DEF 14A: Definitive proxy statements

Published on August 23, 2002

Table of Contents

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨

|

Preliminary Proxy Statement |

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x |

Definitive Proxy Statement |

¨

|

Definitive Additional Materials |

¨

|

Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

(Name of Registrant As Specified In

Its Charter)

KORN/FERRY INTERNATIONAL

(Name of Person(s) Filing Proxy

Statement)

Payment of Filing Fee (Check the appropriate box):

x |

No Fee required |

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

(1) Title of |

each class of securities to which transaction applies: |

(2) |

Aggregate number of securities to which transaction applies: |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated

and state how it was determined): |

(4) |

Proposed maximum aggregate value of transaction: |

(5) |

Total fee paid: |

¨

|

Fee paid previously with preliminary materials. |

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing |

(1) |

Amount Previously Paid: |

(2) |

Form, Schedule or Registration Statement No.: |

(3) |

Filing Party: |

(4) |

Date Filed: |

Notes:

Table of Contents

1800 Century Park East, Suite 900

Los Angeles, California 90067

August 23, 2002

Dear Stockholders:

It is

my pleasure to invite you to attend the 2002 Annual Meeting of Stockholders of Korn/Ferry International. The Annual Meeting will be held on Tuesday, September 24, 2002 at 10:00 a.m. at the Century Plaza Hotel at Century City located at 2025 Avenue

of the Stars, Los Angeles, California 90067.

At the Annual Meeting we will discuss the items of business

discussed in the attached notice and give a report on our business operations.

We are delighted that you have

chosen to invest in Korn/Ferry International and hope that, whether or not you attend the meeting, you will vote as soon as possible by completing, signing, dating and returning the enclosed proxy card in the envelope provided. Your vote is

important, and voting by written proxy will ensure your representation at the annual meeting. You may revoke your proxy in accordance with the procedures described in the proxy statement at any time prior to the time it is voted. If you attend

the meeting, you may vote in person even if you previously mailed your proxy card.

Sincerely,

Paul C. Reilly

Chairman of the Board

and

Chief Executive Officer

Table of Contents

1800 Century Park East, Suite 900

Los Angeles, California 90067

NOTICE OF ANNUAL MEETING

To Be Held on September 24, 2002

To

the Stockholders:

On Tuesday, September 24, 2002, Korn/Ferry International will hold its 2002 Annual Meeting of

Stockholders at the Century Plaza Hotel at Century City located at 2025 Avenue of the Stars, Los Angeles, California 90067. The meeting will begin at 10:00 a.m.

Only stockholders who owned our common stock at the close of business on the record date of August 1, 2002 can vote at this meeting or any adjournments that may take place. The purposes of the Annual

Meeting are to:

1. |

Elect six directors to serve on the Board; |

2. |

Ratify the appointment of Ernst & Young LLP as independent auditors for fiscal 2003; and |

3. |

Transact any other business properly presented at the meeting. |

Our Board of Directors recommends that you vote in favor of each of the two proposals outlined in the Proxy Statement accompanying this notice.

A quorum comprised of the holders of a majority of the outstanding shares of our common stock on the record date must be

present or represented for the transaction of business at the meeting. Accordingly, it is important that your shares be represented at the meeting. Whether or not you plan to attend the meeting, please complete, date and sign the enclosed proxy card

and return it in the envelope provided. You may revoke your proxy at any time prior to the time it is voted by (1) notifying the Corporate Secretary in writing; (2) returning a later-dated proxy card; or (3) attending the meeting and voting in

person.

Please read the proxy materials carefully. Your vote is important and we appreciate your cooperation in

considering and acting on the matters presented.

By Order of the Board of Directors,

Peter L. Dunn

Corporate Secretary and

General Counsel

August 23, 2002

Los Angeles, California

Table of Contents

| Page | ||

| 1 | ||

| 4 | ||

| 5 | ||

| 6 | ||

| 6 | ||

| 8 | ||

| 9 | ||

| 10 | ||

| 13 | ||

| 13 | ||

| 15 | ||

| 16 | ||

| 19 | ||

| 19 | ||

| 20 | ||

| 21 | ||

| 22 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 24 | ||

| APPENDIX |

||

| 26 |

Table of Contents

1. |

Q: Why am I receiving this proxy statement and the other enclosed materials? |

A: |

Our Board is providing these materials to you in connection with, and soliciting proxies for use at, our 2002 Annual Meeting of Stockholders, which will take

place on September 24, 2002. As a stockholder on the record date, you are invited to attend the Annual Meeting and you are requested to vote on each of the proposals described in this proxy statement. You do not need to attend the Annual Meeting to

vote your shares. |

2. |

Q: What information is included in this mailing? |

A: |

The information included in this proxy statement relates to, among other things, the proposals to be voted on at the annual meeting, the voting process and our

compensation of directors and executive officers. |

3. |

Q: What proposals will be voted on at the annual meeting? |

A: |

(1) The election of directors to serve on the Board; and |

(2) |

The ratification of the appointment of Ernst & Young LLP as our independent auditors for fiscal 2003. |

4. |

Q: How does the Board recommend I vote on each of the proposals? |

A: |

The Board recommends that you vote your shares FOR all of its nominees to the Board and FOR the ratification of the appointment of the

independent auditors. |

5. |

Q: Who is entitled to vote at the annual meeting? |

A: |

Holders of our common stock and our 7.5% Convertible Series A Preferred Stock as of the record date, which is the close of business on August 1, 2002, are

entitled to vote at the annual meeting. |

6. |

Q: How many votes are provided to each share of common stock? |

A: |

Each share of our common stock outstanding as of the record date is entitled to one vote. Holders of our 7.5% Convertible Series A Preferred Stock shall be

entitled to cast such number of votes as such holders would be entitled to cast if the 7.5% Convertible Series A Preferred Stock and our 7.5% Convertible Subordinated Notes Due 2010 were converted into common stock as of the record date. As of the

record date on August 1, 2002, 37,755,199 shares of our common stock were issued and outstanding and 5,150,776 shares of our common stock were issuable upon conversion of the 7.5% Convertible Series A Preferred Stock and the 7.5% Convertible

Subordinated Notes Due 2010. |

7. |

Q: How do I vote? |

A: |

You can vote either by completing, signing and dating each proxy card you received and returning it in the envelope provided or by attending the annual meeting

and voting in person. Once you have submitted your proxy, you have the right to revoke your proxy at any time before it is voted by: |

(1) |

Notifying the Corporate Secretary in writing; |

(2) |

Returning a later-dated proxy card; or |

(3) |

Attending the annual meeting and voting in person. |

8. |

Q: Who will count the votes? |

A: |

Representatives of Mellon Investor Services will count the votes and act as the inspector of election at the annual meeting. |

1

Table of Contents

9. |

Q: What does it mean if I receive more than one proxy card? |

A: |

It means that your shares are registered differently and are in more than one account. Sign and return all proxy cards to ensure that all your shares are voted.

