from the drop-down menu, then click on the “Corporate Governance” link located in a list on the right side of the page. Requests for a printed copy should be addressed to Korn/Ferry International, 1900 Avenue of the Stars, Suite 2600, Los Angeles, California 90067, Attention: Corporate Secretary.

|

|

2017 Proxy Statement 2017 Proxy Statement |

21 |

This page intentionally left blank

|

|

2017 Proxy Statement 2017 Proxy Statement |

22 |

|

|

2017 Proxy Statement 2017 Proxy Statement |

23 |

ADVISORY RESOLUTION TO APPROVE EXECUTIVE COMPENSATION

In accordance with the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and more specifically, Section 14A of the Exchange Act which was added under the Dodd-Frank Wall Street Reform and Consumer Protection Act, we are asking stockholders to vote on an advisory resolution to approve the Company’s executive compensation as reported in this Proxy Statement. Our executive compensation program is designed to support the Company’s long-term success. As described below in the “Compensation Discussion and Analysis” section of this Proxy Statement, the Compensation and Personnel Committee has structured our executive compensation program to achieve the following key objectives:

| • | provide compensation packages to our executives that are competitive with other major employment services firms, a broader group of human capital companies and similarly-sized publicly traded companies; |

| • | closely tie individual annual cash incentive and equity-based awards to the performance of the Company as a whole, or one or more of its divisions or business units as well as to the team and individual performance of the named executive officer; and |

| • | align the interests of senior management with those of our stockholders through direct ownership of Company common stock and by providing a portion of each named executive officer’s direct total compensation in the form of equity-based incentives. |

We urge stockholders to read the “Compensation Discussion and Analysis” section below, which describes in more detail how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives, as well as the Summary Compensation Table and related compensation tables and narrative below which provide detailed information on the compensation of our named executive officers. The Compensation and Personnel Committee and the Board believe that the policies and procedures articulated in the “Compensation Discussion and Analysis” section are effective in achieving our goals and that the compensation of our named executive officers reported in this Proxy Statement has supported and contributed to the Company’s success.

We are asking stockholders to approve the following advisory resolution at the 2017 Annual Meeting of Stockholders:

RESOLVED, that the stockholders of Korn/Ferry International (the “Company”) approve, on an advisory basis, the compensation of the Company’s named executive officers set forth in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables and narrative in the Proxy Statement for the Company’s 2017 Annual Meeting of Stockholders.

This advisory resolution, commonly referred to as a “say-on-pay” resolution, is non-binding on the Board. Although non-binding, the Board and the Compensation and Personnel Committee will carefully review and consider the voting results when evaluating our executive compensation program. As described in Proposal No. 3, stockholders are being given the opportunity to express their preference for the frequency of future “say-on-pay” votes. The Board’s current policy is to include an advisory resolution to approve the compensation of our named executive officers annually, but will consider the outcome of the advisory vote in Proposal No. 3 on the frequency of “say-on-pay” votes. Unless the Board modifies its policy on the frequency of future “say-on-pay” votes, the next advisory vote to approve our executive compensation will occur at the 2018 Annual Meeting of Stockholders.