|

10. |

Q: What shares are covered by the enclosed proxy card(s)? |

A: |

The shares on the enclosed proxy card(s) represent all shares owned by you as of the record date. These shares include shares (1) held directly in your name as

the stockholder of record and (2) held for you as the beneficial owner through a stockbroker, bank or other nominee. If you do not return your proxy card(s) with respect to these shares, your shares may not be voted. If you

own shares that are held in our 401(k) plan, you will receive a proxy card for those shares also. While the trustees of the 401(k) plan will vote those shares, you are requested to return that proxy card to advise the trustees of your wishes with

respect to the matters to be voted on. |

11. |

Q: What is the difference between holding shares as a stockholder of record and as a beneficial

owner? |

A: |

Those terms refer to the following. You are a: |

Stockholder |

of record, if your shares are registered directly in your name with our transfer agent, Mellon Investor Services. You are considered, with respect to

those shares, to be the stockholder of record, and these proxy materials have been sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy to us or to vote in person at the Annual Meeting. We have

enclosed a proxy card for you to use. |

Beneficial |

owner, if your shares are held in a stock brokerage account, including an Individual Retirement Account, or by a bank or other nominee, you are considered

to be the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee, who is considered, with respect to those shares, to be the stockholder of record. As the beneficial

owner, you have the right to direct your broker or nominee on how to vote (your broker or nominee has enclosed a voting instruction card for you to use) and you are invited to attend the annual meeting. However, because you are not the stockholder

of record, you may not vote your shares in person at the annual meeting. |

12. |

Q: What if a beneficial owner does not provide the stockholder of record with voting instructions for

a particular proposal? |

A: |

If you are a beneficial owner and you do not provide the stockholder of record with voting instructions for a particular proposal, your shares may constitute

broker non-votes, as described below, with respect to that proposal. |

13. |

Q: What are broker non-votes? |

A: |

Broker non-votes are shares held by a broker or nominee with respect to which the broker or nominee does not have discretionary power to vote on a

particular proposal or with respect to which instructions were never received from the beneficial owner. Shares which constitute broker non-votes with respect to a particular proposal will not be considered present and entitled to vote on that

proposal at the annual meeting, even though the same shares will be considered present for quorum purposes and may be entitled to vote on other proposals. |

14. |

Q: How are votes counted? |

A: |

In the election of directors, you may vote FOR all of the nominees or your vote may be WITHHELD with respect to one or more of the

nominees. For the other proposals, you may vote FOR, AGAINST or ABSTAIN. If you sign your proxy card or broker voting instruction card

|

2

Table of Contents

|

without voting FOR, AGAINST or ABSTAIN for any of the proposals, your shares will be voted in accordance with the recommendations of the Board. With respect to

Proposal No. 2, abstentions will be equivalent to AGAINST votes, while broker non-votes will be disregarded and will have no effect on the approval or rejection of the proposals. |

15. |

Q: What is the voting requirement to approve each proposal? |

A: |

In order to conduct business at the annual meeting, a quorum, as described below, must be established. In the election of directors, the

Boards nominees will become directors so long as they receive a plurality of FOR votes; however, if any additional nominees for director are properly brought before the stockholders for consideration, only the nominees who receive

the highest number of FOR votes will become directors. Approval of Proposal No. 2, relating to ratification of the auditors appointed by the Board, will require affirmative FOR votes from a majority of those shares present

(either in person or by proxy) and entitled to vote at the annual meeting. |

16. |

Q: What is a quorum? |

A: |

A quorum is a majority of the holders of the outstanding shares entitled to vote. A quorum must be present or represented by proxy at the annual

meeting for business to be conducted. Abstentions and broker non-votes will be counted as present for quorum purposes. |

17. |

Q: What happens if additional matters (other than the proposals described in this proxy statement)

are presented at the Annual Meeting? |

A |

The Board is not aware of any additional matters to be presented for a vote at the Annual Meeting; however, if any additional matters are properly presented at

the annual meeting, your signed proxy card gives authority to Paul C. Reilly and Gary D. Burnison to vote on those matters in their discretion. |

18. |

Q: How much did this proxy solicitation cost? |

A: |

We hired Mellon Investor Services to assist in the distribution of proxy materials and solicitation of votes for approximately $7,000, including out-of-pocket

expenses. We also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to beneficial owners. |

3

Table of Contents

Our Board is divided into three classes, with

one class elected at each Annual Meeting. Directors of each class are elected to serve for three year terms. At this Annual Meeting we will elect six directors and our Board for the coming year will be composed of twelve directors. Of the total

nominees for election as directors, two will be elected to serve for a term of two years and four will be elected to serve for a term of three years. The nominees for election at the Annual Meeting to serve as Class 2004 Directors are David L. Lowe

and Edward D. Miller and as Class 2005 Directors are Frank V. Cahouet, Spencer C. Fleischer, Charles D. Miller and Gerhard Schulmeyer. Messrs. Fleischer, Lowe and Miller were first elected to the Board in June 2002. Detailed information regarding

each of these nominees is provided on pages 6-8 of this proxy statement. We do not expect any of the nominees to become unavailable to stand for election, but, should this happen, the Board will designate a substitute for each unavailable nominee.

Proxies voting for any unavailable nominee will be cast for that nominees substitute. Each of the nominees has consented to be named as a nominee in this proxy statement.

Required Vote

The Boards nominees will become

directors so long as they receive a plurality of FOR votes; however, if any additional nominees for director are properly brought before the stockholders for consideration, only the nominees who receive the highest number of

FOR votes will become directors.

Recommendation of the Board

The Board unanimously recommends that you vote FOR each of the nominees named above for election as a director. Proxies will be voted FOR

each of the nominees named above unless you otherwise specify on your proxy card.

4

Table of Contents

OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS

The Audit Committee has recommended, and the Board has approved, the appointment of Ernst & Young LLP as our independent auditors for

fiscal 2003. Ernst & Young LLP has served as our independent auditors since March 2002. They have unrestricted access to the Audit Committee to discuss audit findings and other financial matters. Neither our certificate of incorporation nor

bylaws requires that the stockholders ratify the selection of Ernst & Young LLP as our independent auditors. We are doing so because we believe it is a matter of good corporate practice. If our stockholders do not ratify the selection, the Board

and the Audit Committee will reconsider whether or not to retain Ernst & Young LLP, but may, nonetheless, retain such independent auditors. Even if the selection is ratified, the Board and the Audit Committee in their discretion may change the

appointment at any time during the year if they determine that such change would be in the best interests of Korn/Ferry International and our stockholders. Representatives of Ernst & Young will attend the annual meeting to answer appropriate

questions and may also make a statement if they so desire.

Audit Fees

The aggregate fees billed by Ernst & Young LLP for professional services, including tax services, rendered for the audit of our annual financial statements for the

fiscal year ended April 30, 2002 were $635,070.

Financial Information Systems Design and Implementation Fees

There were no additional fees billed by Ernst & Young LLP for professional services rendered for information technology

services relating to financial information systems design and implementation for the fiscal year ended April 30, 2002.

All Other Fees

There were no additional fees billed by Ernst & Young LLP for services rendered other than the services

described above under Audit Fees for the fiscal year ended April 30, 2002.

Required Vote

Ratification of the auditors appointed by the Board will require affirmative FOR votes from a majority of those shares

present, either in person or by proxy, and entitled to vote at the annual meeting.

Recommendation of the Board

The Board unanimously recommends that you vote FOR the ratification of Ernst & Young LLPs appointment

as independent auditors for fiscal 2003.

5

Table of Contents

The members of our Board of Directors are grouped into three

classes: Class 2003 Directors will serve until the Annual Meeting of Stockholders in 2003; Class 2004 Directors will serve until the Annual Meeting of Stockholders in 2004; and Class 2005 Directors will serve until the Annual Meeting of Stockholders

in 2005.

The following table sets forth certain information regarding the

Class 2003 Directors, who serve on the Board until the Annual Meeting of Stockholders in 2003.

| Name |

Age |

Business Experience |

Director Since | |||

| Patti S. Hart |

46 |

Ms. Hart was Chairman and Chief Executive Officer of Excite@Home, from April 2001 to March 2002. Excite@Home filed for bankruptcy under Chapter 11 of the

federal Bankruptcy Code in September 2001. Prior to joining Excite@Home, Ms. Hart served as Chief Executive Officer and President of Telocity, Inc., from June 1999 until April 2001. From February 1994 to April 1999, she served as President and

Chief Operating Officer of Sprints Long Distance Division. Ms. Hart is also a director of Plantronics. |

2000 | |||

| Windle B. Priem |

64 |

Mr. Priem was Chief Executive Officer and President, and a member of the Office of the Chief Executive, from December 1998 until June 2001. From May 1997

to December 1998, he served as Vice Chairman and Chief Operating Officer. From May 1995 to May 1997, he was the President of the North American region. Mr. Priem joined us in 1976. Mr. Priem is also a director of EMC Corporation.

|

1992 | |||

| Paul C. Reilly |

48 |

Mr. Reilly was elected to the position of Chairman of the Board and Chief Executive Officer in June 2001. Prior to joining Korn/Ferry International, Mr.

Reilly was Chief Executive Officer of KPMG International from October 1998. Prior to being named to that position, Mr. Reilly served as Vice Chairman Financial Services of KPMG L.L.P., the United States member firm of KPMG International. Mr.

Reilly joined KPMG International as a partner in 1987. |

2001 | |||

| Mark C. Thompson |

44 |

Mr. Thompson is President and Chief Executive Officer of Sentium Leadership Strategies since 2002. He is also Chairman of Network Public Broadcasting

International since 2002. From 1988 to 2000, he was an officer of The Charles Schwab Corporation, where he was most recently Senior Vice President and Executive Producer of Schwab.com. Mr. Thompson is also a director of Best Buy Enterprises,

Integration Associates, Inc. and Rioport, Inc. |

2000 |

6

Table of Contents

The following table sets forth certain information

regarding the Class 2004 Directors, who serve on the Board until the Annual Meeting of Stockholders in 2004.

| Name |

Age |

Business Experience |

Director Since | |||

| James E. Barlett |

58 |

Mr. Barlett was Chairman, President and Chief Executive Officer of Galileo International until October 2001. From 1994 to 1997, Mr. Barlett was President and

Chief Executive Officer of Galileo International. Mr. Barlett is also Vice Chairman of TeleTech Holdings, Inc. |

1999 | |||

| Sakie T. Fukushima |

52 |

Ms. Fukushima has been a Vice President since 1993 and Regional Managing Director for Japan since September 2000. She currently serves on our Asia Pacific

Regional Operating Committee. Ms. Fukushima joined us in 1991. |

1995 | |||

| In addition, the following Class 2004 Directors, if elected at the 2002 Annual

Meeting, will serve on the Board until the Annual Meeting of Stockholders in 2004. | ||||||

| David L. Lowe |

42 |

Mr. Lowe has been Vice Chairman of Friedman Fleischer & Lowe, a private equity firm, since it was founded in 1998. Prior to this, he served as Chief

Executive Officer and Chairman of the Board of ADAC Laboratories, a medical diagnostic imaging company. Previously, he worked as a consultant at Bain & Company. He is currently Chairman of the Board of Advanced Career Technologies, Inc. and a

director of SteelPoint Technologies, Inc. He is also on the board of the National Childrens Cancer Society. |

2002 | |||

| Edward D. Miller |

61 |

Mr. Miller is a member of the Supervisory Board and senior advisor to the Chief Executive Officer of AXA Group. From August 1997 through May 2001, Mr.

Miller served as President and Chief Executive Officer of AXA Financial, Inc. He also served as Chairman and Chief Executive Officer of AXA Financial, Inc.s principal subsidiary, AXA Client Solutions, and as a director of AXA Financial,

Equitable Life, Alliance Capital and Donaldson, Lufkin & Jenrette. Mr. Miller is currently a director of KeySpan Corporation and Topps Company, Incorporated. He also serves on the Board of Governors of the United Way of Tri-State, and is

Chairman of the Board of Phoenix House. |

2002 | |||

7

Table of Contents

The following table sets forth information regarding

the Class 2005 Directors, who, if elected at the 2002 Annual Meeting, will serve on the Board until the Annual Meeting of Stockholders in 2005.

| Name |

Age |

Business Experience |

Director Since | |||

| Frank V. Cahouet |

70 |

Mr. Cahouet retired as Chairman, President and Chief Executive Officer of Mellon Financial Corporation in 1998, positions which he had held since 1987. Mr.

Cahouet is a director of Avery Dennison Corporation, Allegheny Technologies Inc., Teledyne Technologies Inc., and Saint-Gobain Corporation. |

1999 | |||

| Spencer C. Fleischer |

48 |

Mr. Fleischer has been Vice Chairman of Friedman Fleischer & Lowe, a private equity firm, since it was founded in 1998. Mr. Fleischer was previously a

Managing Director at Morgan Stanley, which he joined in 1979 and where he was most recently head of investment banking in Asia. He is a director of Advanced Career Technologies, Inc. and SteelPoint Technologies, Inc. |

2002 | |||

| Charles D. Miller |

74 |

Mr. Miller retired as Chairman of Avery Dennison Corporation in April 2000. From April 1983 through April 1998, Mr. Miller was Chairman and Chief Executive

Officer of Avery Dennison Corporation. Mr. Miller is also Chairman of Nationwide Health Properties, Inc. and a director of The Air Group, Avery Dennison Corporation, and Mellon West, a subsidiary of Mellon Financial

Corporation. |

1999 | |||

| Gerhard Schulmeyer |

63 |

Mr. Schulmeyer served as President and Chief Executive Officer of Siemens Corporation from 1999 until 2001. From 1994 through 1998, Mr. Schulmeyer was

President and Chief Executive Officer of Siemens Nixdorf, Munich/Paderborn. Mr. Schulmeyer is also a director of Alcan Aluminium Ltd., Allied Zurich p.l.c., FirePond, Inc.,

and Ingram Micro Inc. Mr. Schulmeyer is currently a Professor at MIT Sloan School of Management. |

1999 |

The Board held eleven meetings during fiscal 2002,

and all of the directors attended at least 75% of the Board meetings and the meetings of committees of which they were members, except for Spencer Fleischer, David Lowe and Edward Miller who joined the Board in June 2002.

Although the full Board considers all major decisions, the Bylaws permit the Board to have the following standing committees to more fully

address certain areas of importance: an Audit Committee, a Compensation and Personnel Committee, and a Nominating Committee. The members of the current standing committees are:

| Name |

Audit |

Compensation and Personnel |

Nominating |

||||||

| James E. Barlett |

X |

|

X |

(Chair) | |||||

| Frank V. Cahouet |

X |

(Chair) |

X |

|

|||||

| Charles D. Miller |

X |

|

X |

(Chair) |

|||||

| Gerhard Schulmeyer |

X |

|

X |

| |||||

8

Table of Contents

Audit Committee. The Audit Committee makes recommendations concerning the

engagement of independent auditors, reviews the plans and results of the audit engagement with the independent auditors, approves professional services provided by the independent auditors, reviews the independence of the auditors, considers the

range of audit and non-audit fees, reviews the adequacy of our internal accounting controls and ensures the integrity of financial information supplied to stockholders. The Audit Committee is also available to receive reports, suggestions, questions

and recommendations from the independent auditors, the Chief Financial Officer and the General Counsel. It also confers with those parties in order to assure the sufficiency and effectiveness of the programs being followed by corporate officers in

the area of compliance with the law and conflicts of interest. The Audit Committee is composed entirely of outside directors and met eight times in fiscal 2002. The Board has adopted a written charter for the Audit Committee, a copy of which is

attached as an appendix to this proxy statement. The Board, in its business judgment, has determined that all members of the Audit Committee are independent as required by the applicable listing standards of the New York Stock Exchange.

Compensation and Personnel Committee. The Compensation and Personnel Committee determines the compensation

of our executive officers and administers the Performance Award Plan. In addition, the Compensation and Personnel Committee reviews and makes recommendations to the Board with respect to our overall compensation program for managing directors, vice

presidents and other employees, including salaries, employee benefit plans, stock option grants and payment of bonuses. The Compensation and Personnel Committee is composed entirely of outside directors. The Compensation and Personnel Committee met

twelve times during fiscal 2002.

Nominating Committee. The Nominating Committee recommends criteria to the

Board for the selection of nominees to the Board, evaluates all proposed nominees, recommends nominees to the Board to fill vacancies on the Board, and, prior to each Annual Meeting of Stockholders, recommends to the Board a slate of nominees for

election to the Board by the stockholders at the Annual Meeting. The Nominating Committee also seeks possible nominees for the Board and otherwise serves to aid in attracting qualified nominees to be elected to the Board. The Nominating Committee is

composed of two outside directors, with four inside directors as ex-officio members. The Nominating Committee met five times in fiscal 2002.

The New York Stock Exchange has proposed new corporate governance standards which, if adopted, may require us to change the membership of some Board committees and certain functions of those

committees.

Directors who are also employees or officers do not

receive any additional compensation for their service on the Board. Non-employee directors are automatically granted, under our Performance Award Plan, a nonqualified stock option to purchase shares of common stock with a value of $28,000 as an

annual retainer. One fourth of the annual amount is granted quarterly. Non-employee directors also receive $1,200 in cash for each regular or special meeting attended and $600 in cash for telephonic meetings. In addition, committee chairs receive

$4,000 in cash annually. All directors are reimbursed for their out-of-pocket expenses incurred in connection with their duties as directors.

Directors who are not officers or employees are eligible to receive annual stock option grants under our Performance Award Plan. Under the Performance Award Plan, a non-employee director is

automatically granted a nonqualified stock option to purchase 2,500 shares of common stock when the person takes office, at an exercise price equal to the market price of the common stock at the close of trading on that date. In addition, on the day

of the Annual Meeting of Stockholders in each calendar year, beginning with the year after they are first elected and continuing for each subsequent year during the term of the Performance Award Plan, each continuing non-employee director is granted

a nonqualified stock option to purchase 2,500 shares of common stock at an exercise price equal to the market price of the common stock at the close of trading on that date. Non-employee directors may also be granted discretionary awards. All

automatically granted non-employee director stock options will have a ten-year term and will be immediately exercisable. If a non-employee directors services are terminated for any reason, any automatically granted stock options held by the

non-employee director that are

9

Table of Contents

exercisable will remain exercisable for twelve months after such termination of service or until the expiration of the option term, whichever occurs first. Automatically-granted options are

subject to the same adjustment, change in control, and acceleration provisions that apply to awards generally, except that any changes or Board or committee actions (1) will be effected through a stockholder approved reorganization agreement or will

be consistent with the effect on options held by other than executive officers and (2) will be consistent in respect of the underlying shares with the effect on stockholders generally. Any outstanding automatic option grant that is not exercised

prior to a change in control event in which we do not survive will terminate, unless the option is assumed or replaced by the surviving corporation.

The following table

sets forth as of August 1, 2002 the names and holdings of each director and each nominee for director, the names and holdings of each executive officer named in the Summary Compensation Table (the named executive officers), and the

holdings of all directors, nominees and executive officers as a group. The following table also sets forth the names of those persons known to us to be beneficial owners of more than 5% of our common stock.

| Name of Beneficial Owner |

Amount Beneficially Owned and Nature of Beneficial Ownership(1) |

Percent of Class | |||

| Paul C. Reilly |

270,000 |

(2) |

* | ||

| James E. Barlett |

7,829 |

(3) |

* | ||

| Frank V. Cahouet |

43,529 |

(4) |

* | ||

| Spencer C. Fleischer |

5,153,668 |

(18) |

12.01% | ||

| Sakie T. Fukushima |

172,464 |

(5) |

* | ||

| Patti S. Hart |

5,829 |

(6) |

* | ||

| David L. Lowe |

5,153,668 |

(18) |

12.01% | ||

| Charles D. Miller |

39,829 |

(7) |

* | ||

| Edward D. Miller |

10,692 |

(8) |

* | ||

| Windle B. Priem |

619,788 |

(9) |

1.64% | ||

| Gerhard Schulmeyer |

7,829 |

(10) |

* | ||

| Mark C. Thompson |

5,829 |

(11) |

* | ||

| Gary D. Burnison |

26,750 |

(12) |

* | ||

| Gary C. Hourihan |

120,771 |

(13) |

* | ||

| James E. Boone |

140,713 |

(14) |

* | ||

| Robert H. McNabb |

19,667 |

(15) |

* | ||

| All directors and executive officers as a group (16 persons) |

6,748,079 |

(16) |

15.54% | ||

| Farralon Capital Management, L.L.C. and Farralon Partners, L.L.C. |

2,137,500 |

(17) |

5.66% | ||

| Friedman Fleischer & Lowe Capital Partners, L.P. and FFL Executive Partners, L.P. |

5,150,776 |

(18) |

12.00% | ||

| State of Wisconsin Investment Board |

1,979,400 |

(19) |

5.24% | ||

* |

Designates ownership of less than 1% of the companys outstanding common shares. |

(1) |

Other than with respect to the shares held under the 401(k) plan and the options under the Performance Award Plan, each person has sole voting and dispositive

power with respect to the shares shown unless otherwise indicated. |

10

Table of Contents

(2) |

Holding includes 100,000 shares of restricted stock as to which Mr. Reilly has voting power and right to acquire beneficial ownership of 100,000 shares of

common stock within 60 days through the exercise of options granted under the Performance Award Plan. |

(3) |

Holding includes right to acquire beneficial ownership of 7,829 shares of common stock within 60 days through the exercise of options granted under the

Performance Award Plan. |

(4) |

Holding includes 35,700 shares of common stock held by the Frank V. Cahouet Revocable Trust dated November 2, 1993 and right to acquire beneficial ownership of

7,829 shares of common stock within 60 days through the exercise of options granted under the Performance Award Plan. |

(5) |

Holding includes right to acquire beneficial ownership of 72,472 shares of common stock within 60 days through the exercise of options granted under the

Performance Award Plan. |

(6) |

Holding includes right to acquire beneficial ownership of 5,829 shares of common stock within 60 days through the exercise of options granted under the

Performance Award Plan. |

(7) |

Holding includes 32,000 shares of common stock held by the Miller Family Trust dated September 8, 1988 and right to acquire beneficial ownership of 7,829 shares

of common stock within 60 days through the exercise of the options granted under the Performance Award Plan. |

(8) |

Holding includes right to acquire beneficial ownership of 2,892 shares of common stock within 60 days through the exercise of options granted under the

Performance Award Plan. |

(9) |

Holding includes 215,015 shares of common stock held by the trustees of the 401(k) plan for the benefit of the listed individual and right to acquire beneficial

ownership of 199,097 shares of common stock within 60 days through the exercise of options granted under the Performance Award Plan. |

(10) |

Holding includes right to acquire beneficial ownership of 7,829 shares of common stock within 60 days through the exercise of options granted under the

Performance Award Plan. |

(11) |

Holding includes right to acquire beneficial ownership of 5,829 shares of common stock within 60 days through the exercise of options granted under the

Performance Award Plan. |

(12) |

Holding includes 10,000 shares of restricted stock as to which Mr. Burnison has voting power. |

(13) |

Holding includes 10,000 shares of restricted stock as to which Mr. Hourihan has voting power and right to acquire beneficial ownership of 54,159 shares of

common stock within 60 days through the exercise of options granted under the Performance Award Plan. |

(14) |

Holding includes 20,000 shares of restricted stock as to which Mr. Boone has voting power and right to acquire beneficial ownership of 35,333 shares of common

stock within 60 days through the exercise of options granted under the Performance Award Plan. |

(15) |

Holding includes right to acquire beneficial ownership of 11,667 shares of common stock within 60 days through the exercise of options granted under the

Performance Award Plan. |

(16) |

Total holding as a group includes 215,015 shares of common stock held by the trustees of the 401(k) plan, 32,000 shares of common stock held by the Miller

Family Trust dated September 8, 1988, 35,700 shares of common stock held by the Frank V. Cahouet Revocable Trust dated November 2, 1993, securities convertible into 5,150,776 shares of common stock held by Friedman Fleischer & Lowe Capital

Partners, L.P. and FFL Executive Partners, L.P., 140,000 shares of restricted stock which have voting power and right to acquire beneficial ownership of a total 524,378 shares of common stock within 60 days through the exercise of options granted

under the Performance Award Plan. |

(17) |

Shares are owned of record by several Farralon affiliates. The investment managers that hold beneficial ownership of all such securities include Enrique H.

Boilini, David I. Cohen, Joseph F. Downes, William F. Duhamel, Andrew B. Fremder, Richard B. Fried, Monica R. Landry, William F. Mellin, Steven L. Millham, Meridee A. Moore, Thomas F. Steyer and Mark C. Wehrly. This information is obtained from the

Schedule 13F for the period ended June 30, 2002. |

11

Table of Contents

(18) |

Freidman Fleischer & Lowe Capital Partners, L.P. holding includes 3,833,097 shares of common stock issuable upon conversion of convertible notes, 958,244

shares of common stock issuable upon conversion of preferred stock and 267,881 shares of common stock issuable upon exercise of warrants. FFL Executive Partners, L.P. holding includes 69,342 shares of common stock issuable upon the conversion of

convertible notes, 17,366 shares of common stock issuable upon conversion of preferred stock and 4,846 shares of common stock issuable upon conversion of warrants. The investment managers are Tully M. Friedman, Spencer C. Fleischer and David L.

Lowe. This information was obtained from the Schedule 13D filed on July 2, 2002. The holdings of Spencer C. Fleischer and David L. Lowe, each as individual directors, also includes right to acquire beneficial ownership of 2,892 shares of common

stock within 60 days through the exercise of options granted under the Performance Award Plan. |

(19) |

This information is obtained from the Schedule 13G filed on February 12, 2002. |

12

Table of Contents

Committee Composition and Role

The Compensation and Personnel Committee is comprised entirely of directors who have never served as our officers. The

Committee (a) approves and oversees our compensation programs, including incentive and stock option programs provided to members of our senior management group, including all named executive officers, and (b) approves or recommends to our Board, as

required, specific compensation actions, including salary adjustments, annual cash bonuses, stock option grants, and employment contracts for our Chief Executive Officer and other members of our senior officer group. The Committee met twelve times

during fiscal 2002.

Executive Compensation Philosophy

In establishing and assessing the compensation programs and compensation policies for the executive officers and other senior executives, the Committee is guided by the

following principles:

|

The total compensation of our executive officers and other key employees must be competitive with those of other major executive recruiting firms, recognizing

our size and complexity relative to our peers; |

|

Individual cash bonuses and stock option awards should be closely tied to the performance of the company as a whole, as well as to the team and individual

performance of the executive group; and |

|

The interests of senior management and our stockholders should be closely aligned through direct management ownership of our common stock, and by providing a

meaningful portion of each key employees total compensation in the form of stock options. |

Because a number of our peer organizations are privately-held, precise information regarding the senior executive compensation practices among our competitor group is difficult to obtain. In addition, even when such data are

available, meaningful differences in size, complexity and organizational structure among our competitor group make direct comparisons of compensation practices problematic. In assessing the competitiveness of our senior executive compensation, the

Committee relies on information obtained from the proxies of publicly-traded competitors, information derived from data obtained from executives and senior search consultants we recruited from competitor organizations, and the Committees

general knowledge of the market for senior management positions. From time to time, the Committee also retains compensation consultants to assess the competitiveness of our officer compensation and to make suggestions regarding compensation program

design.

Senior Executive Compensation

The compensation provided to our senior officers, including the named executive officers, consists of an annual base salary, an annual cash bonus and stock options granted at the market price of our

common stock as of the date of grant.

Base Salaries

Base salaries for our executive officers, including our Chief Executive Officer, and selected other key employees, are established annually by the Committee based on

the Committees understanding of competitive practices among our major competitors, internal equity considerations, and individual performance. For fiscal 2002, Paul Reilly, Gary Hourihan and James Boone elected to take decreases to their base

salaries.

Cash Bonuses

The maximum aggregate annual cash bonuses paid to our executive officers is limited by a formula that ties aggregate bonuses to a percentage of our net income. The actual

annual cash bonus of each executive officer, including the Chief Executive Officer, is determined by the Committee based on its assessment of the

13

Table of Contents

performance of the Company and of the executive officers as a group (team performance) and as individuals. The assessment of individual performance is based on objectives established and mutually

agreed to at the beginning of the fiscal year, as well as other factors deemed important by the Committee. Subject to the maximum aggregate cash bonuses dictated by the above-mentioned formula, the target and maximum cash bonuses available to each

executive officer are more fully described in each executive officers employment contract on pages 16-18 of this proxy statement.

In determining the level of cash bonuses for our executive officers for fiscal 2002, the Committee took into consideration the Companys financial performance and stock price performance, the performance of our

subsidiary operations, including Futurestep, and the performance of each officer with respect to their individual objectives. The Committee determined that cash bonuses, other than previously guaranteed amounts, will not be granted to our executive

officers for fiscal 2002. Therefore, the only cash bonus awarded to our executive officers for fiscal 2002 was to Paul Reilly in the amount of $1,000,000, of which Mr. Reilly received payment of $500,000 in fiscal 2002 and elected to defer payment

of the remaining $500,000 to fiscal 2003.

Restricted Stock

In lieu of cash bonuses, restricted stock grants were awarded to executive officers as follows: Gary Burnison, 10,000 shares; Gary

Hourihan, 10,000 shares and James Boone, 20,000 shares. The restricted stock awarded will vest in three equal annual installments beginning in July 2003.

Stock Options

As part of their total compensation

package, each of our executive officers, including the Chief Executive Officer, is eligible to receive an annual grant of stock options (performance options). For fiscal 2002, the Committee determined that the stock option grants would be made on or

about September 27, 2002. The Committee approved stock option awards as follows: Paul Reilly, 200,000 shares; Gary Burnison, 20,000 shares; Gary Hourihan, 30,000 shares; James Boone, 25,000 shares and Robert McNabb, 20,000 shares.

Employment Contracts

Each of our named executive officers is covered by an employment agreement or letter of employment that provides for a minimum level of salary, cash bonus potential, and option and benefit eligibility. The agreements also provide for

a defined severance benefit in the event of a termination of employment without cause or for good reason as such terms are defined in the agreements. Such severance benefits range up to two times salary and target bonus

depending upon the officer. The agreements also provide for the continuation of health and welfare benefits upon a termination without cause or for good reason. It is the Committees belief that such agreements are necessary from a competitive

perspective and also contribute to the stability of the management team.

Internal Revenue Code Section 162(m)

As one of the factors in the review of compensation matters, the Compensation Committee considers the anticipated tax treatment

to the company. The deductibility of some types of compensation for executive officers depends upon the timing of an executives vesting or exercise of previously granted rights or on whether such plans qualify as performance-based

plans under the provisions of the tax laws. It is the Committees policy, to the extent that such policy does not conflict with prudent management practices, to satisfy the requirements necessary to allow the compensation of its executive

officers to be deductible under Section 162(m) of the Internal Revenue Code, as amended.

Compensation and Personnel Committee

Charles D. Miller, Chair

Frank V. Cahouet

Gerhard Schulmeyer

14

Table of Contents

| Annual Compensation |

Restricted Stock (as of Date of Grant) ($)(1) |

Long-Term Compensation Awards Securities Underlying Options (#)(2) |

||||||||||||

| Name and Principal Position |

Fiscal Year |

Salary ($) |

Bonus ($) |

Other Annual Compensation ($) |

All Other Compensation ($)(3) | |||||||||

| Paul C. Reilly Chief Executive Officer and Chairman

of the Board |

2002 |

500,542(4) |

1,400,000(5) |

0 |

1,549,000 |

650,000 |

9,403(6) | |||||||

| Gary D. Burnison Chief Financial Officer and Execuive

Vice-President |

2002 |

37,083(7) |

0 |

0 |

74,400 |

50,000 |

630(8) | |||||||

| Gary C. Hourihan Executive Vice-President of Organizational

Development and President of Management Assessment |

2002 2001 2000 |

336,000(9) 356,666 333,333 |

0 250,000

612,000 |

0 0 0 |

74,400 0 0 |

30,000 10,530 32,475 |

13,541(10) 26,729(11) 146,568(12) | |||||||

| James E. Boone Chairman of Global Operating Committee and

President of The Americas |

2002 2001 2000 |

420,000(13) 391,970 350,000 |

0 626,970

1,203,392 |

0 0 0 |

148,800 0 0 |

25,000 15,050 41,900 |

14,544(14) 13,822(15) 23,984(16) | |||||||

| Robert H. McNabb Chief Executive Officer of Korn/Ferry

International Futurestep, Inc. |

2002 |

177,083(17) |

0 |

0 |

0 |

55,000 |

4,348(18) | |||||||

(1) |

The number and value of the restricted stock holdings as of April 30, 2002 for Paul C. Reilly was 100,000 shares and $1,050,000. The other restricted stock

grants were made subsequent to April 30, 2002. |

(2) |

Our executive officers were granted stock options in connection with the commencement of employment and performance-related stock options.

|

(3) |

No contributions were made to our 401(k) plan for fiscal 2002. |

(4) |

Represents compensation paid to Mr. Reilly from June 29, 2001, when he joined the company, through the end of fiscal 2002. From June 29, 2001 until August 31,

2001, Mr. Reillys base salary was paid at an annual rate of $650,000. From September 1, 2001 until April 30, 2002, Mr. Reillys base salary was paid at an annual rate of $585,000. |

(5) |

Represents a guaranteed bonus of $1,000,000, of which Mr. Reilly received $500,000 on April 30, 2002 and elected to defer payment of the remaining $500,000

until December 31, 2002. Includes also a payment of $400,000 made at the start of employment as compensation for unpaid bonus by previous employer. |

(6) |

Represents an auto allowance of $6,030, executive life insurance premiums and/or imputed income of $1,258, executive medical benefits of $1,852 and travel

accident insurance premiums of $263. |

(7) |

Represents compensation paid to Mr. Burnison from March 20, 2002, when he joined the company, through the end of fiscal 2002. Mr. Burnisons base salary

for fiscal 2002 was paid at an annual rate of $325,000. |

(8) |

Represents an auto allowance of $630. |

(9) |

Represents compensation paid to Mr. Hourihan for fiscal 2002. From May 1, 2001 until August 31, 2001, Mr. Hourihans base salary was paid at an annual rate

of $360,000. From September 1, 2001 until April 30, 2002, Mr. Hourihans base salary was paid at an annual rate of $324,000. |

15

Table of Contents

(10) |

Represents a tuition reimbursement of $2,000, an auto allowance of $7,200, executive life insurance premiums and/or imputed income of $1,264, executive medical

benefits of $2,777 and travel accident insurance premiums of $300. |

(11) |

Represents insurance premiums of $24,729 and a tuition reimbursement of $2,000. |

(12) |

Represents insurance premiums of $13,547, a 401(k) plan contribution of $8,021 and second installment of a signing bonus of $125,000.

|

(13) |

Represents compensation paid to Mr. Boone for fiscal 2002. From May 1, 2001 until August 31, 2001, Mr. Boones base salary was paid at an annual rate of

$400,000. From September 1, 2001 until December 31, 2001, Mr. Boones base salary was paid at an annual rate of $360,000. From January 1, 2002 until April 30, 2002, Mr. Boones base salary was paid at an annual rate of $500,000.

|

(14) |

Represents an auto allowance of $5,400, accrued interests on special contribution plan of $4,665, executive life insurance premiums and/or imputed income of

$1,402, executive medical benefits of $2,777 and travel accident insurance premiums of $300. |

(15) |

Represents an auto allowance of $5,400, accrued interests on special contribution plan of $4,312, executive life insurance premiums and/or imputed income of

$1,220, executive medical benefits of $2,777 and travel accident insurance premiums of $113. |

(16) |

Represents an auto allowance of $5,400, a 401(k) plan contribution of $10,275, accrued interests on special contribution plan of $4,266, executive life

insurance premiums and/or imputed income of $882, executive medical benefits of $3,048 and travel accident insurance premiums of $113. |

(17) |

Represents compensation paid to Mr. McNabb from December 3, 2001, when he joined Futurestep, through the end of fiscal 2002. Mr. McNabbs base salary for

fiscal 2002 was paid at an annual rate of $425,000. |

(18) |

Represents an auto allowance of $3,000, executive life insurance premiums and/or imputed income of $532, executive medical benefits of $694 and travel accident

insurance of $122. |

Paul C. Reilly, Chairman and Chief Executive Officer since

June 29, 2001. In connection with the appointment of Paul Reilly as Chairman and Chief Executive Officer, we entered into an employment agreement with Mr. Reilly. The term of the agreement is for three years, and will automatically renew for

successive two-year periods thereafter until the first April 30th following the date on which Mr. Reilly reaches age 65; provided, however, that either we or Mr. Reilly may terminate this agreement at the end of the initial term or any renewal term

by delivering to the other party at least 60 days prior written notice. Mr. Reillys base salary is $650,000 and the agreement provides for an annual target bonus equal to 150% of base salary and an annual maximum bonus of up to 300% of

base salary. In December 2001, Mr. Reillys agreement was amended to provide for his minimum bonus of $1,000,000 for fiscal 2002 to be paid in two installments. In addition, the agreement provides that Mr. Reilly will be eligible for an annual

grant of stock options having a target grant value of $1,250,000 and a maximum grant value of $1,750,000 based on a Black-Scholes option pricing model valuation. We have also agreed to pay certain transition and relocation costs incurred by Mr.

Reilly.

In connection with his election, Mr. Reilly was granted options to purchase 450,000 shares with an

exercise price of $15.50 per share, the closing price of the stock in trading in the New York Stock Exchange on June 29, 2001. Of these options 300,000 vest in equal installments over three years and 150,000 vest in three equal installments based on

the attainment of specified price levels in our stock. The price levels for vesting are $28 per share, $33 per share and $38 per share. In addition, the Board made a restricted stock award of 100,000 shares to Mr. Reilly. The restricted stock

awarded to Mr. Reilly will vest in three annual installments beginning in June 2002. To the extent not vested, the restricted stock will be forfeited if Mr. Reilly is terminated with cause or he resigns without good reason.

16

Table of Contents

If Mr. Reillys employment terminates due to death or disability, then we

will pay Mr. Reilly, or his legal representatives, all accrued compensation as of the date of termination, and all outstanding stock options held by Mr. Reilly at the time of termination will vest and remain exercisable until their originally

scheduled expiration dates. If Mr Reillys employment is terminated by us for cause, is terminated by Mr. Reilly prior to its expiration without good reason or if Mr. Reilly fails to renew the agreement after its initial term, then we will pay

Mr. Reilly all accrued compensation as of the date of termination.

Prior to a change in control, if Mr.

Reillys employment is terminated by us without cause or is terminated by Mr. Reilly for good reason then we will pay Mr. Reilly all accrued compensation as of the date of termination, and a lump sum amount equal to 200% of his base salary and

target bonus. If prior to a change in control, Mr. Reillys employment is terminated because the Company elects not to renew the agreement, then Mr. Reilly will be entitled to a lump sum amount equal to his base salary and target bonus. On

termination in any of the foregoing circumstances, all of Mr. Reillys outstanding stock options as of the date of termination will vest and will remain exercisable until their originally scheduled expiration dates.

If there is a change in control and within 12 months Mr. Reillys employment is terminated by us without cause, or because we elect

not to renew the agreement before Mr. Reilly reaches the age of 65, or by Mr. Reilly for good reason, then we will pay Mr. Reilly all accrued compensation as of the date of termination, and a lump sum equal to (1) 200% of the greater of his base

salary or the annual base salary in effect just prior to the change in control, whichever amount is higher, plus (2) the greater of 200% of his maximum bonus for the incentive year in which such termination occurs or the maximum bonus for the

preceding fiscal year. On termination in any of the foregoing circumstances, all of Mr. Reillys outstanding stock options as of the date of termination will vest and will remain exercisable until their originally scheduled expiration dates.

Gary D. Burnison, Chief Financial Officer and Executive Vice-President since March 20, 2002. In March

2002, we made an offer of employment to Gary Burnison as Chief Financial Officer and Executive Vice President. The offer provided that Mr. Burnison would be provided a grant of 30,000 stock options effective on the date such grant was approved by

the Compensation Committee of the Board, which occurred on June 3, 2002. Mr. Burnisons salary is $350,000 per year and the offer provided that he would have a target annual cash bonus of 100% of his base salary and a maximum annual cash bonus

opportunity equal to 200% of base salary. In addition, he would be eligible to receive an annual stock option grant with a target grant value equal to 50% of base salary and a maximum grant value equal to 100% of base salary based on a Black-Scholes

option pricing model valuation. The offer also provided that should Mr. Burnison be terminated without cause as defined in the agreement and upon execution of a separation and release agreement, he would receive severance equal to 50% of

his then current annual base salary plus 50% of his current target cash bonus.

Gary C. Hourihan, Executive

Vice-President of Organizational Development since March 2000 and President of Management Assessment. In March 2000, we entered into an employment agreement with Gary Hourihan as Executive Vice President and President of Management Assessment.

The initial term of the agreement was through April 30, 2002 and automatically renews for successive two-year periods thereafter until the first April 30th following the date on which Mr. Hourihan reaches age 65; provided, however, that either we or

Mr. Hourihan may terminate this agreement at the end of the initial term or renewal term by delivering to the other party at least 120 days prior written notice. Mr. Hourihans base salary is $375,000 and the agreement provides for an

annual target bonus equal to 100% of base salary and an annual maximum bonus of up to 200% of base salary. If, prior to a change in control, Mr. Hourihans employment is terminated by us without cause or is terminated by Mr. Hourihan for good

reason then we will pay Mr. Hourihan all accrued compensation as of the date of termination, and a lump sum amount equal to 150% of his base salary and target bonus. If Mr. Hourihans employment is terminated because the Company elects not to

renew the agreement, then Mr. Hourihan will be entitled to a lump sum amount equal to one times his base salary and target bonus. If Mr. Hourihans employment is terminated by us for performance reasons, then Mr. Hourihan will be entitled to a

lump sum amount equal to one times his base salary and target bonus. On termination in any of the foregoing circumstances, all of Mr. Hourihans outstanding stock options as of the date of termination will vest and will

17

Table of Contents

remain exercisable until their originally scheduled expiration dates. If there is a change in control and within 12 months Mr. Hourihans employment is terminated by us without cause,

because we elect not to renew the agreement, or for a performance reason, or by Mr. Hourihan for good reason, Mr. Hourihan is entitled to receive severance payments similar to those described above for Mr. Reilly.

James E. Boone, Chairman of Global Operating Committee and President of The Americas since May 1999. We entered into an employment

agreement with James Boone as a Managing Director in May 1995. He was appointed, President, The Americas Region in May 1999. His base salary is $500,000 per year and under the terms of his employment agreement he is eligible to receive an annual

bonus as approved by the Board. Mr. Boone is eligible for a severance arrangement which provides 18 months continuation of salary, service-adjusted bonus and health insurance coverage if we terminate his employment without cause or if

Mr. Boone terminates his employment for good reason. Good reason does not include a material reduction in responsibility or failure to be redesignated as a senior officer if Mr. Boones then current base salary is maintained for at least

12 months and the bonus opportunity is maintained at 75% of its then current level for at least 12 months. The severance arrangement also provides 12 months continuation of salary, service-adjusted bonus and health insurance coverage if Mr.

Boones employment is terminated for performance reasons. If Mr. Boones employment is terminated for any of the foregoing reasons, we will waive the continued employment requirement for retaining his unvested options.

Robert H. McNabb, Chief Executive Officer of Korn/Ferry International Futurestep, Inc. since July 2002. Korn/Ferry

International Futurestep, Inc. entered into an employment agreement with Robert McNabb as President of Futuresteps Americas and Asia-Pacific regions in December 2001. Mr. McNabb was appointed Chief Executive Officer of Futurestep in July 2002.

The agreement provided that Mr. McNabb would be awarded a grant of 35,000 stock options effective on the date such grant was approved by the Compensation Committee of the Board, which occurred on January 7, 2002. Mr. McNabbs salary is $425,000

per year, and the agreement provides for a target annual cash bonus of 100% of base salary and a maximum annual cash bonus opportunity equal to 200% of base salary. In addition, he is eligible to receive an annual stock option grant with a target

grant value equal to 50% of base salary and a maximum grant value equal to 100% of base salary, based on a Black-Scholes option pricing model valuation. The agreement also provides that if Mr. McNabb is terminated without cause, as defined in the

agreement, during the initial two-year term of the agreement, he will receive all accrued compensation and a severance payment equal to 150% of his then current annual base salary. If his agreement is not renewed within the renewal period, he will

receive severance equal to 100% of his then current annual base salary.

18

Table of Contents

The following table shows

information for the named executive officers, concerning:

(1) |

exercises of stock options during fiscal 2002; and |

(2) |

the amount and values of unexercised stock options as of April 30, 2002. |

| Shares Acquired on

Exercise |

Value Realized |

Number of Securities Underlying Options At FY-End |

Value of Unexercised In-the- Money Options at FY-End (1) | |||||||||

| Name |

(2) |

($) |

Unexercisable |

Exercisable |

Unexercisable |

Exercisable | ||||||

| Paul C. Reilly |

0 |

0 |

450,000 |

0 |

0 |

0 | ||||||

| Gary D. Burnison |

0 |

0 |

0 |

0 |

0 |

0 | ||||||

| Gary C. Hourihan |

0 |

0 |

32,180 |

39,824 |

0 |

0 | ||||||

| James E. Boone |

35,333 |

172,277.38 |

0 |

35,333 |

0 |

0 | ||||||

| Robert H. McNabb |

0 |

0 |

35,000 |

0 |

0 |

0 | ||||||

(1) |

This amount represents solely the difference between the closing price on April 30, 2002 of $10.50 per share of our common stock and the respective exercise

prices of those unexercised options that had an exercise price below such market price (i.e., in-the-money options). No assumptions or representations regarding the value of such options are made or intended.

|

(2) |

This amount represents the number of securities with respect to which the options were exercised with no shares acquired. |

| Individual Grants |

Potential Realizable Value At

Assumed Annual Rates Of Stock Price Appreciation For Option Term | |||||||||||

| Name (a)

|

Number Of Securities Underlying Option/SARs Granted (b) |

Percent of Total Options/SARs Granted To Employees In Fiscal Year (c) |

Exercise Of Base Price ($/Sh) (d) |

Expiration Date (e) |

5% ($) (f) |

10% ($) (g) | ||||||

| Paul C. Reilly |

150,000(1) 300,000(1) |

6.91% 13.82% |

15.50 15.50 |

06/29/2006 06/29/2011 |

642,355 2,924,360 |

1,419,436 7,410,902 |

||||||

| Gary D. Burnison |

0 |

|

|

|

|

| ||||||

| Gary C. Hourihan |

0 |

|

|

|

|

| ||||||

| James E. Boone |

0 |

|

|

|

|

| ||||||

| Robert H. McNabb |

35,000(1) |

1.61% |

11.16 |

01/07/2012 |

245,646 |

622,516 | ||||||

(1) |

This amount represents stock options granted in connection with the commencement of employment during fiscal 2002. |

19

Table of Contents

| Final Average |

Years of Service | ||||||||||||

| Salary |

5 |

10 |

15 |

20 | |||||||||

| $ |

200,000 |

$ |

12,500 |

$ |

25,000 |

$ |

37,500 |

$ |

50,000 | ||||

| |

300,000 |

|

18,750 |

|

37,500 |

|

56,250 |

|

75,000 | ||||

| |

400,000 |

|

25,000 |

|

50,000 |

|

75,000 |

|

100,000 | ||||

| |

500,000 |

|

31,250 |

|

62,500 |

|

93,750 |

|

125,000 | ||||

| |

600,000 |

|

37,500 |

|

75,000 |

|

112,500 |

|

150,000 | ||||

| |

700,000 |

|

43,750 |

|

87,500 |

|

131,250 |

|

175,000 | ||||

| |

800,000 |

|

50,000 |

|

100,000 |

|

150,000 |

|

200,000 | ||||

| |

900,000 |

|

56,250 |

|

112,500 |

|

168,750 |

|

225,000 | ||||

| |

1,000,000 |

|

62,500 |

|

125,000 |

|

187,500 |

|

250,000 | ||||

Estimated Annual Benefit* for Representative Years of Service and Final

Average Salary

*Benefit is calculated using full target benefit of 25% of final average salary.

Under the terms of our Worldwide Executive Benefit Retirement Plan, designated Managing Directors and Vice Presidents will be entitled to receive an unfunded

supplemental retirement benefit upon attainment of age 65, with a reduced benefit available as early as age 55. The supplemental benefit calculated on a single-life basis would be an annual amount equal to the named executives final average

salary multiplied by a service percentage. The target service percentage is 25% with 1/20th accrued each

year over the first 20 years of participation. The supplemental benefit is also offset by any retirement benefits provided by us and/or the local government. The final average salary is the annual average of the highest consecutive 36 months of

salary out of the last 72 months of employment. As of April 30, 2002, the credited years of service for our named executive officers was: Paul C. Reilly, 0 years; Gary D. Burnison, 0 years; Gary C. Hourihan, 3 years; James E. Boone, 7 years; and

Robert H. McNabb, 0 years. Based on 2001 compensation and no future service accruals, the annual retirement benefit payable at age 65 to the two named executives are estimated as follows: Gary C. Hourihan, $705 and James E. Boone, $3,801.

20

Table of Contents

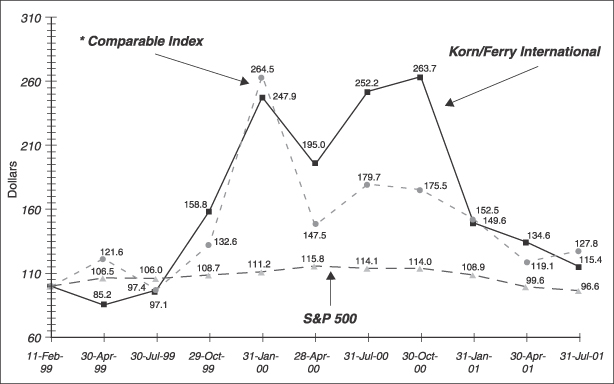

We have presented below a graph comparing the cumulative total

stockholder return on our shares with the cumulative total stockholder return on (1) a broad equity market index and (2) a published industry index or a company-established peer group. The following graph compares the monthly percentage change in

our cumulative total stockholder return with the cumulative total return of the companies in the Standard & Poors 500 Stock Index and a peer group constructed by us. Cumulative total return for each of the periods shown in the performance

graph is measured assuming an initial investment of $100 on February 11, 1999, the date public trading of our common stock began in connection with our initial public offering, and the reinvestment of any dividends paid by any company in the peer

group on the date the dividends were declared.

The peer group is comprised of publicly traded companies, which

are engaged principally or in significant part in professional staffing and consulting. The returns of each company have been weighted according to their respective stock market capitalization at the beginning of each measurement period for purposes

of arriving at a peer group average. The members of the peer group are Caldwell Partners International Inc. (CWL/A CN), Heidrick & Struggles International, Inc. (HSII), TMP Worldwide, Inc. (TMPW), and Whitehead Mann Group Plc (WHT.LN)

The stock price performance depicted in this graph is not necessarily indicative of future price performance.

This graph will not be deemed to be incorporated by reference by any general statement incorporating this proxy statement into any filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we

specifically incorporate this information by reference, and shall not otherwise be deemed soliciting material or deemed filed under those Acts.

* |

Comparable Index = Caldwell Partners International Inc. (CWL/A CN), Heidrick & Struggles International, Inc. (HSII), TMP Worldwide, Inc. (TMPW), and

Whitehead Mann Group Plc (WHT. LN). |

21

Table of Contents

The following report will not be deemed to be

incorporated by reference by any general statement incorporating this proxy statement into any filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate this information by

reference, and shall not otherwise deemed soliciting material or deemed filed under those Acts.

The role of the

Audit Committee is to assist the Board of Directors in its oversight of the companys financial reporting process. As set forth in the Audit Committee charter, management of the Company is responsible for maintaining a system of internal

controls, appropriate accounting and financial reporting principles and policies and preparing the Companys financial statements. The independent auditors are responsible for planning and carrying out a proper audit of the financial statements

and other procedures requested by the Company.

In the performance of our oversight function, the Audit Committee

of the Board of Directors, comprised of three outside directors, held eight meetings during fiscal 2002. The Audit Committee met with the independent auditors, management and internal auditors to assure that all were carrying out their respective

responsibilities. The Committee reviewed the performance and fees of the independent auditors, and met with them to discuss the scope and results of their audit work, including the adequacy of internal controls and the quality of the companys

reporting. The Committee discussed with the independent auditors their judgments regarding the quality and acceptability of the companys accounting principles, the clarity of its disclosure and the degree of aggressiveness or conservatism of

its accounting principles and underlying estimates. The Committee received a letter from the independent auditors confirming their independence. The Committee also considered whether the provision of non-audit services by the independent auditors to

the company is compatible with maintaining the auditors independence, and the Committee has discussed with the auditors their independence.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, or with respect to the

assessment of auditor independence. Members of the Committee rely without independent verification on the information provided to them and on the representations made by management and the independent auditors. Accordingly, the Audit

Committees oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal control and procedures designed to assure compliance with

accounting standards and applicable laws and regulations. Furthermore, the Audit Committees considerations and discussions referred to above do not assure that the audit of the companys financial statements has been carried out in

accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that the companys auditors are in fact independent.

Based upon the reports and discussions described in this report, and subject to the limitations on the role and

responsibilities of the Committee referred to above and in its charter, the Committee reviewed and discussed the audited financial statements for the fiscal year ended April 30, 2002 with management and recommended to the Board of Directors that

those financial statements be included in the companys Form 10-K filing with the Securities and Exchange Commission.

Audit Committee

Frank V. Cahouet, Chair

James E. Barlett

Charles D. Miller

22

Table of Contents

On June 13, 2002, we entered into a

Purchase Agreement with funds managed by Friedman Fleischer & Lowe, LLC pursuant to which we issued and sold to the Friedman Fleischer funds for an aggregate price of $50,000,000 (i) 10,000 shares of our 7.5% Convertible Series A Preferred Stock

at a price of $1,000 per share, (ii) 7.5% Convertible Subordinated Notes Due 2010, in an aggregate principal amount of $40,000,000 and (iii) eight-year warrants to purchase 272,727 shares of our common stock. The Preferred Stock, the Notes and

the Warrants are initially convertible into or may be exercised to purchase a total of 5,150,776 shares of our common stock.

Under the terms of an Investor Rights Agreement we entered into with the Friedman Fleischer funds on June 13, 2002, we agreed to expand the number of directors on the Board from ten to twelve and to designate two persons

chosen by Friedman Fleischer to serve on the Board. Friedman Fleischer designated Spencer C. Fleischer and David L. Lowe, both of whom manage the Friedman Fleischer funds, and they were appointed by us to serve on the Board in June 2002. The

Investor Rights Agreement is attached as an exhibit to our Form 8-K filed on June 18, 2002, and more fully describes the rights of the Friedman Fleischer funds.

We believe that all SEC

filings of our officers, directors and ten percent stockholders complied with the requirements of Section 16 of the Securities Exchange Act of 1934 during fiscal 2002, based on a review of forms filed.

Enclosed with this proxy statement is our annual report